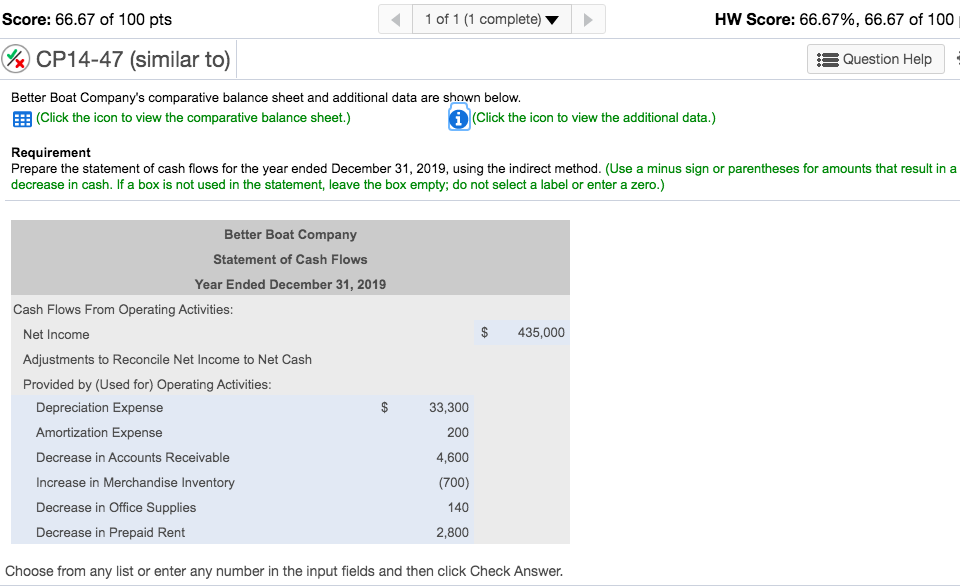

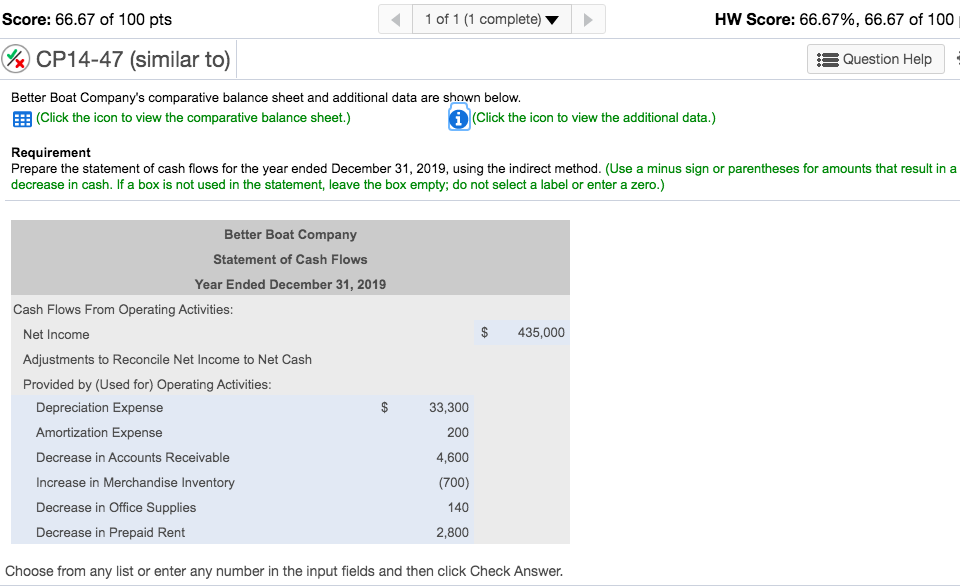

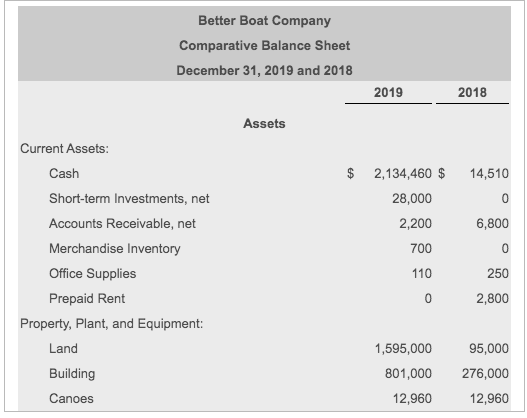

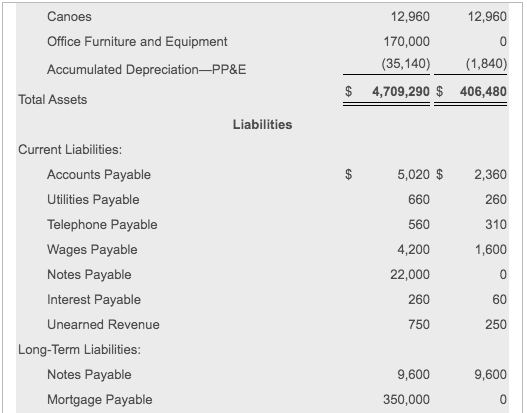

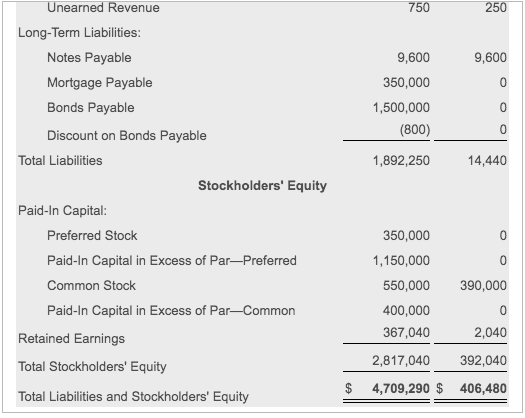

Better Boat Company's comparative balance sheet and additional data are shown below.

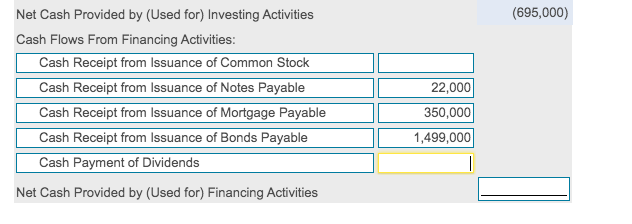

Requirement: Prepare the statement of cash flows for the year ended December 31, 2019, using the indirect method. (Use a minus sign or parentheses for amounts that result in a decrease in cash. If a box is not used in the statement, leave the box empty; do not select a label or enter a zero.) I have already completed some of the question, I need help with the last three parts please.

Please help with the rest of the statement of cash flows. Thank you!

Please help with the rest of the statement of cash flows. Thank you!

