Answered step by step

Verified Expert Solution

Question

1 Approved Answer

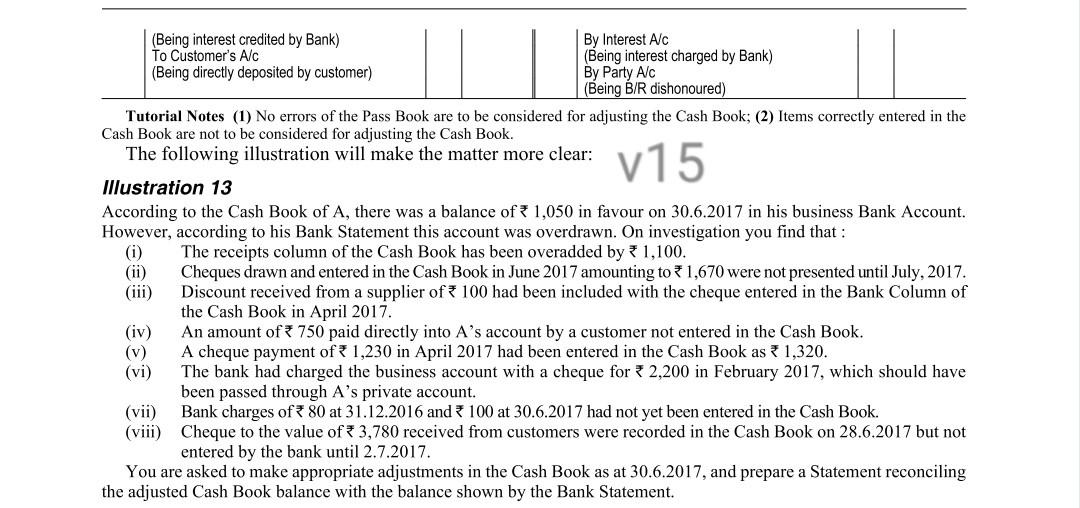

bh v15 (Being interest credited by Bank) By Interest A/C To Customer's A/C (Being interest charged by Bank) (Being directly deposited by customer) By Party

bh

v15 (Being interest credited by Bank) By Interest A/C To Customer's A/C (Being interest charged by Bank) (Being directly deposited by customer) By Party Alc (Being BIR dishonoured) Tutorial Notes (1) No errors of the Pass Book are to be considered for adjusting the Cash Book; (2) Items correctly entered in the Cash Book are not to be considered for adjusting the Cash Book. The following illustration will make the matter more clear: Illustration 13 According to the Cash Book of A, there was a balance of 3 1,050 in favour on 30.6.2017 in his business Bank Account. However, according to his Bank Statement this account was overdrawn. On investigation you find that : (i) The receipts column of the Cash Book has been overadded by * 1,100. Cheques drawn and entered in the Cash Book in June 2017 amounting to 7 1,670 were not presented until July, 2017. Discount received from a supplier of 100 had been included with the cheque entered in the Bank Column of the Cash Book in April 2017. (iv) An amount of 750 paid directly into A's account by a customer not entered in the Cash Book. (v) A cheque payment of 1,230 in April 2017 had been entered in the Cash Book as 1,320. (vi) The bank had charged the business account with a cheque for 2,200 in February 2017, which should have been passed through A's private account. (vii) Bank charges of 80 at 31.12.2016 and 100 at 30.6.2017 had not yet been entered in the Cash Book. (viii) Cheque to the value of 3,780 received from customers were recorded in the Cash Book on 28.6.2017 but not entered by the bank until 2.7.2017. You are asked to make appropriate adjustments in the Cash Book as at 30.6.2017, and prepare a Statement reconciling the adjusted Cash Book balance with the balance shown by the Bank StatementStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started