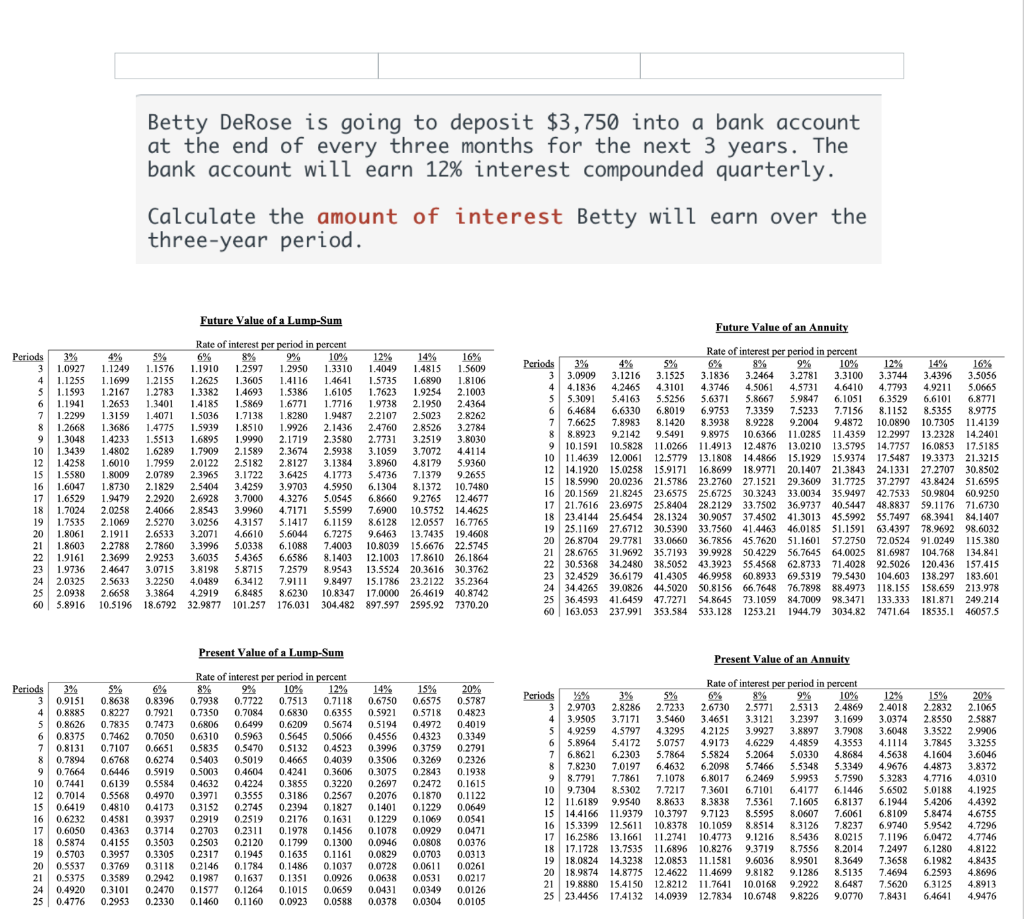

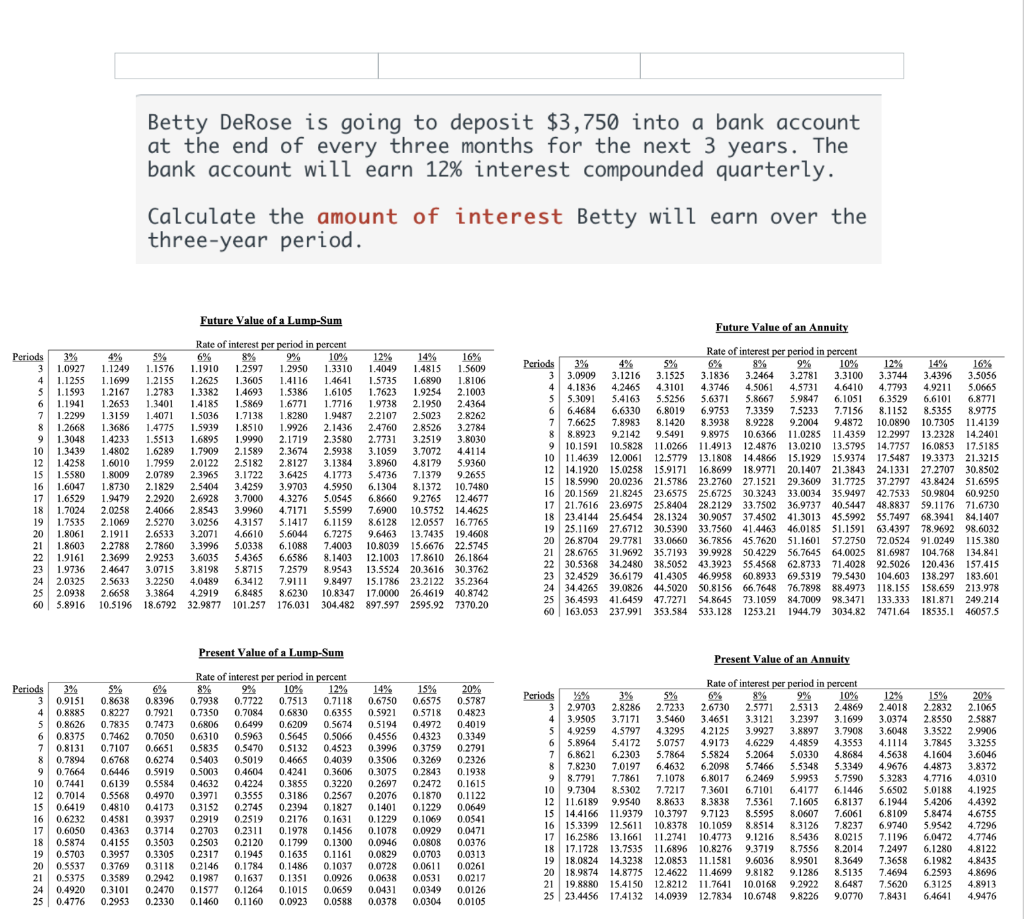

Betty DeRose is going to deposit $3,750 into a bank account at the end of every three months for the next 3 years. The bank account will earn 12% interest compounded quarterly. Calculate the amount of interest Betty will earn over the three-year period. Future Value of a Lump-Sum a Periods 3% 3 1.0927 4 1.1255 5 1.1593 6 1.1941 7 1.2299 8 8 1.2668 9 9 1.3048 10 1.3439 12 1.4258 15 1.5580 16 1.6047 17 1.6529 18 1.7024 19 1.7535 20 1.8061 21 1.8603 22 1.9161 23 1.9736 24 2.0325 25 2.0938 60 5.8916 Rate of interest per period in percent 4% 5% 6% 8% 9% % 10% 12% 14% 16% 1.1249 1.1576 1.1910 1.2597 1.2950 1.3310 1.4049 1.4815 1.5609 1.1699 1.2155 1.2625 1.3605 1.4116 1.4641 1.5735 1.6890 1.8106 1.2167 1.2783 1.3382 1.4693 1.5386 1.6105 1.7623 1.9254 2.1003 1.2653 1.3401 1.4185 1.5869 1.6771 1.7716 1.9738 2.1950 2.4364 1.3159 1.4071 1.5036 1.7138 1.8280 1.9487 2.2107 2.5023 2.8262 1.3686 1.4775 1.5939 1.8510 1.9926 2.1436 2.4760 2.8526 3.2784 1.4233 1.5513 1.6895 1.9990 2.1719 2.3580 2.7731 3.2519 3.8030 1.4802 1.6289 1.7909 2.1589 2.3674 2.5938 3.1059 3.7072 4.4114 1.6010 1.7959 2.0122 2.5182 2.8127 3.1384 3.8960 4.8179 5.9360 1.8009 2.0789 2.3965 3.1722 3.6425 4.1773 5.4736 7.1379 9.2655 1.8730 2.1829 2.5404 3.4259 3.9703 4.5950 6.1304 8.1372 10.7480 1.9479 2.2920 2.6928 3.7000 4.3276 5.0545 6.8660 9.2765 12.4677 2.0258 2.4066 2.8543 3.9960 4.7171 5.5599 7.6900 10.5752 14.4625 2.1069 2.5270 3.0256 4.3157 5.1417 6.1159 8.6128 12.0557 16.7765 2.1911 2.6533 3.2071 4.6610 5.6044 6.7275 9.6463 13.7435 19.4608 2.2788 2.7860 3.3996 5.0338 6.1088 7.4003 10.8039 15.6676 22.5745 