Answered step by step

Verified Expert Solution

Question

1 Approved Answer

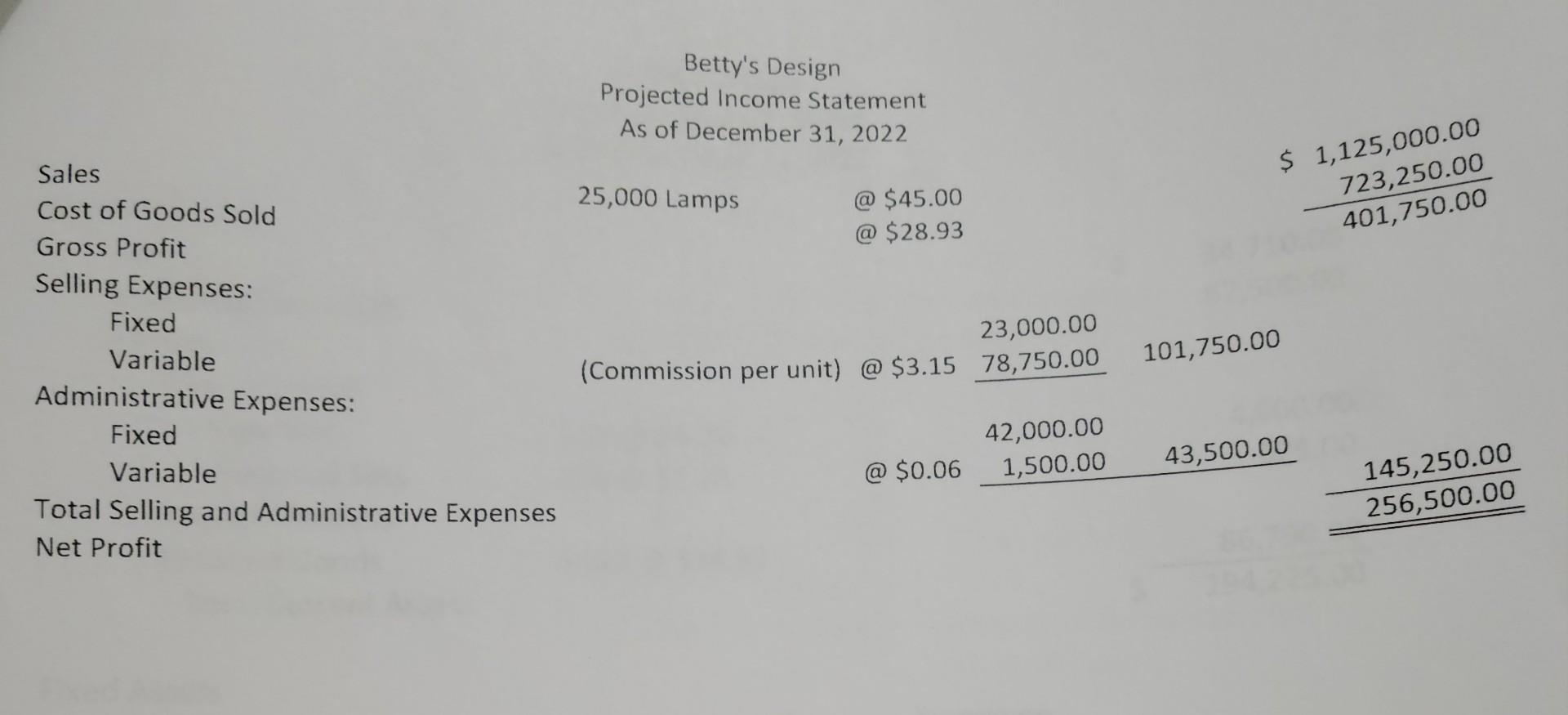

Betty's Design Projected Income Statement As of December 31, 2022 Sales Cost of Goods Sold Gross Profit Selling Expenses: Fixed Variable Administrative Expenses: Fixed Variable

