Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Betty just graduated from college. Since she is starting her own business, it's time to upgrade from her clunker to a reliable vehicle. Betty

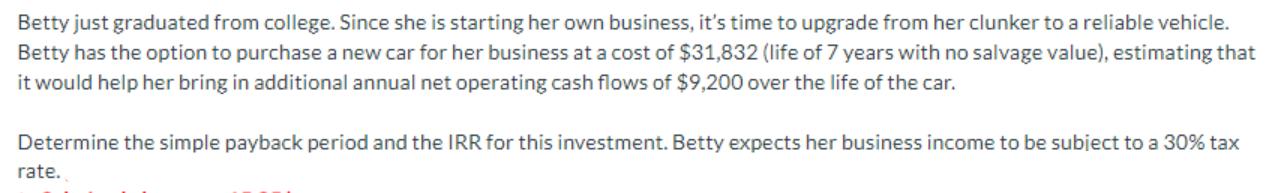

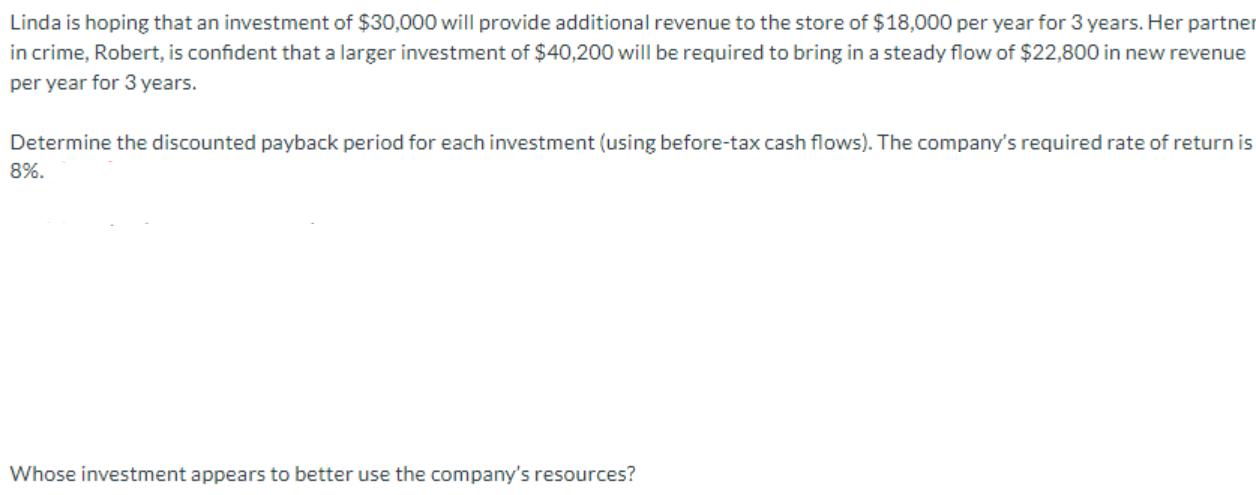

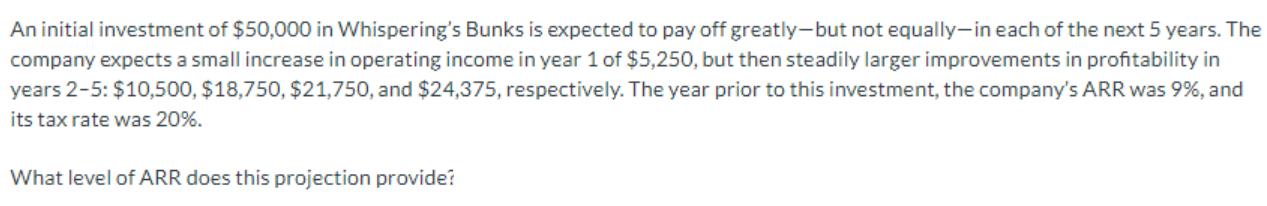

Betty just graduated from college. Since she is starting her own business, it's time to upgrade from her clunker to a reliable vehicle. Betty has the option to purchase a new car for her business at a cost of $31,832 (life of 7 years with no salvage value), estimating that it would help her bring in additional annual net operating cash flows of $9,200 over the life of the car. Determine the simple payback period and the IRR for this investment. Betty expects her business income to be subject to a 30% tax rate. Linda is hoping that an investment of $30,000 will provide additional revenue to the store of $18,000 per year for 3 years. Her partner in crime, Robert, is confident that a larger investment of $40,200 will be required to bring in a steady flow of $22,800 in new revenue per year for 3 years. Determine the discounted payback period for each investment (using before-tax cash flows). The company's required rate of return is 8%. Whose investment appears to better use the company's resources? An initial investment of $50,000 in Whispering's Bunks is expected to pay off greatly-but not equally-in each of the next 5 years. The company expects a small increase in operating income in year 1 of $5,250, but then steadily larger improvements in profitability in years 2-5: $10,500, $18,750, $21,750, and $24,375, respectively. The year prior to this investment, the company's ARR was 9%, and its tax rate was 20%. What level of ARR does this projection provide?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started