Answered step by step

Verified Expert Solution

Question

1 Approved Answer

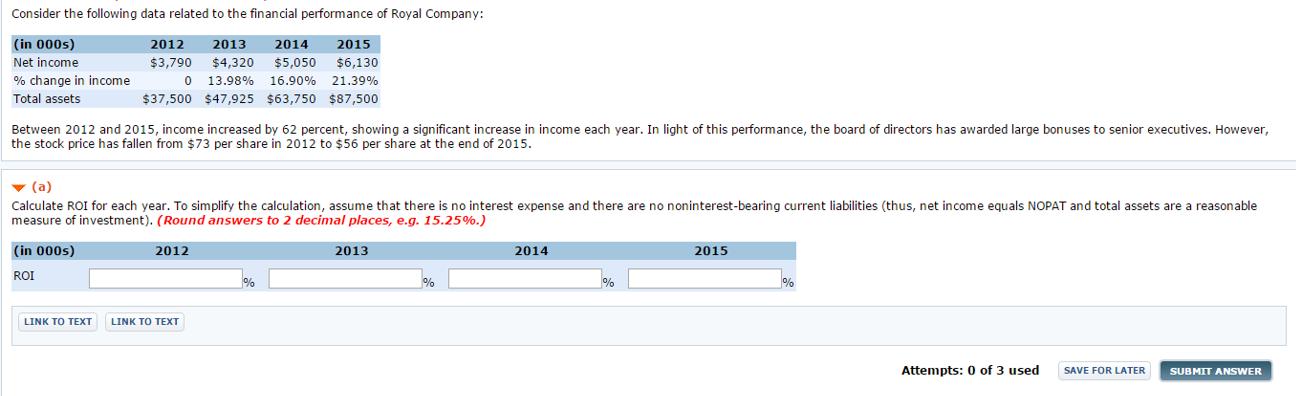

Consider the following data related to the financial performance of Royal Company: (in 000s) 2012 2013 2014 2015 Net income $3,790 $4,320 $5,050 $6,130

Consider the following data related to the financial performance of Royal Company: (in 000s) 2012 2013 2014 2015 Net income $3,790 $4,320 $5,050 $6,130 % change in income 13.98% 16.90% 21.39% Total assets $37,500 $47,925 $63,750 $87,500 Between 2012 and 2015, income increased by 62 percent, showing a significant increase in income each year. In light of this performance, the board of directors has awarded large bonuses to senior executives. However, the stock price has fallen from $73 per share in 2012 to $56 per share at the end of 2015. v (a) Calculate ROI for each year. To simplify the calculation, assume that there is no interest expense and there are no noninterest-bearing current liabilities (thus, net income equals NOPAT and total assets are a reasonable measure of investment). (Round answers to 2 decimal places, e.g. 15.25%.) (in 000s) 2012 2013 2014 2015 ROI LINK TO TEXT LINK TO TEXT Attempts: 0 of 3 used SAVE FOR LATER SUBMIT ANSWER

Step by Step Solution

★★★★★

3.45 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Statement showing computations Particu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started