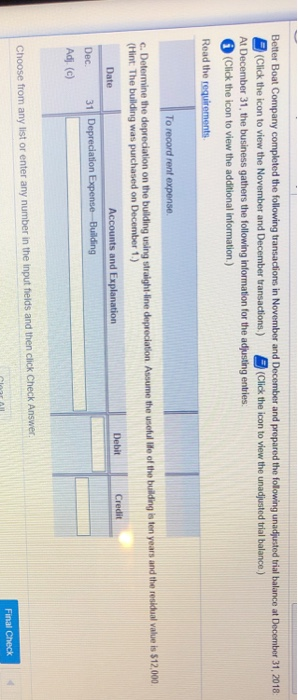

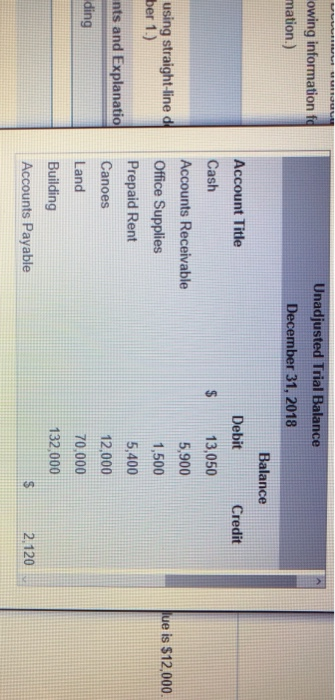

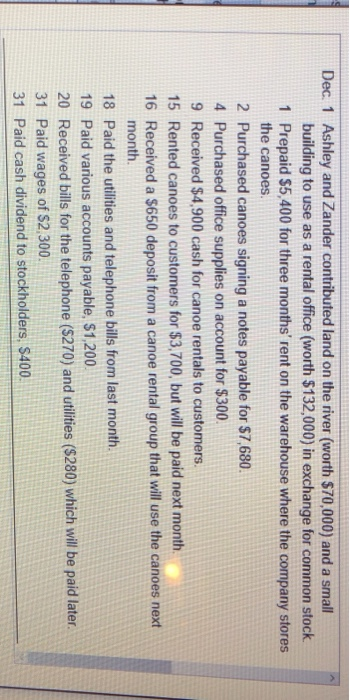

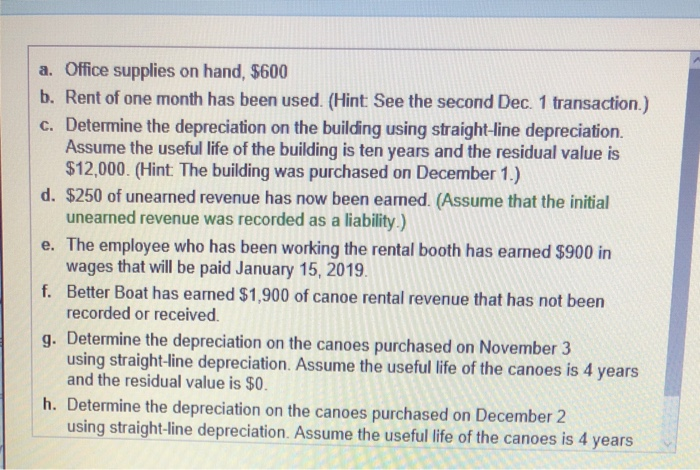

Better Boat Company completed the following transactions in November and December and prepared the following unadjusted trial balance at December 31, 2018 (Click the icon to view the November and December transactions Click the icon to view the unad usted trial balance At December 31, the business gathers the following information for the adjusting entries (Click the icon to view the additional information.) Read the requirements To record rent ex c. Determine the depreciation on the building using straight ne depreciation Assume the usoful lo of the building is ten years and the Hint. The building was purchased on December 1.) esichual value is $12,000 Date Accounts and Explan Debit 31 Depreciation Dec. Adj. (c) Choose from any list or enter any number in the input fields and then click Check Answer owing information f mation.) Unadjusted Trial Balance December 31, 2018 Balance Account Title Cash Accounts Receivable Debit Credit $ 13,050 5,900 1,500 5,400 12,000 70,000 132,000 using straight-line dOffice Supplies lue is $12,000. ber 1.) nts and Explanatio ding Prepaid Rent Canoes Land Building Accounts Payable s2,120 Dec. 1 Ashley and Zander contributed land on the river (worth $70,000) and a small building to use as a rental office (worth $132,000) in exchange for common stock 1 Prepaid $5,400 for three months' rent on the warehouse where the company stores the canoes. 2 Purchased canoes signing a notes payable for $7,680. 4 Purchased office supplies on account for $300 9 Received $4,900 cash for canoe rentals to customers 15 Rented canoes to customers for $3,700, but will be paid next month. 16 Received a $650 deposit from a canoe rental group that will use the canoes next month 18 Paid the utilities and telephone bills from last month. 19 Paid various accounts payable, $1,200 20 Received bills for the telephone ($270) and utilities ($280) which will be paid later 31 Paid wages of S2,300 31 Paid cash dividend to stockholders, $400 a. Office supplies on hand, $600 b. Rent of one month has been used. (Hint See the second Dec. 1 transaction.) c. Determine the depreciation on the building using straight-line depreciation. Assume the useful life of the building is ten years and the residual value is $12,000. (Hint The building was purchased on December 1.) d. $250 of unearned revenue has now been eamed. (Assume that the initial unearned revenue was recorded as a liability ) e. The employee who has been working the rental booth has eamed $900 in wages that will be paid January 15, 2019 Better Boat has earned $1,900 of canoe rental revenue that has not been recorded or received. f. g. Determine the depreciation on the canoes purchased on November 3 using straight-line depreciation. Assume the useful life of the canoes is 4 years and the residual value is $0 h. Determine the depreciation on the canoes purchased on December2 