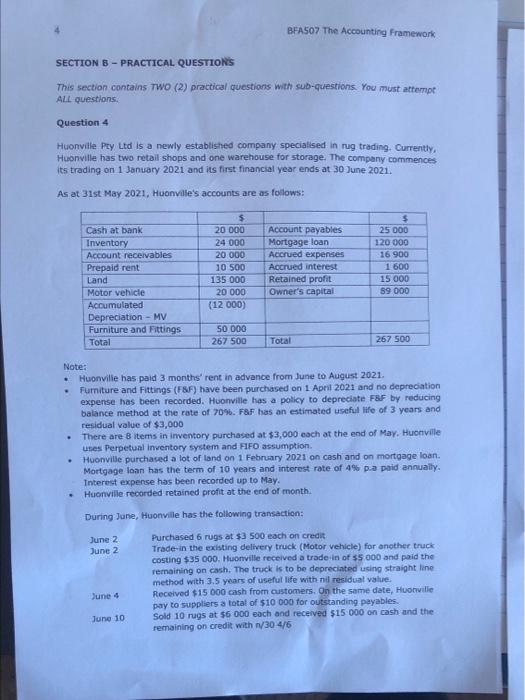

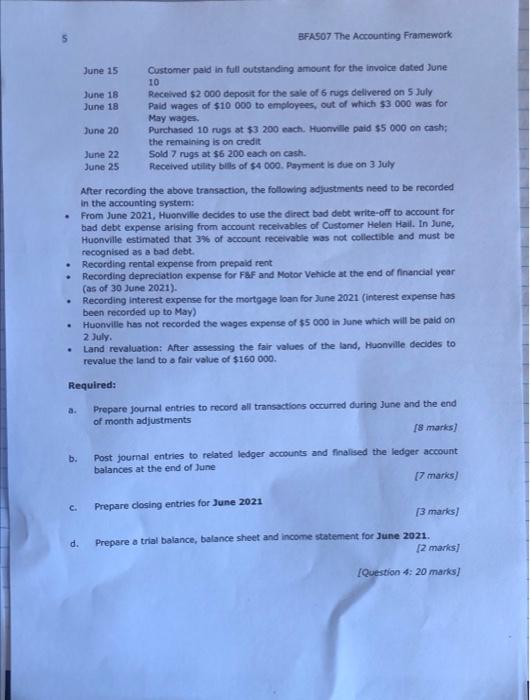

BFA507 The Accounting Framework SECTION B - PRACTICAL QUESTION'S This section contains TWO (2) practical questions with sub-questions. You must attempt ALL questions. Question 4 Huonville Pty Ltd is a newly established company specialised in rug trading. Currently, Huonville has two retail shops and one warehouse for storage. The company commences its trading on 1 January 2021 and its first financial year ends at 30 June 2021. As at 31st May 2021, Huonville's accounts are as follows: $ Cash at bank $ 20 000 24 000 20:000 Account payables Mortgage loan 25 000 120 000 Inventory Accrued expenses 16 900 Account receivables Prepaid rent 10 500 Accrued interest 1600 Land 135 000 Retained profit 15 000 89 000 Motor vehicle 20 000 Owner's capital Accumulated (12 000) Depreciation - MV 50.000 Furniture and Fittings Total 267 500 Total 267 500 Note: . . Huonville has paid 3 months' rent in advance from June to August 2021. Furniture and Fittings (F&F) have been purchased on 1 April 2021 and no depreciation expense has been recorded. Huonville has a policy to depreciate F&F by reducing balance method at the rate of 70%. F&F has an estimated useful life of 3 years and residual value of $3,000 . There are 8 items in inventory purchased at $3,000 each at the end of May. Huonville uses Perpetual inventory system and FIFO assumption. . Huonville purchased a lot of land on 1 February 2021 on cash and on mortgage loan. Mortgage loan has the term of 10 years and interest rate of 4% p.a paid annually. Interest expense has been recorded up to May. Huonville recorded retained profit a the end of month. . During June, Huonville has the following transaction: June 2 Purchased 6 rugs at $3 500 each on credit June 2 Trade-in the existing delivery truck (Motor vehicle) for another truck costing $35 000. Huonville received a trade-in of $5.000 and paid the remaining on cash. The truck is to be depreciated using straight line method with 3.5 years of useful life with nil residual value. June 4 Received $15 000 cash from customers. On the same date, Huonville pay to suppliers a total of $10 000 for outstanding payables. Sold 10 rugs at $6 000 each and received $15 000 on cash and the remaining on credit with n/30 4/6 June 10 BFAS07 The Accounting Framework June 15 Customer paid in full outstanding amount for the invoice dated June 10 June 18 June 18 Received $2 000 deposit for the sale of 6 rugs delivered on 5 July Paid wages of $10 000 to employees, out of which $3.000 was for May wages. June 20 Purchased 10 rugs at $3 200 each. Huonville paid $5 000 on cash; the remaining is on credit June 22 Sold 7 rugs at $6 200 each on cash. June 25 Received utility bills of $4 000. Payment is due on 3 July After recording the above transaction, the following adjustments need to be recorded in the accounting system: From June 2021, Huonville decides to use the direct bad debt write-off to account for bad debt expense arising from account receivables of Customer Helen Hail. In June, Huonville estimated that 3% of account receivable was not collectible and must be recognised as a bad debt. . Recording rental expense from prepaid rent Recording depreciation expense for F&F and Motor Vehicle at the end of financial year (as of 30 June 2021). . Recording interest expense for the mortgage loan for June 2021 (interest expense has been recorded up to May) . Huonville has not recorded the wages expense of $5 000 in June which will be paid on 2 July. . Land revaluation: After assessing the fair values of the land, Huonville decides to revalue the land to a fair value of $160 000. Required: a. Prepare journal entries to record all transactions occurred during June and the end of month adjustments [8 marks] b. Post journal entries to related ledger accounts and finalised the ledger account balances at the end of June [7 marks] C. Prepare closing entries for June 2021 [3 marks] d. Prepare a trial balance, balance sheet and income statement for June 2021. [2 marks] [Question 4: 20 marks]