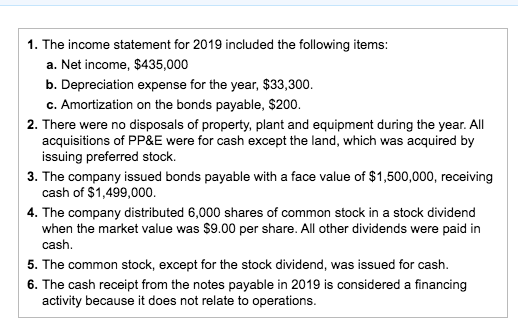

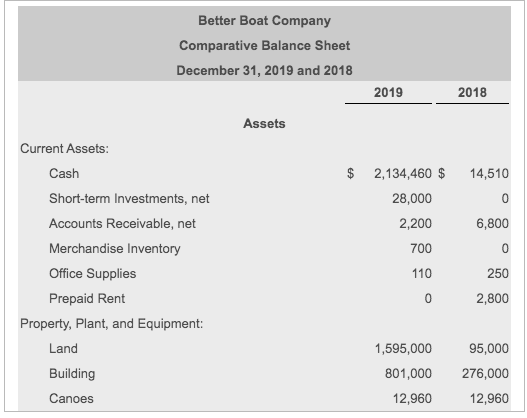

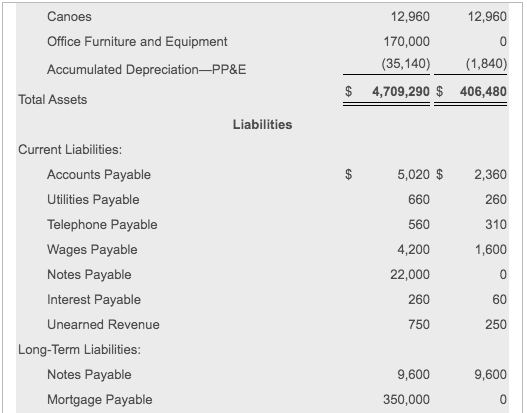

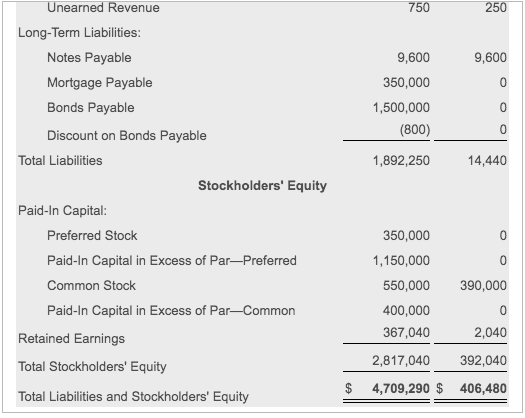

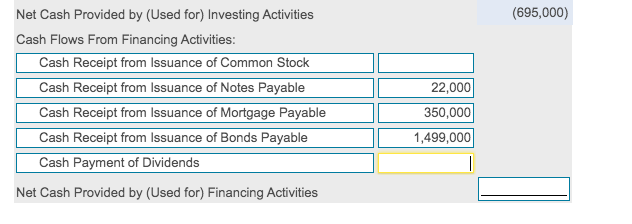

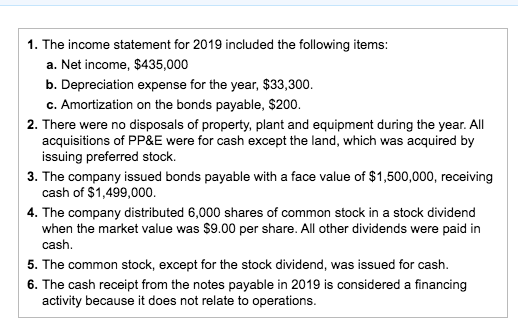

Score: 66.67 of 100 pts 1 of 1 (1 complete) HW Score: 66.67%, 66.67 of 100 CP14-47 (similar to) Question Help Better Boat Company's comparative balance sheet and additional data are shown below. (Click the icon to view the comparative balance sheet.) Click the icon to view the additional data.) Requirement Prepare the statement of cash flows for the year ended December 31, 2019, using the indirect method. (Use a minus sign or parentheses for amounts that result in a decrease in cash. If a box is not used in the statement, leave the box empty; do not select a label or enter a zero.) $ 435,000 Better Boat Company Statement of Cash Flows Year Ended December 31, 2019 Cash Flows From Operating Activities: Net Income Adjustments to Reconcile Net Income to Net Cash Provided by (Used for) Operating Activities: Depreciation Expense Amortization Expense Decrease in Accounts Receivable Increase in Merchandise Inventory Decrease in Office Supplies Decrease in Prepaid Rent $ 33,300 200 4,600 (700) 140 2,800 Choose from any list or enter any number in the input fields and then click Check Answer. 1. The income statement for 2019 included the following items: a. Net income, $435,000 b. Depreciation expense for the year, $33,300. c. Amortization on the bonds payable, $200. 2. There were no disposals of property, plant and equipment during the year. All acquisitions of PP&E were for cash except the land, which was acquired by issuing preferred stock. 3. The company issued bonds payable with a face value of $1,500,000, receiving cash of $1,499,000 4. The company distributed 6,000 shares of common stock in a stock dividend when the market value was $9.00 per share. All other dividends were paid in cash 5. The common stock, except for the stock dividend, was