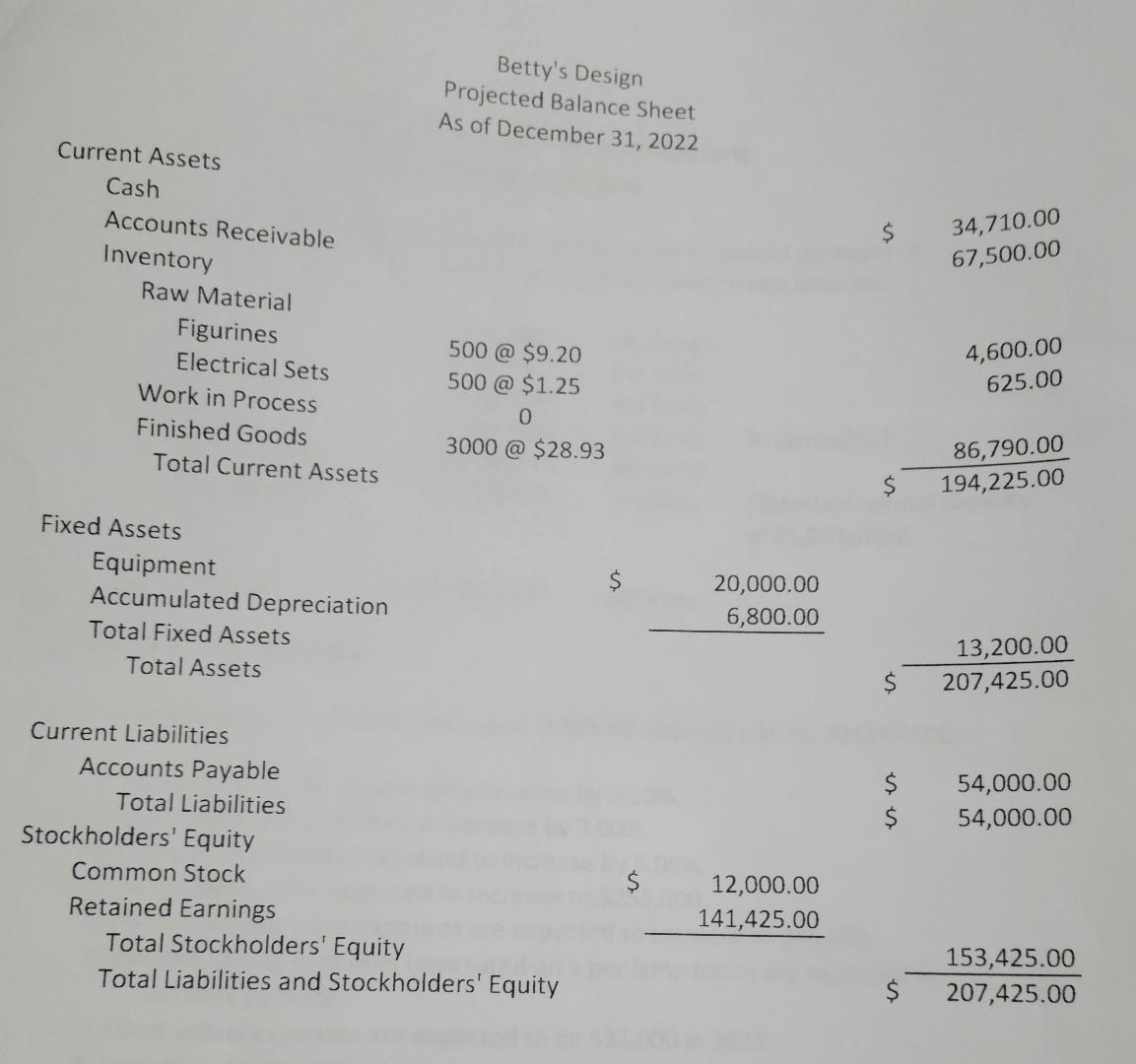

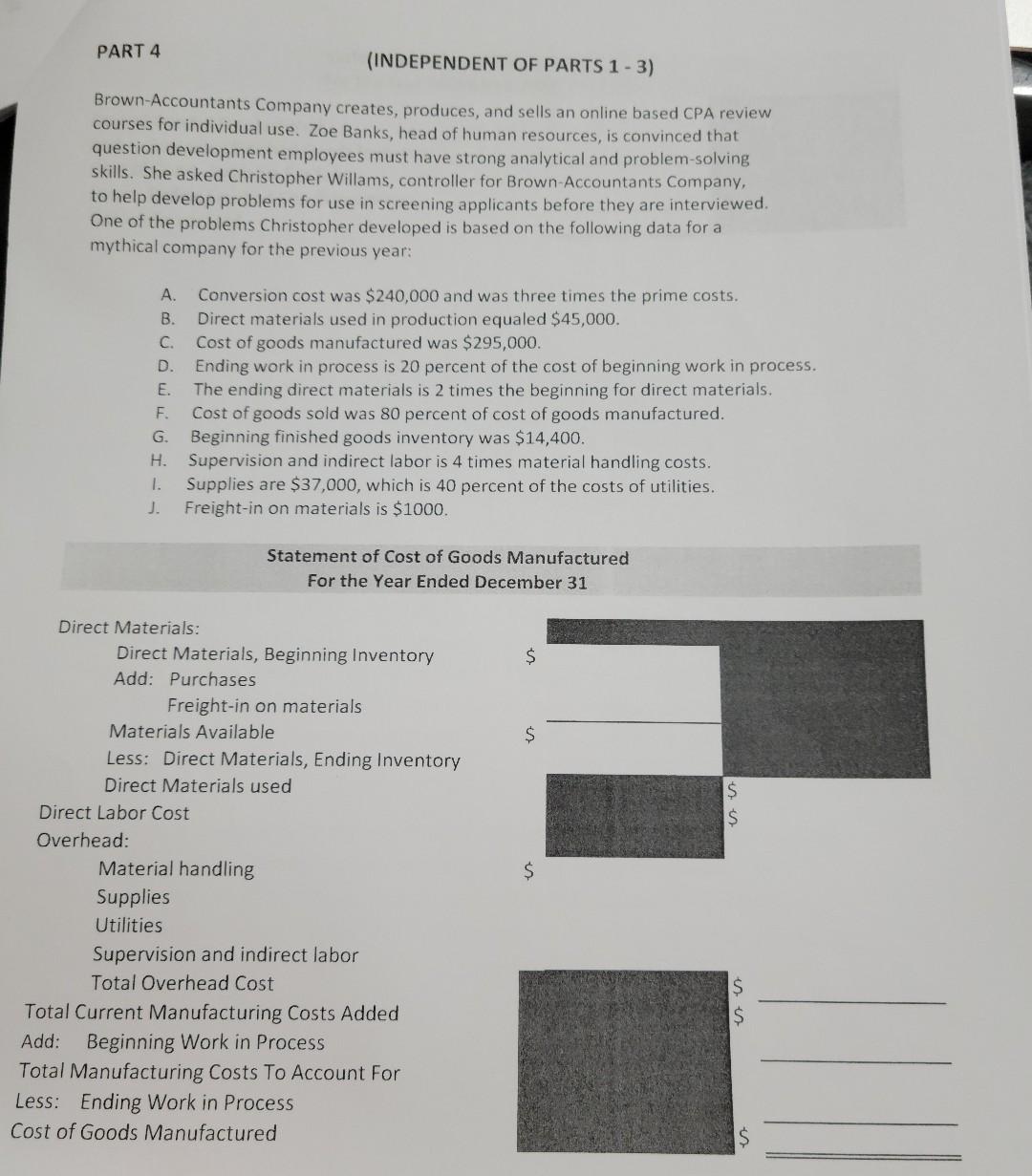

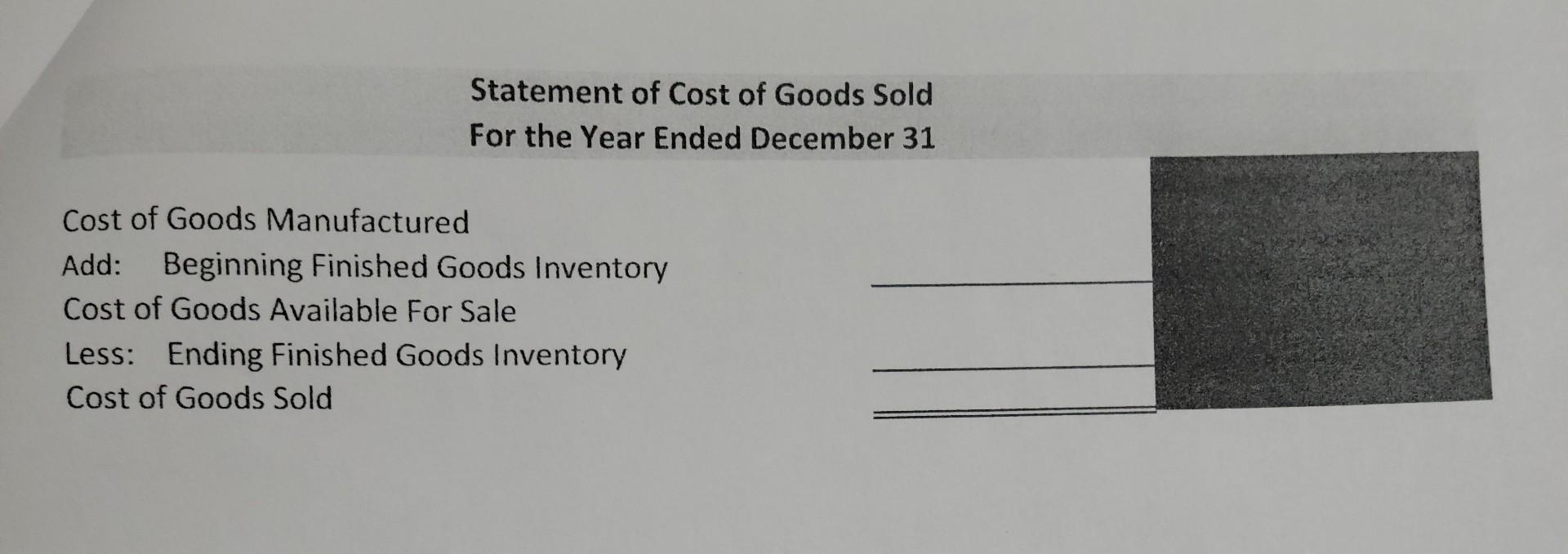

Betty's Design Projected Income Statement As of December 31, 2022 Sales Cost of Goods Sold Gross Profit Selling Expenses: Fixed Variable Administrative Expenses: Fixed Variable Total Selling and Administrative Expenses Net Profit @ $45.00 @ $28.93 \begin{tabular}{rlrr} (Commission per unit) @$3.15 & \begin{tabular}{r} 23,000.00 \\ 78,750.00 \end{tabular} & 101,750.00 \\ & 42,000.00 & \\ & @$0.06 & 1,500.00 & 43,500.00 \\ \hline \end{tabular} \$ 1,125,000.00 25,000 Lamps 723,250.00401,750.00 145,250.00256,500.00 Betty's Design Projected Balance Sheet As of December 31, 2022 Current Assets Cash Accounts Receivable Inventory Raw Material Figurines Electrical Sets Work in Process Finished Goods Total Current Assets Fixed Assets Equipment Accumulated Depreciation Total Fixed Assets Total Assets Current Liabilities Accounts Payable Total Liabilities Stockholders' Equity Common Stock Retained Earnings Total Stockholders' Equity Total Liabilities and Stockholders' Equity $34,710.00 67,500.00 \begin{tabular}{cr} 500@$9.20 & 4,600.00 \\ 500@$1.25 & 625.00 \\ 0 & \\ 3000@$28.93 & $86,790.00 \\ \hline & 194,225.00 \end{tabular} \begin{tabular}{r} 20,000.00 \\ 6,800.00 \\ \hline \end{tabular}\begin{tabular}{r} 13,200.00 \\ 