Question

Bethany incorporated a business with the intention of opening a small location on July 1, 20X3, on the town's main street, where she would manufacture

Bethany incorporated a business with the intention of opening a small location on July 1, 20X3, on the town's main street, where she would manufacture and sell a variety of bags, from diaper bags to evening bags. All the materials will be sourced from local suppliers and the manufacturing will be done by Bethany. Handbag sales are anticipated to come from the Internet (15%), mail orders over the phone (15%), and walk-ins to the store (70%). All on-line and mail-order sales are to be paid by credit card and the in-store sales are anticipated to be paid by cash (10%), debit card (30%), aJld credit card (60%). Bethany has made an arrangement with a local financial institution such that the debit processing will be done the same day but the credit card processing will be done on the last day of the month for the entire month's credit card sales. The cost of credit card processing is a fee of 5% of the total amount processed, while the debit card processing is covered by her monthly business banking fees.

The manufacturing process takes approximately two months. To take advantage of fabric and material purchase discounts, Bethany plans to buy the material for the year in January and February (50% in each month) and she will do all the manufacturing herself. Because Bethany will be buying material in July for 20X3, she will need to purchase and pay for all the material at once to get the discount. The cost of the materials will vary depending on the type of bag, with costs approximating $20, $10, $10, and $50 per bag for a diaper, shopping, school, and evening bags, respectively; the cost includes the discount for buying in January and February.

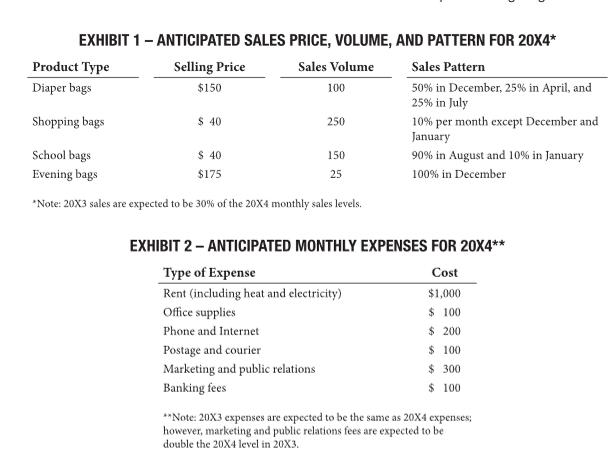

Bethany has already contributed $1,000 in cash when incorporating the business; therefore, she expects to have access to the $1,000 in cash that she contributed and a $10,000 line of credit (5% annual interest cost) that she has already secured from her financial institution and from which she can borrow in $1,000 increments. The anticipated sales price, volume, and pattern are presented in Exhibit 1 and the expected monthly expenses are presented in Exhibit 2; monthly expenses are paid in cash in the month incurred.

Required: Bethany wants help in budgeting her monthly financial resources and projecting her potential monthly income. Write a report to Bethany that includes sales budget, cash collections, materials/expenses budget, and a cash budget.

EXHIBIT 1 - ANTICIPATED SALES PRICE, VOLUME, AND PATTERN FOR 20X4* Sales Volume Sales Pattern Selling Price $150 50% in December, 25% in April, and 25% in July Product Type Diaper bags Shopping bags School bags Evening bags *Note: 20X3 sales are expected to be 30% of the 20X4 monthly sales levels. $ 40 $ 40 $175 100 Postage and courier Marketing and public relations Banking fees 250 150 25 10% per month except December and January 90% in August and 10% in January 100% in December EXHIBIT 2- ANTICIPATED MONTHLY EXPENSES FOR 20X4** Type of Expense Cost Rent (including heat and electricity) $1,000 Office supplies $ 100 Phone and Internet $ 200 $ 100 $ 300 $ 100 **Note: 20X3 expenses are expected to be the same as 20X4 expenses; however, marketing and public relations fees are expected to be double the 20X4 level in 20X3.

Step by Step Solution

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

EXHIBIT 1 ANTICIPATED SALES PRICE VOLUME AND PATTERN FOR 20X4 Product Type Selling Price Sales Volume Sales Pattern Diaper bags 50 1000 January December Shopping bags 30 2000 January December School b...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started