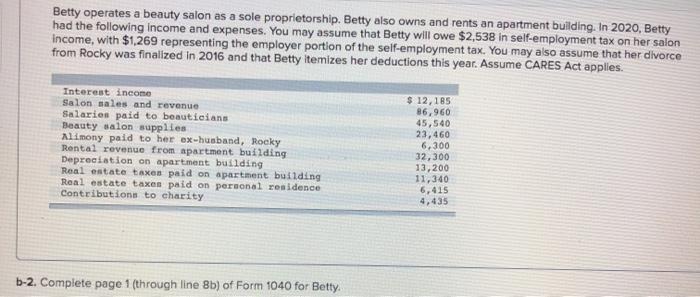

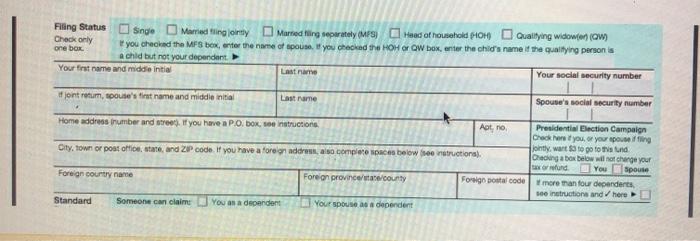

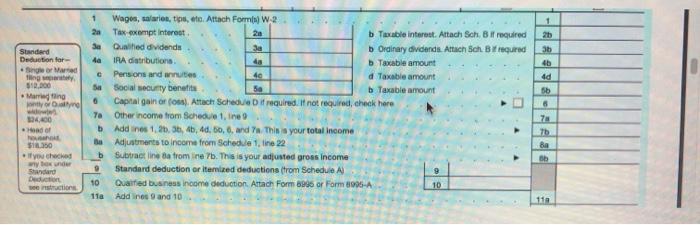

Betty operates a beauty salon as a sole proprietorship. Betty also owns and rents an apartment building. In 2020, Betty had the following income and expenses. You may assume that Betty will owe $2,538 in self-employment tax on her salon income, with $1,269 representing the employer portion of the self-employment tax. You may also assume that her divorce from Rocky was finalized in 2016 and that Betty itemizes her deductions this year. Assume CARES Act applies. Interest income Salon sales and revenue Salarios paid to beauticians Beauty salon supplies Alimony paid to her ex-husband, Rocky Rental revenue from apartment building Depreciation on apartment building Real estate taxes paid on apartment building Real estate taxes paid on personal residence Contributions to charity $ 12,185 86,960 45,540 23,460 6,300 32,300 13,200 11.340 6,415 4,435 b-2. Complete page 1 (through line 8b) of Form 1040 for Betty Filing Status Singe Married flingorny Marned hiling separately (MPS) and at household How Qualifying widown (ow Check only one box you checked the MFS box, enter the name of pouse, you checked the HOH or GW box, enter the child's name if the qualifying person is a chid but not your dependent Your first name and middle initial Last name Your social security number ont return, toute's first name and middle initial Last name Spouse's social security number Home address inumber and street). If you have a P.O. box, so instructions At, no Presidential Election Campaign Check you or your spousefing Jointly want to go to and City, town or post office state, and ZIP code. If you have a foreign address also complete ac below constructions Deing a box below will not change your axund You Spouse Foreign country name Fore on province //county Foreigo postal code more than four dependents, see instructions and here Standard Someone can claim you as a dependent Your spouse as dependent 1 1 25 Sa ta 3b 45 Standard Deduction for or Marne Thing $10.000 Marrigting 4d sb 0 Wages, salaries, tips, etc. Attach Form) W2 Tax-exempt interest 20 b Taxable interest. Attach Soh B if required Quated vidends Ja b Ordinary dividends. Attach Sch Bruired IRA distributions Taxable amount Pensions and its 40 Taxable amount Social security benefits 5a b Taxable amount Capital gain or (0) Attach Scheduif required. If not required, check here Other income from Schedule 1. In Addines 1. 2. 3. 4b, 4d, bo, 6 and 7. This is your total income Adjustments to income from Schedule 1. line 22 Subtract line atromine. This is your adjusted gross income Standard deduction or itemized deductions (trom Schedule A Qualified business income deduction Attach Form 8996 or Form 1986-A 10 Add nes 9 and 10 6 124.00 Ta b . Bo Tb 8 Bb S350 you checked wound Standard Det b 10 11a Betty operates a beauty salon as a sole proprietorship. Betty also owns and rents an apartment building. In 2020, Betty had the following income and expenses. You may assume that Betty will owe $2,538 in self-employment tax on her salon income, with $1,269 representing the employer portion of the self-employment tax. You may also assume that her divorce from Rocky was finalized in 2016 and that Betty itemizes her deductions this year. Assume CARES Act applies. Interest income Salon sales and revenue Salarios paid to beauticians Beauty salon supplies Alimony paid to her ex-husband, Rocky Rental revenue from apartment building Depreciation on apartment building Real estate taxes paid on apartment building Real estate taxes paid on personal residence Contributions to charity $ 12,185 86,960 45,540 23,460 6,300 32,300 13,200 11.340 6,415 4,435 b-2. Complete page 1 (through line 8b) of Form 1040 for Betty Filing Status Singe Married flingorny Marned hiling separately (MPS) and at household How Qualifying widown (ow Check only one box you checked the MFS box, enter the name of pouse, you checked the HOH or GW box, enter the child's name if the qualifying person is a chid but not your dependent Your first name and middle initial Last name Your social security number ont return, toute's first name and middle initial Last name Spouse's social security number Home address inumber and street). If you have a P.O. box, so instructions At, no Presidential Election Campaign Check you or your spousefing Jointly want to go to and City, town or post office state, and ZIP code. If you have a foreign address also complete ac below constructions Deing a box below will not change your axund You Spouse Foreign country name Fore on province //county Foreigo postal code more than four dependents, see instructions and here Standard Someone can claim you as a dependent Your spouse as dependent 1 1 25 Sa ta 3b 45 Standard Deduction for or Marne Thing $10.000 Marrigting 4d sb 0 Wages, salaries, tips, etc. Attach Form) W2 Tax-exempt interest 20 b Taxable interest. Attach Soh B if required Quated vidends Ja b Ordinary dividends. Attach Sch Bruired IRA distributions Taxable amount Pensions and its 40 Taxable amount Social security benefits 5a b Taxable amount Capital gain or (0) Attach Scheduif required. If not required, check here Other income from Schedule 1. In Addines 1. 2. 3. 4b, 4d, bo, 6 and 7. This is your total income Adjustments to income from Schedule 1. line 22 Subtract line atromine. This is your adjusted gross income Standard deduction or itemized deductions (trom Schedule A Qualified business income deduction Attach Form 8996 or Form 1986-A 10 Add nes 9 and 10 6 124.00 Ta b . Bo Tb 8 Bb S350 you checked wound Standard Det b 10 11a