using straight-ine depreciation Assume the useful life of the canoes is 4 years Better Boat Company completed the following transactions in November and December and prepared the following unadjusted trial balance at December 31, 2018 (Click the icon to view the November and December transactions Click the icon to view the unad usted trial balance At December 31, the business gathers the following information for the adjusting entries (Click the icon to view the additional information.) Read the requirements To record rent ex c. Determine the depreciation on the building using straight ne depreciation Assume the usoful lo of the building is ten years and the Hint. The building was purchased on December 1.) esichual value is $12,000 Date Accounts and Explan Debit 31 Depreciation Dec. Adj. (c) Choose from any list or enter any number in the input fields and then click Check Answer owing information f mation.) Unadjusted Trial Balance December 31, 2018 Balance Account Title Cash Accounts Receivable Debit Credit $ 13,050 5,900 1,500 5,400 12,000 70,000 132,000 using straight-line dOffice Supplies lue is $12,000. ber 1.) nts and Explanatio ding Prepaid Rent Canoes Land Building Accounts Payable s2,120 Dec. 1 Ashley and Zander contributed land on the river (worth $70,000) and a small building to use as a rental office (worth $132,000) in exchange for common stock 1 Prepaid $5,400 for three months' rent on the warehouse where the company stores the canoes. 2 Purchased canoes signing a notes payable for $7,680. 4 Purchased office supplies on account for $300 9 Received $4,900 cash for canoe rentals to customers 15 Rented canoes to customers for $3,700, but will be paid next month. 16 Received a $650 deposit from a canoe rental group that will use the canoes next month 18 Paid the utilities and telephone bills from last month. 19 Paid various accounts payable, $1,200 20 Received bills for the telephone ($270) and utilities ($280) which will be paid later 31 Paid wages of S2,300 31 Paid cash dividend to stockholders, $400 a. Office supplies on hand, $600 b. Rent of one month has been used. (Hint See the second Dec. 1 transaction.) c. Determine the depreciation on the building using straight-line depreciation. Assume the useful life of the building is ten years and the residual value is $12,000. (Hint The building was purchased on December 1.) d. $250 of unearned revenue has now been eamed. (Assume that the initial unearned revenue was recorded as a liability ) e. The employee who has been working the rental booth has eamed $900 in wages that will be paid January 15, 2019 Better Boat has earned $1,900 of canoe rental revenue that has not been recorded or received. f. g. Determine the depreciation on the canoes purchased on November 3 using straight-line depreciation. Assume the useful life of the canoes is 4 years and the residual value is $0 h. Determine the depreciation on the canoes purchased on December2 using straight-ine depreciation Assume the useful life of the canoes is 4 years