Better visible pictures

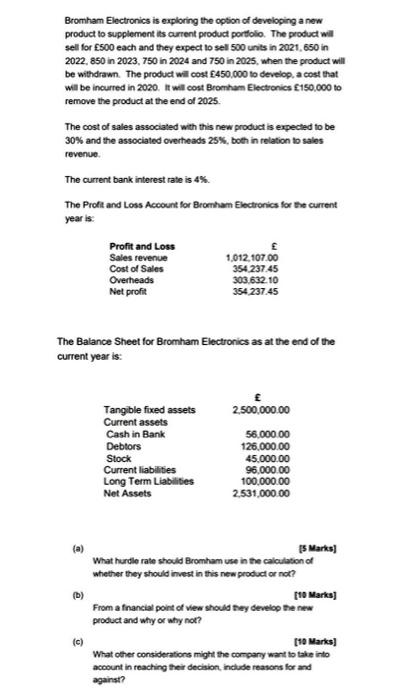

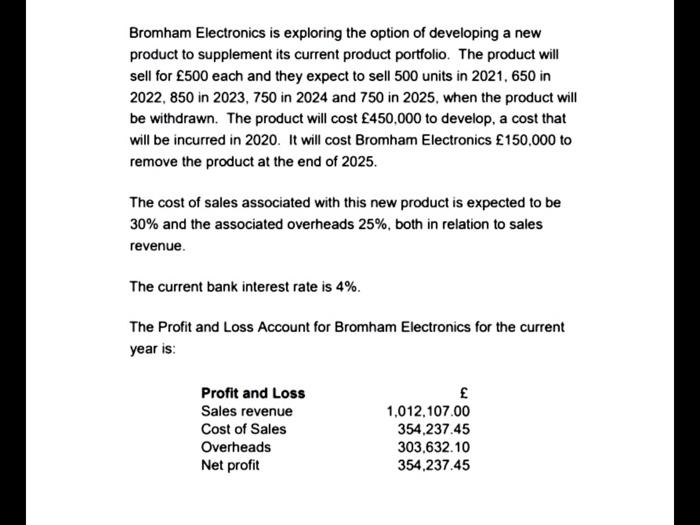

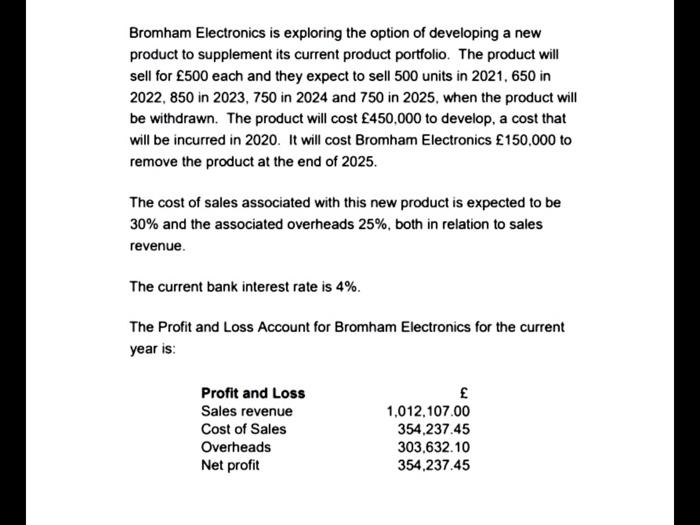

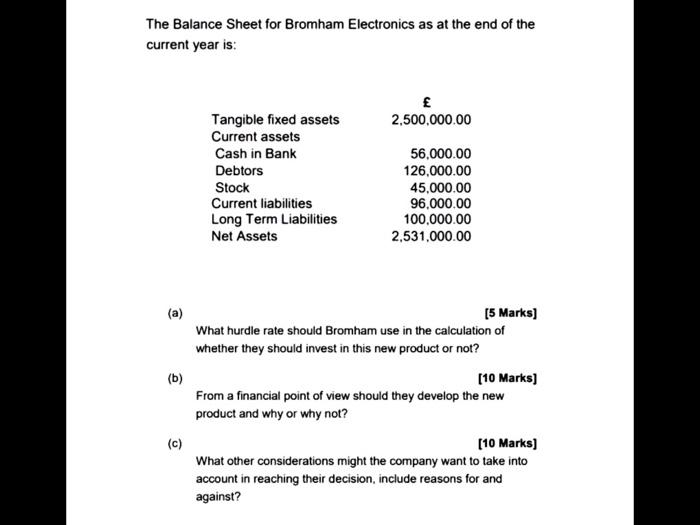

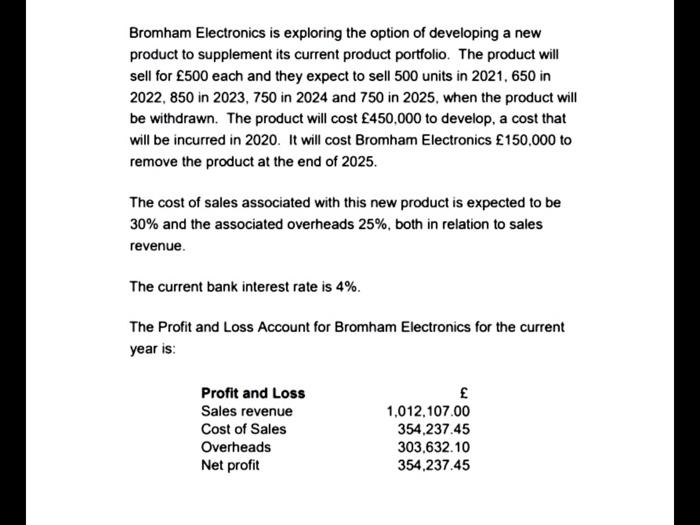

Bromham Electronics is exploring the option of developing a new product to supplement its current product portfolio. The product wil sell for 500 each and they expect to sell 500 units in 2021.650 in 2022, 850 in 2023, 750 in 2024 and 750 in 2025, when the product will be withdrawn. The product will cost 450,000 to develop a cost that will be incurred in 2020. It will cost Bromham Electronics 150,000 to remove the product at the end of 2025. The cost of sales associated with this new product is expected to be 30% and the associated overheads 25%, both in relation to sales revenue The current bank interest rate is 4%. The Profit and Loss Account for Bromham Electronics for the current year is: Profit and Loss Sales revenue Cost of Sales Overheads Net profit 1,012, 107.00 354.23745 303,632.10 354237.45 The Balance Sheet for Bromham Electronics as at the end of the current year is: Tangible fixed assets Current assets Cash in Bank Debtors Stock Current liabilities Long Term Liabilities Net Assets 2,500,000.00 56,000.00 126,000.00 45.000.00 96,000.00 100,000.00 2.531,000.00 5 Marks! What hurdle rate should Bromham use in the calculation of whether they should invest in this new product or not? [10 Marks] From a financial point of view should they develop the new product and why or why not? [10 Marks] What other considerations might the company want to take into account in reaching their decision include reasons for and against? (1) Bromham Electronics is exploring the option of developing a new product to supplement its current product portfolio. The product will sell for 500 each and they expect to sell 500 units in 2021, 650 in 2022, 850 in 2023, 750 in 2024 and 750 in 2025, when the product will be withdrawn. The product will cost 450,000 to develop, a cost that will be incurred in 2020. It will cost Bromham Electronics 150,000 to remove the product at the end of 2025. The cost of sales associated with this new product is expected to be 30% and the associated overheads 25%, both in relation to sales revenue. The current bank interest rate is 4%. The Profit and Loss Account for Bromham Electronics for the current year is: Profit and Loss Sales revenue Cost of Sales Overheads Net profit 1,012, 107.00 354,237.45 303,632.10 354,237.45 The Balance Sheet for Bromham Electronics as at the end of the current year is: 2,500,000.00 Tangible fixed assets Current assets Cash in Bank Debtors Stock Current liabilities Long Term Liabilities Net Assets 56,000.00 126,000.00 45,000.00 96,000.00 100,000.00 2,531,000.00 (a) (b) [5 Marks) What hurdle rate should Bromham use in the calculation of whether they should invest in this new product or not? [10 Marks) From a financial point of view should they develop the new product and why or why not? [10 Marks) What other