Answered step by step

Verified Expert Solution

Question

1 Approved Answer

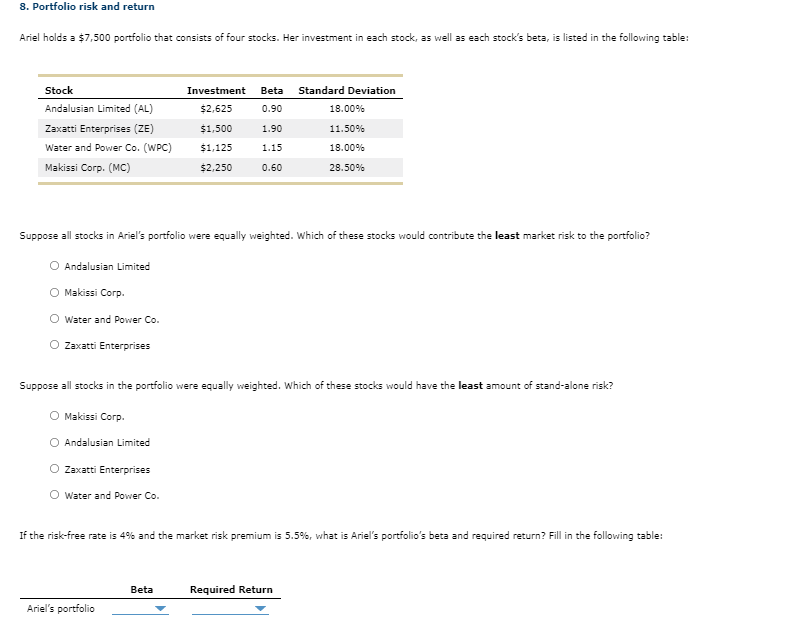

Beta's options: 0.8904, 1.5713, 1.0475, 0.7018 Required Return options: 1,122.40%, 531.00%, 9.76%, 761.28% 8. Portfolio risk and return Ariel holds a $7,500 portfolio that consists

Beta's options: 0.8904, 1.5713, 1.0475, 0.7018

Beta's options: 0.8904, 1.5713, 1.0475, 0.7018

Required Return options: 1,122.40%, 531.00%, 9.76%, 761.28%

8. Portfolio risk and return Ariel holds a $7,500 portfolio that consists of four stocks. Her investment in each stock, as well as each stock's beta, is listed in the following table: Stock Investment Beta Standard Deviation Andalusian Limited (AL) $2,625 0.90 18.00% Zaxatti Enterprises (ZE) $1,500 1.90 11.50% $1,125 1.15 18.00% Water and Power Co. (WPC) Makissi Corp. (MC) $2,250 0.60 28.50% Suppose all stocks in Ariel's portfolio were equally weighted. Which of these stocks would contribute the least market risk to the portfolio? O Andalusian Limited O Makissi Corp. Water and Power Co. Zaxatti Enterprises Suppose all stocks in the portfolio were equally weighted. Which of these stocks would have the least amount of stand-alone risk? O Makissi Corp. O Andalusian Limited Zaxatti Enterprises Water and Power Co. If the risk-free rate is 4% and the market risk premium is 5.5%, what is Ariel's portfolio's beta and required return? Fill in the following table: Beta Required Return Ariel's portfolioStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started