Answered step by step

Verified Expert Solution

Question

1 Approved Answer

bh V17 Illustration 15 Sri A Basu maintained two separate banking accounts, one with United Bank of India and the other with State Bank of

bh

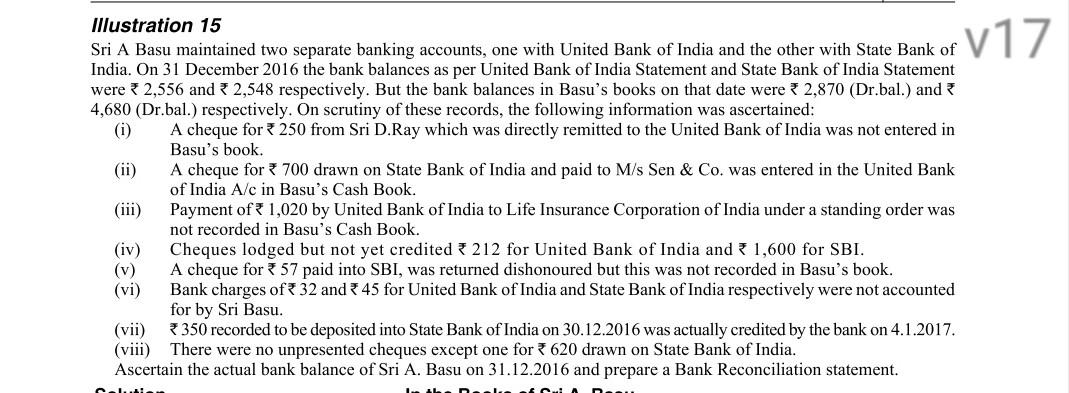

V17 Illustration 15 Sri A Basu maintained two separate banking accounts, one with United Bank of India and the other with State Bank of India. On 31 December 2016 the bank balances as per United Bank of India Statement and State Bank of India Statement were *2,556 and 2,548 respectively. But the bank balances in Basu's books on that date were * 2,870 (Dr.bal.) and 4,680 (Dr.bal.) respectively. On scrutiny of these records, the following information was ascertained: (i) A cheque for 250 from Sri D.Ray which was directly remitted to the United Bank of India was not entered in Basu's book. (ii) A cheque for 700 drawn on State Bank of India and paid to M/s Sen & Co. was entered in the United Bank of India A/c in Basu's Cash Book. (iii) Payment of 1,020 by United Bank of India to Life Insurance Corporation of India under a standing order was not recorded in Basu's Cash Book. (iv) Cheques lodged but not yet credited 212 for United Bank of India and 1,600 for SBI. (v) A cheque for 57 paid into SBI, was returned dishonoured but this was not recorded in Basu's book. (vi) Bank charges of 32 and 45 for United Bank of India and State Bank of India respectively were not accounted for by Sri Basu. (vii) 350 recorded to be deposited into State Bank of India on 30.12.2016 was actually credited by the bank on 4.1.2017. (viii) There were no unpresented cheques except one for 620 drawn on State Bank of India. Ascertain the actual bank balance of Sri A. Basu on 31.12.2016 and prepare a Bank Reconciliation statementStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started