Better Health and Fitness (BHF) is a newly established business... Better Health and Fitness (BHF) is a newly established business that offers yoga classes and

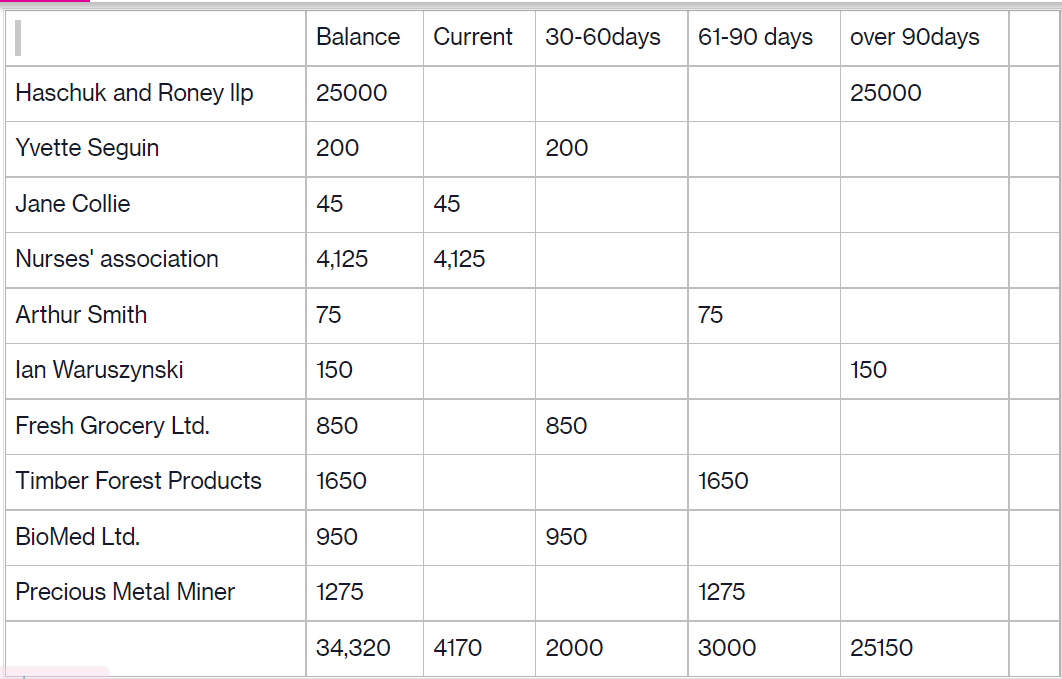

Better Health and Fitness (BHF) is a newly established business... Better Health and Fitness (BHF) is a newly established business that offers yoga classes and yoga clothing and accessories. The BHF operates out of Saskatoon, Saskatchewan, and is owned by Carol Osborne a former yoga teacher for a large gym franchise. Carol decided to start her own yoga centre in order to provide a larger variety of customized yoga classes to small groups, including beginner, intermediate, and advanced classes. The BHF also has a small storefront that is used to sell yoga clothing, along with other accessories, such as headbands, water bottles, and yoga mats. In order to help finance operations, BHF obtained a working capital loan from the small business department of a local credit union. The loan is a revolving line of credit that is secured by the company's inventory and accounts receivable. The loan is not to exceed a maximum of 50% of inventory and 75% of accounts receivable as at the company's year end (March 31, 2020). The BHF must present reviewed financial statements, prepared in accordance with ASPE, to the credit union within 60 days of its year end. It is now February 2020, and Carol is starting to get nervous about the preparation of the financial statements. Carol has minimal exposure to accounting duties; therefore, she hired a local bookkeeper to help her select an appropriate fiscal year end, set up an accounting software package, and design processes and documents to be used in day-to-day functions. Carol has contacted Lebeau and Liang LLP in regards to conducting a review of the BHF's financial statements. You are the senior accountant in charge of the review, and recently sat down with Carol to discuss the engagement. Carol feels confident that all of her routine transactions have been posted correctly, but is unsure of some of the more complicated issues that arose during the year. Carol discusses with you the following unresolved issues: BHF was able to obtain a large corporate client, Haschuk and Roney, Barristers and Solicitors, LLP. On July 1, 2019, BHF and the law firm agreed that the employees of the law firm would have unlimited access to the yoga classes for a yearly fee of $50,000, with 50% payable upfront. The fee is nonrefundable, noncancelable, and not dependent on the number of classes actually participated in by the law firm employees. Carol credited revenue for $50,000 when the contract was signed, and debited both cash and accounts receivable for $25,000 each. This large contract helped with cash flows, and is a major reason why BHF has a current cash balance of $10,000. Mid-way through the year, BHF began selling energy bars and drinks in its storefront. BHF reached an exclusive agreement to be the sole distributor of Excel Energy Plus bars in Saskatoon. BHF was required to purchase 5,000 bars at the onset of the contract, at a cost of $2.50 per bar. On March 15, an ingredient included in the bars was allegedly linked to various illnesses. Currently, the Food and Drug Administration in the United States is investigating the allegations, and the outcome is uncertain. Canadian officials have not yet commented on the situation. BHF sold 1,340 bars during the year. The aged accounts receivable balance is as follows:

BHF reached an agreement with a local nurses' association to provide 55 pairs of yoga pants and shirts for an upcoming walk-a-thon in May 2019. The shirt and pants were customized with an embroidery of each nurse's name. BHF charged the nurses' association a special promotion price of $75 per combo and delivered the goods mid-March. In late March, the nurses' association contacted BHF stating that the goods received are not the same as the goods ordered. The nurses' association has asked for a 40% discount on the goods, or else it plans to return goods and cancel its order.Receivables 7 to 10 are a result of a promotion held by BHF in order to attract more corporate clients. Based on her experience with a larger gym franchise, Carol states that 10% of receivables past 60 days are typically uncollectible. However, she is very confident that the receivable from Haschuk and Roney, LLP will be collected. Even though a violation of the covenant can result in the credit facility becoming canceled with the outstanding balance due immediately, Carol states that she is not too concerned because her accounts receivable and inventory are $34,320 and $96,550, respectively, while her loan is only $65,000. However, she would like you to prepare a report, to go along with the review engagement, that discusses the appropriate accounting treatment of the above noted accounting issues.

Required

write up 2 case issues in proper format - issue,impact, applicable GAAP, supported by case facts, alternatives (if applicable), then conclude.

Balance Current 30-60days 61-90 days over 90days Haschuk and Roney Ilp 25000 25000 Yvette Seguin 200 200 Jane Collie 45 45 Nurses' association 4,125 4,125 Arthur Smith 75 75 lan Waruszynski 150 150 Fresh Grocery Ltd. 850 850 Timber Forest Products 1650 1650 BioMed Ltd. 950 950 Precious Metal Miner 1275 1275 34,320 4170 2000 3000 25150 Balance Current 30-60days 61-90 days over 90days Haschuk and Roney Ilp 25000 25000 Yvette Seguin 200 200 Jane Collie 45 45 Nurses' association 4,125 4,125 Arthur Smith 75 75 lan Waruszynski 150 150 Fresh Grocery Ltd. 850 850 Timber Forest Products 1650 1650 BioMed Ltd. 950 950 Precious Metal Miner 1275 1275 34,320 4170 2000 3000 25150Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started