Answered step by step

Verified Expert Solution

Question

1 Approved Answer

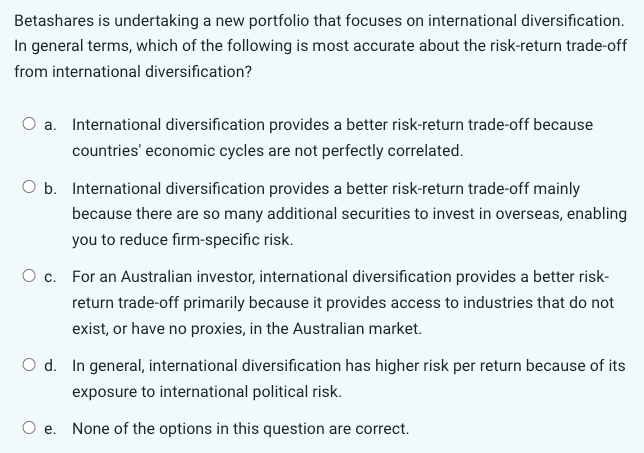

Betashares is undertaking a new portfolio that focuses on international diversification. In general terms, which of the following is most accurate about the risk-return trade-off

Betashares is undertaking a new portfolio that focuses on international diversification. In general terms, which of the following is most accurate about the risk-return trade-off from international diversification? a. International diversification provides a better risk-return trade-off because countries' economic cycles are not perfectly correlated. b. International diversification provides a better risk-return trade-off mainly because there are so many additional securities to invest in overseas, enabling you to reduce firm-specific risk. c. For an Australian investor, international diversification provides a better riskreturn trade-off primarily because it provides access to industries that do not exist, or have no proxies, in the Australian market. d. In general, international diversification has higher risk per return because of its exposure to international political risk. e. None of the options in this question are correct

Betashares is undertaking a new portfolio that focuses on international diversification. In general terms, which of the following is most accurate about the risk-return trade-off from international diversification? a. International diversification provides a better risk-return trade-off because countries' economic cycles are not perfectly correlated. b. International diversification provides a better risk-return trade-off mainly because there are so many additional securities to invest in overseas, enabling you to reduce firm-specific risk. c. For an Australian investor, international diversification provides a better riskreturn trade-off primarily because it provides access to industries that do not exist, or have no proxies, in the Australian market. d. In general, international diversification has higher risk per return because of its exposure to international political risk. e. None of the options in this question are correct Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started