considerations might the company want to take into account in reaching their decision, include reasons for and against? (c) Bromham Electronics is exploring the option of developing a new product to supplement its current product portfolio. The product wil sell for 500 each and they expect to sell 500 units in 2021.650 in 2022, 850 in 2023, 750 in 2024 and 750 in 2025, when the product will be withdrawn. The product will cost 450,000 to develop a cost that will be incurred in 2020. It will cost Bromham Electronics 150,000 to remove the product at the end of 2025. The cost of sales associated with this new product is expected to be 30% and the associated overheads 25%, both in relation to sales revenue The current bank interest rate is 4%. The Profit and Loss Account for Bromham Electronics for the current year is: Profit and Loss Sales revenue Cost of Sales Overheads Net profit 1,012, 107.00 354.23745 303,632.10 354237.45 The Balance Sheet for Bromham Electronics as at the end of the current year is: Tangible fixed assets Current assets Cash in Bank Debtors Stock Current liabilities Long Term Liabilities Net Assets 2,500,000.00 56,000.00 126,000.00 45.000.00 96,000.00 100,000.00 2.531,000.00 5 Marks! What hurdle rate should Bromham use in the calculation of whether they should invest in this new product or not? [10 Marks] From a financial point of view should they develop the new product and why or why not? [10 Marks] What other considerations might the company want to take into account in reaching their decision include reasons for and against? (1) Bromham Electronics is exploring the option of developing a new product to supplement its current product portfolio. The product will sell for 500 each and they expect to sell 500 units in 2021, 650 in 2022, 850 in 2023, 750 in 2024 and 750 in 2025, when the product will be withdrawn. The product will cost 450,000 to develop, a cost that will be incurred in 2020. It will cost Bromham Electronics 150,000 to remove the product at the end of 2025. The cost of sales associated with this new product is expected to be 30% and the associated overheads 25%, both in relation to sales revenue. The current bank interest rate is 4%. The Profit and Loss Account for Bromham Electronics for the current year is: Profit and Loss Sales revenue Cost of Sales Overheads Net profit 1,012, 107.00 354,237.45 303,632.10 354,237.45 The Balance Sheet for Bromham Electronics as at the end of the current year is: 2,500,000.00 Tangible fixed assets Current assets Cash in Bank Debtors Stock Current liabilities Long Term Liabilities Net Assets 56,000.00 126,000.00 45,000.00 96,000.00 100,000.00 2,531,000.00 (a) (b) [5 Marks) What hurdle rate should Bromham use in the calculation of whether they should invest in this new product or not? [10 Marks) From a financial point of view should they develop the new product and why or why not? [10 Marks) What other considerations might the company want to take into account in reaching their decision, include reasons for and against? (c)