2.3699 2.9253 3.6035 5.4365 6.6586 8.1403 12.1003 17.8610 26.1864 2.4647 3.0715 3.8198 5.8715 7.2579 8.9543 13.5524 20.3616 30.3762 2.5633 3.2250 4.0489 6.3412 9.8497 15.1786 23.2122 35.2364 2.6658 3.3864 4.2919 6.8485 8.6230 10.8347 17.0000 26.4619 40,8742 10.5196 18.679232.9877 101.257 176.031 304.482 897.597 2595.92 7370.20 Future Value of an Annuity Rate of interest per period in percent Periods 3% 4% 5% 6% 8% 9% 10% 12% 14% 16% 3 3.0909 3.1216 3.1525 3.1836 3.2464 3.2781 3.3100 3.3744 3.4396 3.5056 4 4.1836 4.2465 4.3101 4.3746 4.5061 4.5731 4.6410 4.7793 4.9211 5.0665 5 5.3091 5.4163 5.5256 5.6371 5.8667 5.9847 6.1051 6.3529 6.6101 6.8771 6 6.4684 6.6330 6.8019 6.9753 7.3359 7.5233 7.7156 8.1152 8.5355 8.9775 7 7.6625 7.8983 8.1420 8.3938 8.9228 9.2004 9.4872 10.0890 10.7305 11.4139 8 8.8923 9.2142 9.5491 9.8975 10.6366 11.0285 11.4359 12.2997 13.2328 14.2401 910.1591 10.5828 11.0266 11.4913 12.4876 13.0210 13.5795 14.7757 16.0853 16.0853 17.5185 10 11.4639 12.0061 12.5779 13.1808 13.1808 14.4866 15.1929 15.9374 17.5487 19.3373 21.3215 12 14.1920 15.0258 15.9171 16.8699 18.9771 20.1407 21.3843 24.1331 27.2707 30.8502 15 18.5990 20.0236 21.5786 23.2760 27.1521 29.3609 31.7725 37.2797 43.8424 51.6595 16 20.1569 21.8245 23.6575 25.6725 30.3243 33.0034 35.9497 42.7533 50.9804 60.9250 17 21.7616 23.6975 25.8404 28.2129 33.7502 36.9737 40.5447 48.8837 59.1176 71.6730 18 23.4144 25.6454 28.1324 30.9057 37.4502 41.3013 45.5992 55.7497 68.3941 68.3941 84.1407 19 25.1169 27.6712 30.5390 33.7560 41.4463 46.0185 51.1591 63.4397 78.9692 98.6032 20 26.8704 29.7781 33.0660 36.7856 45.7620 51.1601 57.2750 72.0524 91.0249 115.380 21 28,6765 31.9692 