Answered step by step

Verified Expert Solution

Question

1 Approved Answer

B&G Incorporated decided to change from the FIFO method of valuing inventory to the weighted average method in July 2017. The cumulative effect on prior

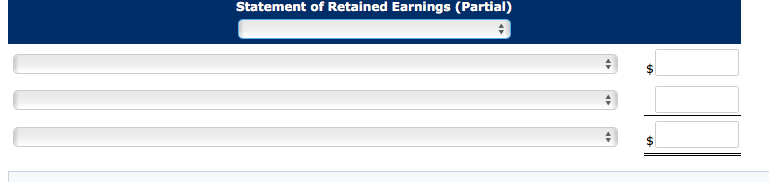

B&G Incorporated decided to change from the FIFO method of valuing inventory to the weighted average method in July 2017. The cumulative effect on prior years of retrospective application of the new inventory costing method was determined to be $15,000 net of $4,000 tax. As prices are decreasing, cost of sales would be lower and ending inventory higher for the preceding period. Retained earnings on January 1, 2017 was $241,000.

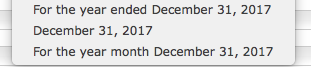

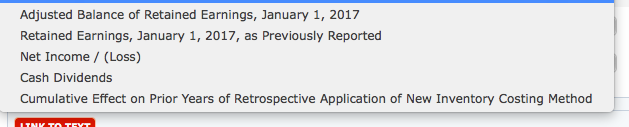

Here are the choices:

Statement of Retained Earnings (Partial) For the year ended December 31, 2017 December 31, 2017 For the year month December 31, 2017 Adjusted Balance of Retained Earnings, January 1, 2017 Retained Earnings, January 1, 2017, as Previously Reported Net Income (Loss) Cash Dividends Cumulative Effect on Prior Years of Retrospective Application of New Inventory Costing Method

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started