issued for cash. 6. The cash receipt from the notes payable in 2019 is considered a financing activity because it does not relate to operations. Better Boat Company Comparative Balance Sheet December 31, 2019 and 2018 2019 2018 Assets $ 14,510 2,134,460 $ 28,000 0 6,800 2,200 700 0 Current Assets: Cash Short-term Investments, net Accounts Receivable, net Merchandise Inventory Office Supplies Prepaid Rent Property, Plant, and Equipment: Land Building 110 250 0 2,800 1,595,000 801,000 12,960 95,000 276,000 12,960 Canoes 12,960 Canoes Office Furniture and Equipment Accumulated DepreciationPP&E 12,960 170,000 (35,140) 0 (1,840) $ 4,709,290 $ 406,480 Total Assets Liabilities $ 5,020 $ 2,360 660 260 560 310 1,600 Current Liabilities: Accounts Payable Utilities Payable Telephone Payable Wages Payable Notes Payable Interest Payable Unearned Revenue Long-Term Liabilities: Notes Payable Mortgage Payable 4,200 22,000 0 260 60 750 250 9,600 9,600 350,000 0 750 250 9,600 0 9,600 350,000 1,500,000 (800) 1,892,250 0 0 14,440 Unearned Revenue Long-Term Liabilities: Notes Payable Mortgage Payable Bonds Payable Discount on Bonds Payable Total Liabilities Stockholders' Equity Paid-In Capital: Preferred Stock Paid-In Capital in Excess of ParPreferred Common Stock Paid-In Capital in Excess of ParCommon Retained Earnings Total Stockholders' Equity 0 0 350,000 1,150,000 550,000 400,000 367,040 390,000 0 2,040 2,817,040 392,040 $ Total Liabilities and Stockholders' Equity 4,709,290 $ 406,480 (695,000) Net Cash Provided by (Used for) Investing Activities Cash Flows From Financing Activities: Cash Receipt from Issuance of Common Stock Cash Receipt from Issuance of Notes Payable Cash Receipt from Issuance of Mortgage Payable Cash Receipt from Issuance of Bonds Payable Cash Payment of Dividends 22,000 350,000 1,499,000 Net Cash Provided by (Used for) Financing Activities

Please help with the rest of the statement of cash flows. Thank you!

Please help with the rest of the statement of cash flows. Thank you!