35.7193 39.9928 50.4229 56.7645 56.7645 64.0025 81.6987 104.768 134.841 22 30.5368 34.2480 38.5052 43.3923 55.4568 62.8733 71.4028 92.5026 120.436 157.415 23 32.4529 36.6179 41.4305 46.9958 60.8933 69.5319 79.5430104.603 138.297 183.601 24 34.4265 39.0826 44.5020 50.8156 66.7648 76.7898 88.4973 118.155 158.659 213.978 25 36.4593 41.6459 47.7271 54.8645 73.1059 84.7009 98.3471 133.333 181.871 249.214 60 163.053 237.991 237.991 353.584 533.128 1253.21 1944.79 3034.82 7471.64 18535.1 46057.5 79111 Present Value of an Annuity Periods 3% 3 0.9151 4 4 0.8885 5 0.8626 6 0.8375 7 0.8131 8 0.7894 9 0.7664 10 0.7441 12 0.7014 15 0.6419 16 0.6232 17 0.6050 18 0.5874 19 0.5703 20 0.5537 21 0.5375 24 0.4920 25 0.4776 5% 0.8638 0.8227 0.7835 0.7462 0.7107 0.6768 0.6446 0.6139 0.5568 0.4810 0.4581 0.4363 0.4155 0.3957 0.3769 0.3589 0.3101 0.2953 6% 0.8396 0.7921 0.7473 0.7050 0.6651 0.6274 0.5919 0.5584 0.4970 0.4173 0.3937 0.3714 0.3503 0.3305 0.3118 0.2942 0.2470 0.2330 Present Value of a Lump-Sum a Rate of interest per period in percent 8% 9% 10% 12% 0.7938 0.7722 0.7513 0.7118 0.7350 0.7084 0.6830 0.6355 0.6806 0.6499 0.6209 0.5674 0.6310 0.5963 0.5645 0.5066 0.5835 0.5470 0.5132 0.4523 0.5403 0.5019 0.4665 0.4039 0.5003 0.4604 0.4241 0.3606 0.4632 0.4224 0.3855 0.3220 0.3971 0.3555 0.3186 0.2567 0.3152 0.2745 0.2394 0.1827 0.2919 0.2519 0.2176 0.1631 0.2703 0.2311 0.1978 0.1456 0.2503 0.2120 0.1799 0.1300 0.2317 0.1945 0.1635 0.1161 0.2146 0.1784 0.1486 0.1037 0.1987 0.1637 0.1351 0.0926 0.1577 0.1264 0.1015 0.0659 0.1460 0.1160 0.0923 0.0588 14% 0.6750 0.5921 0.5194 0.4556 0.3996 0.3506 0.3075 0.2697 0.2076 0.1401 0.1229 0.1078 0.0946 0.0829 0.0728 0.0638 