Answered step by step

Verified Expert Solution

Question

1 Approved Answer

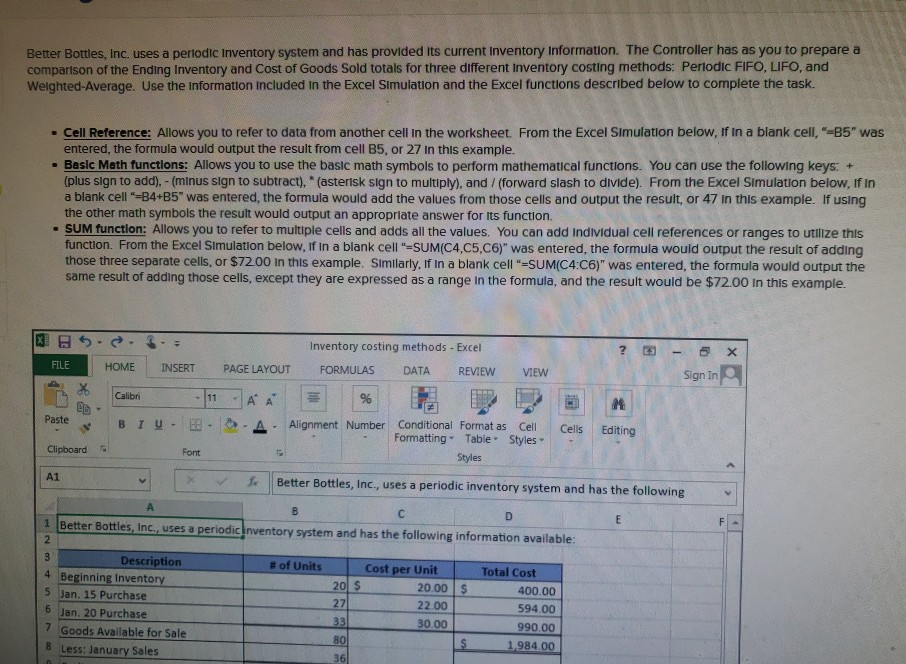

Better Bottles, Inc. uses a periodic Inventory system and has provided its current inventory Information. The Controller has as you to prepare a comparison of

