Answered step by step

Verified Expert Solution

Question

1 Approved Answer

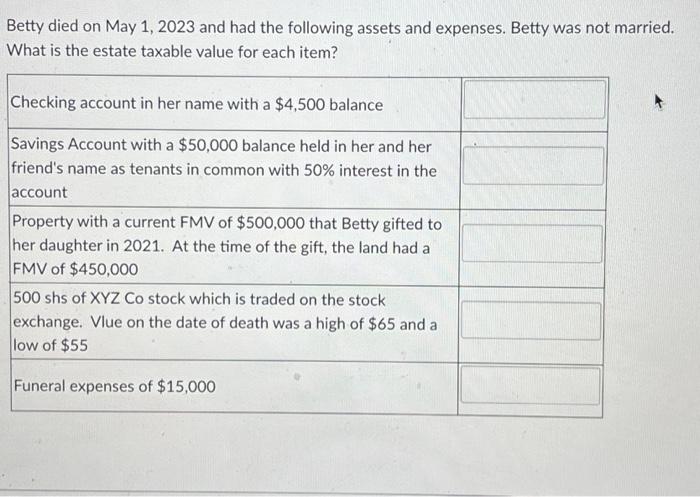

Betty died on May 1, 2023 and had the following assets and expenses. Betty was not married. What is the estate taxable value for

Betty died on May 1, 2023 and had the following assets and expenses. Betty was not married. What is the estate taxable value for each item? Checking account in her name with a $4,500 balance Savings Account with a $50,000 balance held in her and her friend's name as tenants in common with 50% interest in the account Property with a current FMV of $500,000 that Betty gifted to her daughter in 2021. At the time of the gift, the land had a FMV of $450,000 500 shs of XYZ Co stock which is traded on the stock exchange. Vlue on the date of death was a high of $65 and a low of $55 Funeral expenses of $15,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Estate Taxable Value for Bettys Assets Heres a breakdown of the taxable value for each item in Betty...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started