0.0431 0.0378 15% 0.6575 0.5718 0.4972 0.4323 0.3759 0.3269 0.2843 0.2472 0.1870 0.1229 0.1069 0.0929 0.0808 0.0703 0.0611 0.0531 0.0349 0.0304 20% 0.5787 0.4823 0.4019 0.3349 0.2791 0.2326 0.1938 0.1615 0.1122 0.0649 0.0541 0.0471 0.0376 0.0313 0.0261 0.0217 0.0126 0.0105 Rate of interest per period in percent Periods %% 3% 5% 6% 8% 8 9% 10% 3 2.9703 2.8286 2.7233 2.6730 2.5771 2.5313 2.4869 4 3.9505 3.7171 3.5460 3.4651 3.3121 3.2397 3.1699 S 4.9259 4.5797 4.3295 4.2125 3.9927 3.8897 3.7908 6 5.8964 5.4172 5.0757 4.9173 4.6229 4.4859 4.3553 7 7 6.8621 6.2303 5.7864 5.5824 5.2064 5.0330 4.8684 8 7.8230 7.0197 6.4632 6.2098 5.7466 5.5348 5.3349 9 8.7791 7.7861 7.1078 6.8017 6.2469 5.9953 5.7590 10 9.7304 8.5302 7.7217 7.3601 6.7101 6,4177 6.1446 12 11.6189 9.9540 8.8633 8.3838 7.5361 7.1605 6.8137 15 14.4166 11.9379 10.3797 9.7123 8.5595 8.0607 7.6061 16 15.3399 12.5611 10.8378 10.1059 8.8514 8.3126 7.8237 17 16.2586 13.1661 11.2741 10.4773 9.1216 8.5436 8.0215 18 17.1728 13.7535 11.6896 10.8276 9.3719 8.7556 8.2014 19 18.0824 14.3238 12.0853 11.1581 9.6036 8.9501 8.3649 20 18.9874 14.8775 12.4622 11.4699 11.4699 9.8182 9.1286 8.5135 2119.8880 19.8880 15.4150 15.4150 12.8212 12.8212 11.7641 11.7641 10.0168 9.2922 8.6487 25 23.4456 17.4132 14.0939 12.7834 12.7834 10.6748 9.8226 9.0770 12% 2.4018 3.0374 3.6048 4.1114 4.5638 4.9676 5.3283 5.6502 6.1944 6.8109 6.9740 7.1196 7.2497 15% 2.2832 2.8550 3.3522 3.7845 4.1604 4.4873 4.7716 5.0188 5.4206 5.8474 5.9542 6.0472 6.1280 6.1982 6.2593 6.3125 6.4641 20% 2.1065 2.5887 2.9906 3.3255 3.6046 3.8372 4.0310 4.1925 4.4392 4.6755 4.7296 4.7746 4.8122 4.8435 4.8696 4,8913 4.9476 7.3658 7.4694 7.5620 7.8431