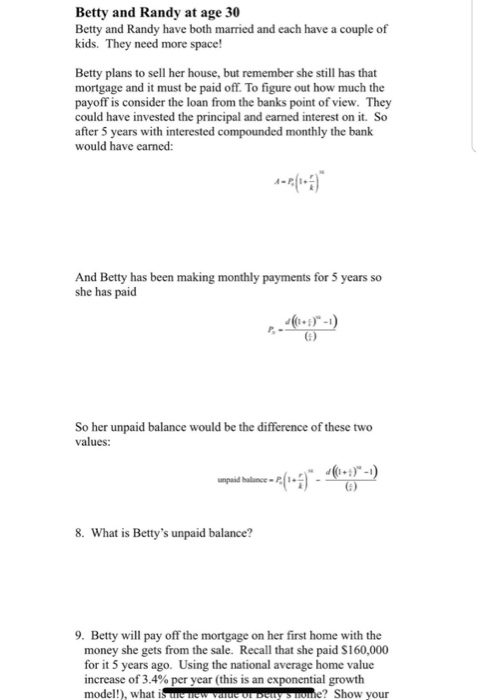

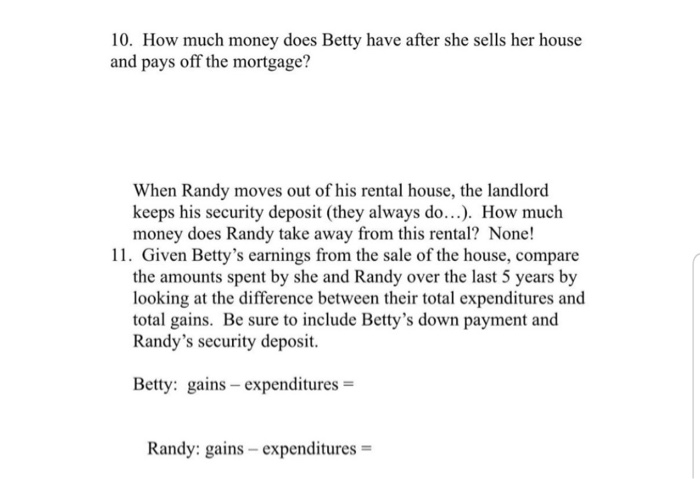

Betty and Randy at age 30 Betty and Randy have both married and each have a couple of kids. They need more space! Betty plans to sell her house, but remember she still has that mortgage and it must be paid off. To figure out how much the payoff is consider the loan from the banks point of view. They could have invested the principal and earned interest on it. So after 5 years with interested compounded monthly the bank would have earned: And Betty has been making monthly payments for 5 years so she has paid So her unpaid balance would be the difference of these two values: 8. What is Betty's unpaid balance? 9. Betty will pay off the mortgage on her first home with the money she gets from the sale. Recall that she paid S160,000 for it 5 years ago. Using the national average home value increase of 3.4% per year (this is an exponential growth model!), what is me hew varde or Beay s Homme? Show your 10. How much money does Betty have after she sells her house and pays off the mortgage? When Randy moves out of his rental house, the landlord keeps his security deposit (they always do...). How much money does Randy take away from this rental? None! 11. Given Betty's earnings from the sale of the house, compare the amounts spent by she and Randy over the last 5 years by looking at the difference between their total expenditures and total gains. Be sure to include Betty's down payment and Randy's security deposit. Betty: gains -expenditures Randy: gains - expenditures Betty and Randy at age 30 Betty and Randy have both married and each have a couple of kids. They need more space! Betty plans to sell her house, but remember she still has that mortgage and it must be paid off. To figure out how much the payoff is consider the loan from the banks point of view. They could have invested the principal and earned interest on it. So after 5 years with interested compounded monthly the bank would have earned: And Betty has been making monthly payments for 5 years so she has paid So her unpaid balance would be the difference of these two values: 8. What is Betty's unpaid balance? 9. Betty will pay off the mortgage on her first home with the money she gets from the sale. Recall that she paid S160,000 for it 5 years ago. Using the national average home value increase of 3.4% per year (this is an exponential growth model!), what is me hew varde or Beay s Homme? Show your 10. How much money does Betty have after she sells her house and pays off the mortgage? When Randy moves out of his rental house, the landlord keeps his security deposit (they always do...). How much money does Randy take away from this rental? None! 11. Given Betty's earnings from the sale of the house, compare the amounts spent by she and Randy over the last 5 years by looking at the difference between their total expenditures and total gains. Be sure to include Betty's down payment and Randy's security deposit. Betty: gains -expenditures Randy: gains - expenditures