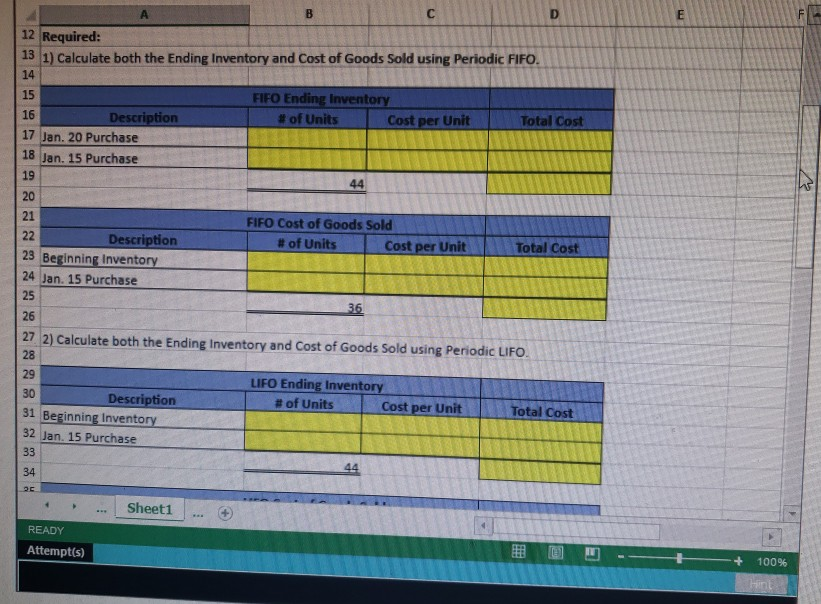

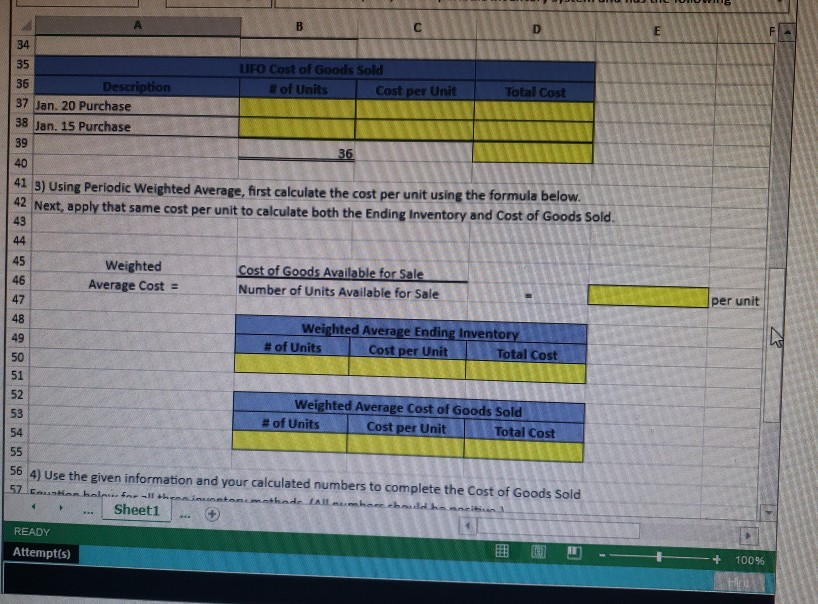

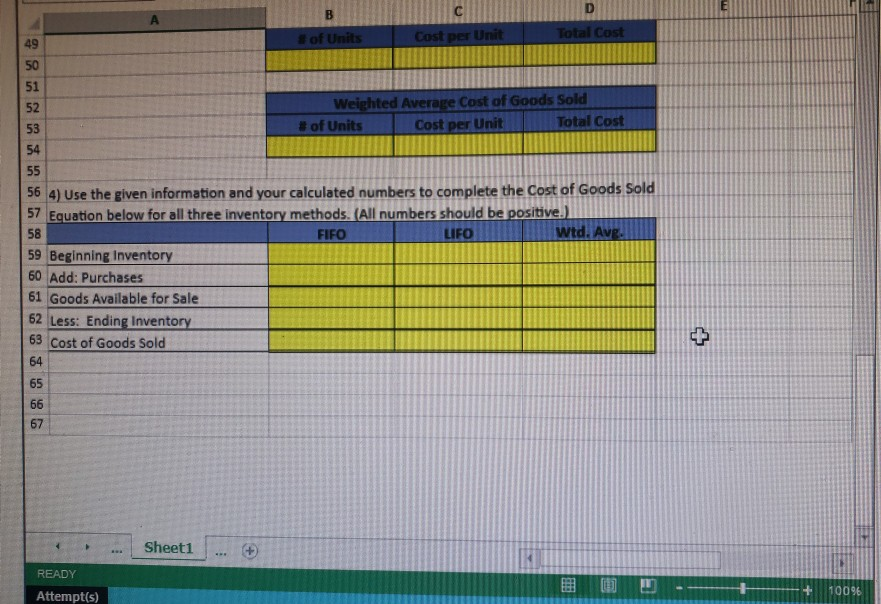

Better Bottles, Inc. uses a periodic Inventory system and has provided its current inventory Information. The Controller has as you to prepare a comparison of the Ending Inventory and Cost of Goods Sold totals for three different Inventory costing methods: Periodic FIFO, LIFO, and Weighted Average. Use the information included in the Excel Simulation and the Excel functions described below to complete the task Cell Reference: Allows you to refer to data from another cell in the worksheet. From the Excel Simulation below, if in a blank cell, "-35" was entered the formula would output the result from cell B5, or 27 in this example. Basic Math functions: Allows you to use the basic math symbols to perform mathematical functions. You can use the following keys: + (plus sign to add). - (minus sign to subtract). (asterisk sign to multiply), and / (forward slash to divide). From the Excel Simulation below. If in a blank cell-B4+85" was entered, the formula would add the values from those cells and output the result, or 47 in this example. If using the other math symbols the result would output an appropriate answer for its function. SUM function: Allows you to refer to multiple cells and adds all the values. You can add individual cell references or ranges to utilize this function. From the Excel Simulation below, if in a blank cell"-SUM(C4,C5,C6)" was entered, the formula would output the result of adding those three separate cells, or $72.00 in this example. Similarly, if in a blank cell =SUM(C4:06)" was entered, the formula would output the same result of adding those cells, except they are expressed as a range in the formula, and the result would be $72.00 in this example. FILE Sign In HOME Calbri B r Inventory costing methods - Excel INSERT PAGE LAYOUT FORMULAS DATA REVIEW VIEW 1 A A u - B - A Alignment Number Conditional Format as Cell Formatting Table Styles Font Styles LA Paste Cells Editing Clipboard Better Bottles, Inc., uses a periodic inventory system and has the following 1 Better Bottles, Inc., uses a periodic Inventory system and has the following information available: # of Units Description 4 Beginning Inventory 5 Jan. 15 Purchase 6 Jan. 20 Purchase 7 Goods Available for Sale 8 Less: January Sales Cost per Unit 20 $ 20.00 $ 22.00 39 30.00 27 Total Cost 400.00 594.00 990.00 1.984.00 12 Required: 1) Calculate both the Ending Inventory and Cost of Goods Sold using Periodic FIFO. FIFO Ending Inventory # of Units Cost per Unit Total Cost Description 17 Jan. 20 Purchase Jan. 15 Purchase 44 FIFO Cost of Goods Sold # of Units Cost per Unit T otal Cost Description 23 Beginning Inventory 24 Jan. 15 Purchase 27 2) Calculate both the Ending Inventory and Cost of Goods Sold using Periodic LIFO. LIFO Ending Inventory #of Units Cost per Unit Description Beginning Inventory 32 Jan. 15 Purchase Total Cost . Sheet1 ... + . READY Attempt(s) + 100% LIFO Cost of Goods Sold of Units Cost per Unit Description 37 Jan. 20 Purchase 38 Jan. 15 Purchase 41 3) Using Periodic Weighted Average, first calculate the cost per unit using the formula below. 42 Next, apply that same cost per unit to calculate both the Ending Inventory and Cost of Goods Sold. Weighted Average Cost = Cost of Goods Available for Sale Number of Units Available for Sale per unit Weighted Average Ending Inventory # of Units Cost per Unit Total Cost Weighted Average Cost of Goods Sold # of Units Cost per Unit T otal Cost 56 4) Use the given information and your calculated numbers to complete the cost of Goods Sold 57 Euskan halpufnehmustannhade Luha dhe ... Sheet1 ... + READY Attempt(s) - + 100% of Units Cost per Unit Total Cost Weighted Average Cost of Goods Sold # of Units Cost per Unit Total Cost 56 4) Use the given information and your calculated numbers to complete the cost of Goods Sold 57 Equation below for all three inventory methods. (All numbers should be positive.) FIFO LIFO 59 Beginning Inventory 60 Add: Purchases 61 Goods Available for Sale 62 Less: Ending Inventory 63 Cost of Goods Sold .. Sheet1 ... + READY E - 10096 Attempt(s)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started