207,425.00 \end{tabular} \begin{tabular}{r} 12,000.00 \\ 141,425.00 \\ \hline \end{tabular} $207,425.00153,425.00 PART 4 (INDEPENDENT OF PARTS 1 - 3) Brown-Accountants Company creates, produces, and sells an online based CPA review courses for individual use. Zoe Banks, head of human resources, is convinced that question development employees must have strong analytical and problem-solving skills. She asked Christopher Willams, controller for Brown-Accountants Company, to help develop problems for use in screening applicants before they are interviewed. One of the problems Christopher developed is based on the following data for a mythical company for the previous year: A. Conversion cost was $240,000 and was three times the prime costs. B. Direct materials used in production equaled $45,000. C. Cost of goods manufactured was $295,000. D. Ending work in process is 20 percent of the cost of beginning work in process. E. The ending direct materials is 2 times the beginning for direct materials. F. Cost of goods sold was 80 percent of cost of goods manufactured. G. Beginning finished goods inventory was $14,400. H. Supervision and indirect labor is 4 times material handling costs. I. Supplies are $37,000, which is 40 percent of the costs of utilities. J. Freight-in on materials is $1000. Manufactured amber 31 Statement of Cost of Goods Sold For the Year Ended December 31 Betty's Design Projected Income Statement As of December 31, 2022 Sales Cost of Goods Sold Gross Profit Selling Expenses: Fixed Variable Administrative Expenses: Fixed Variable Total Selling and Administrative Expenses Net Profit @ $45.00 @ $28.93 \begin{tabular}{rlrr} (Commission per unit) @$3.15 & \begin{tabular}{r} 23,000.00 \\ 78,750.00 \end{tabular} & 101,750.00 \\ & 42,000.00 & \\ & @$0.06 & 1,500.00 & 43,500.00 \\ \hline \end{tabular} \$ 1,125,000.00 25,000 Lamps 723,250.00401,750.00 145,250.00256,500.00 Betty's Design Projected Balance Sheet As of December 31, 2022 Current Assets Cash Accounts Receivable Inventory Raw Material Figurines Electrical Sets Work in Process Finished Goods Total Current Assets Fixed Assets Equipment Accumulated Depreciation Total Fixed Assets Total Assets Current Liabilities Accounts Payable Total Liabilities Stockholders' Equity Common Stock Retained Earnings Total Stockholders' Equity Total Liabilities and Stockholders' Equity $34,710.00 67,500.00 \begin{tabular}{cr} 500@$9.20 & 4,600.00 \\ 500@$1.25 & 625.00 \\ 0 & \\ 3000@$28.93 & $86,790.00 \\ \hline & 194,225.00 \end{tabular} \begin{tabular}{r} 20,000.00 \\ 6,800.00 \\ \hline \end{tabular}\begin{tabular}{r} 13,200.00 \\ 207,425.00 \end{tabular} \begin{tabular}{r} 12,000.00 \\ 141,425.00 \\ \hline \end{tabular} $207,425.00153,425.00 PART 4 (INDEPENDENT OF PARTS 1 - 3) Brown-Accountants Company creates, produces, and sells an online based CPA review courses for individual use. Zoe Banks, head of human resources, is convinced that question development employees must have strong analytical and problem-solving skills. She asked Christopher Willams, controller for Brown-Accountants Company, to help develop problems for use in screening applicants before they are interviewed. One of the problems Christopher developed is based on the following data for a mythical company for the previous year: A. Conversion cost was $240,000 and was three times the prime costs. B. Direct materials used in production equaled $45,000. C. Cost of goods manufactured was $295,000. D. Ending work in process is 20 percent of the cost of beginning work in process. E. The ending direct materials is 2 times the beginning for direct materials. F. Cost of goods sold was 80 percent of cost of goods manufactured. G. Beginning finished goods inventory was $14,400. H. Supervision and indirect labor is 4 times material handling costs. I. Supplies are $37,000, which is 40 percent of the costs of utilities. J. Freight-in on materials is $1000. Manufactured amber 31 Statement of Cost of Goods Sold For the Year Ended December 31

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started