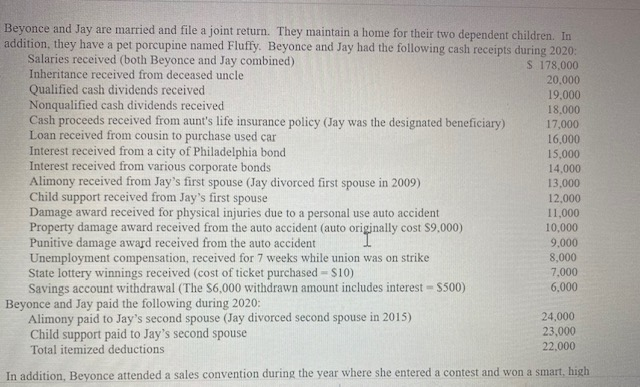

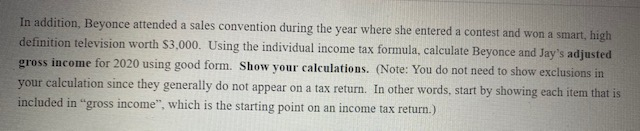

Beyonce and Jay are married and file a joint return. They maintain a home for their two dependent children. In addition, they have a pet porcupine named Fluffy. Beyonce and Jay had the following cash receipts during 2020: Salaries received (both Beyonce and Jay combined) $ 178,000 Inheritance received from deceased uncle 20.000 Qualified cash dividends received 19.000 Nonqualified cash dividends received 18.000 Cash proceeds received from aunt's life insurance policy (Jay was the designated beneficiary) 17,000 Loan received from cousin to purchase used car 16,000 Interest received from a city of Philadelphia bond 15.000 Interest received from various corporate bonds 14.000 Alimony received from Jay's first spouse Jay divorced first spouse in 2009) 13.000 Child support received from Jay's first spouse 12.000 Damage award received for physical injuries due to a personal use auto accident 11,000 Property damage award received from the auto accident (auto originally cost $9,000) 10,000 Punitive damage award received from the auto accident 9,000 Unemployment compensation, received for 7 weeks while union was on strike 8,000 State lottery winnings received (cost of ticket purchased - $10) 7,000 Savings account withdrawal (The S6,000 withdrawn amount includes interest - $500) 6.000 Beyonce and Jay paid the following during 2020: Alimony paid to Jay's second spouse (Jay divorced second spouse in 2015) 24,000 Child support paid to Jay's second spouse 23,000 Total itemized deductions 22.000 In addition, Beyonce attended a sales convention during the year where she entered a contest and won a smart, high In addition, Beyonce attended a sales convention during the year where she entered a contest and won a smart, high definition television worth $3,000. Using the individual income tax formula, calculate Beyonce and Jay's adjusted gross income for 2020 using good form. Show your calculations. (Note: You do not need to show exclusions in your calculation since they generally do not appear on a tax return. In other words, start by showing each item that is included in "gross income", which is the starting point on an income tax return.)