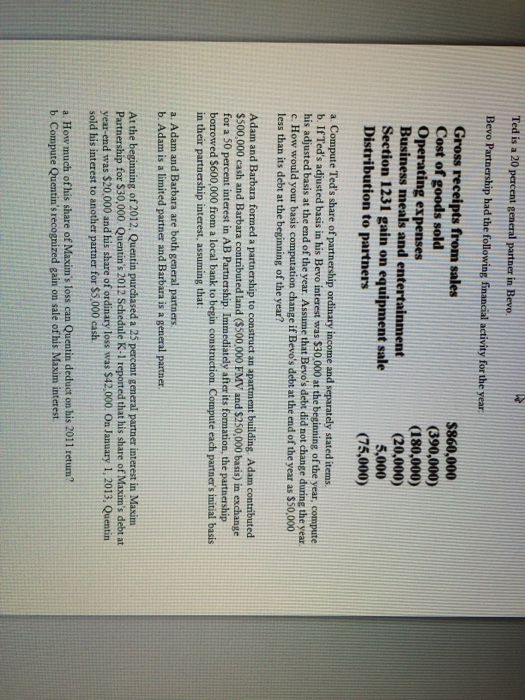

Bevo Partnership had the following financial activity for the year: Compute Ted's share of partnership ordinary income and separately stated items. If Ted's adjusted basis in his Bevo interest was $30,000 at the beginning of the year, compute his adjusted basis at the end of the year. Assume that Bevo's debt did not change during the year. How would your basis computation change if Bevo's debt at the end of the year as $50,000 less than its debt at the beginning of the year? Adam and Barbara formed a partnership to construct an apartment building Adam contributed $500,000 cash and Barbara contributed land ($500,000 FMV and $250,000 basis) b exchange for a 50 percent interest in AB Partnership. Immediately after its formation, the partnership borrowed $600,000 from a local bank to begin construction. Compute each partner's initial basis b their partnership interest, assuming that Adam and Barbara are both general partners. Adam is a limited partner and Barbara is a general partner. At the beginning of 2012. Quentin purchased a 25 percent general partner interest in Maxim. Partnership for $30,000. Quentin's 2012 Schedule K-1 reported that his share of Maxim's debt at year-end was $20,000 and his share of ordinary loss was $42,000. On January 1, 2013, Quentin sold his interest to another partner for $5,000 cash How much of his share of Maxim's loss can Quentin deduct on his 2011 return? Compute Quentin's recognized gain on sale of his Maxim interest. Bevo Partnership had the following financial activity for the year: Compute Ted's share of partnership ordinary income and separately stated items. If Ted's adjusted basis in his Bevo interest was $30,000 at the beginning of the year, compute his adjusted basis at the end of the year. Assume that Bevo's debt did not change during the year. How would your basis computation change if Bevo's debt at the end of the year as $50,000 less than its debt at the beginning of the year? Adam and Barbara formed a partnership to construct an apartment building Adam contributed $500,000 cash and Barbara contributed land ($500,000 FMV and $250,000 basis) b exchange for a 50 percent interest in AB Partnership. Immediately after its formation, the partnership borrowed $600,000 from a local bank to begin construction. Compute each partner's initial basis b their partnership interest, assuming that Adam and Barbara are both general partners. Adam is a limited partner and Barbara is a general partner. At the beginning of 2012. Quentin purchased a 25 percent general partner interest in Maxim. Partnership for $30,000. Quentin's 2012 Schedule K-1 reported that his share of Maxim's debt at year-end was $20,000 and his share of ordinary loss was $42,000. On January 1, 2013, Quentin sold his interest to another partner for $5,000 cash How much of his share of Maxim's loss can Quentin deduct on his 2011 return? Compute Quentin's recognized gain on sale of his Maxim interest