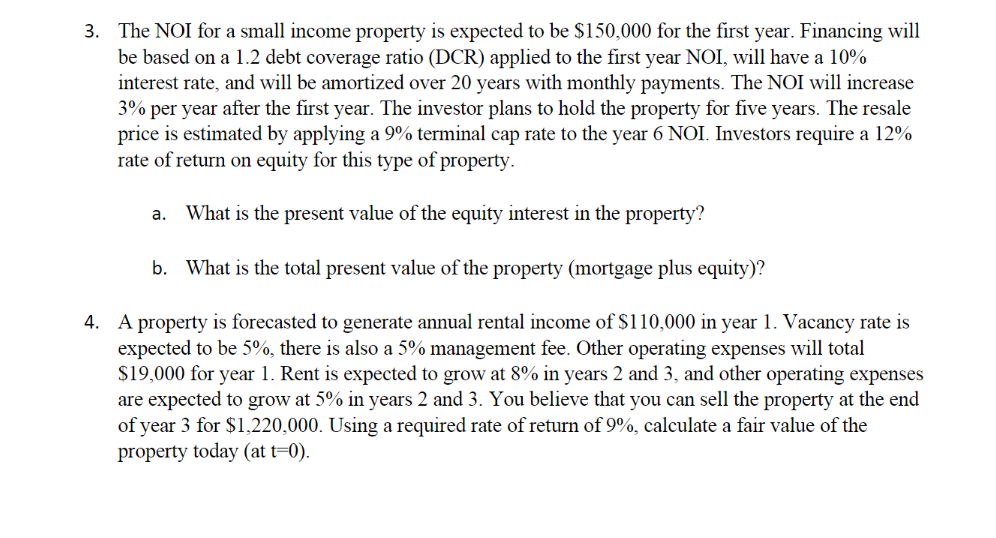

BFIN 421 Fall 2021 Homework Assignment - Chapters 10 & 11 1. Village Property Group is considering the purchase of the Adams Garden Apartment project. Next year's net operating income (NOI) is expected to be $1.5 million, and the local rental market appears to be in balance. NOI is expected to increase at 4% annually, and Village Property Group believes it should earn a 14% return on its investment. a. What would the estimated value for the property be now? b. If the required return were 12%, what would the value of the property be? 2. Athena Investment Co. is considering the purchase of an office property. After a careful review of the market and leases that are in place, Athena believes that next year's cash flow will be $100,000. It also believes cash flow will rise by $7,000 each year for the foreseeable future. It plans to own the property for at least ten years. Based on a review of sales of properties that are now 10 years older than the subject property, Athena has determined that cap rates are in the range of .10. Athena believes that it should earn an IRR of at least 12%. a. What is the estimated value of the property, assuming a 10 terminal cap rate? b. What is the current, or "going in, cap rate for this property? C. What accounts for the difference between the cap rate in b and the terminal cap rate of 10? 3. The NOI for a small income property is expected to be $150,000 for the first year. Financing will be based on a 1.2 debt coverage ratio (DCR) applied to the first year NOI, will have a 10% interest rate, and will be amortized over 20 years with monthly payments. The NOI will increase 3% per year after the first year. The investor plans to hold the property for five years. The resale price is estimated by applying a 9% terminal cap rate to the year 6 NOI. Investors require a 12% rate of return on equity for this type of property. a. What is the present value of the equity interest in the property? b. What is the total present value of the property (mortgage plus equity)? 4. A property is forecasted to generate annual rental income of $110,000 in year 1. Vacancy rate is expected to be 5%, there is also a 5% management fee. Other operating expenses will total $19,000 for year 1. Rent is expected to grow at 8% in years 2 and 3, and other operating expenses are expected to grow at 5% in years 2 and 3. You believe that you can sell the property at the end of year 3 for $1,220,000. Using a required rate of return of 9%, calculate a fair value of the property today (at t=0)