Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Bharat Hotels Company ( BHC ) is a major hotel chain of India with a century old history. The company operates 3 5 hotels of

Bharat Hotels Company BHC is a major hotel chain of India with a century old history. The company operates hotels of which are owned by it and the rest are owned by others but managed by BHC

BHC has had a significant innings spanning the last three decades both in India and overseas and has established itself as the premier hospitality body in this country. Indeed the BHC has spanned the length and breadth of the country, gracing important industrial towns and cities, beautiful beaches, hill stations, historical and pilgrim centres and wildlife destinations. Over the years, the BHC has won international acclaim for its quality hotels and its excellence in business facilities, services, cuisine and interiors. The BHCs operations covers over hotels in India and abroad, and encompass a number of brands across various price segments. The Company has a dominant position in most areas it is present in Providing worldclass personalized service to guests while authentically reproducing the traditions and heritage of India has made the "BHARAT" brand a symbol of luxury and service the world over. The BHC is grouped into strategic business units to get consistency across the different units in the same brand and standardize the product and service across the brands, making them distinct and identifiable. These brands have been classified as Luxury, Business and Leisure.

BHCs principal strategy has been to serve the high end of the international and leisure travel markets in major metropolises, secondary cities, and tourist destinations. It plans to continue to develop new business and leisure hotels to take advantage of the increasing demand that is emanating from the larger flow of commercial and tourist traffic of foreign as well as domestic travellers.

BHC believes that the unique nature of its properties and the emphasis on personal service distinguishes it from other hotels in the country. Its ability to forge management contracts for choice properties owned by others has given it the flexibility to swiftly move into new markets while avoiding the capital intensive and time consuming activity of constructing its hotels.

BHCs major competitors in India are two other major Indian hotel chains and a host of others five star hotels which operate in the metropolises as an extension of multinational hotel chains. The foreign hotel majors are considerably stronger than the Indian hotels in terms of financial resources, but their presence in the country has historically been small.

THE INDUSTRY

The hExhibit

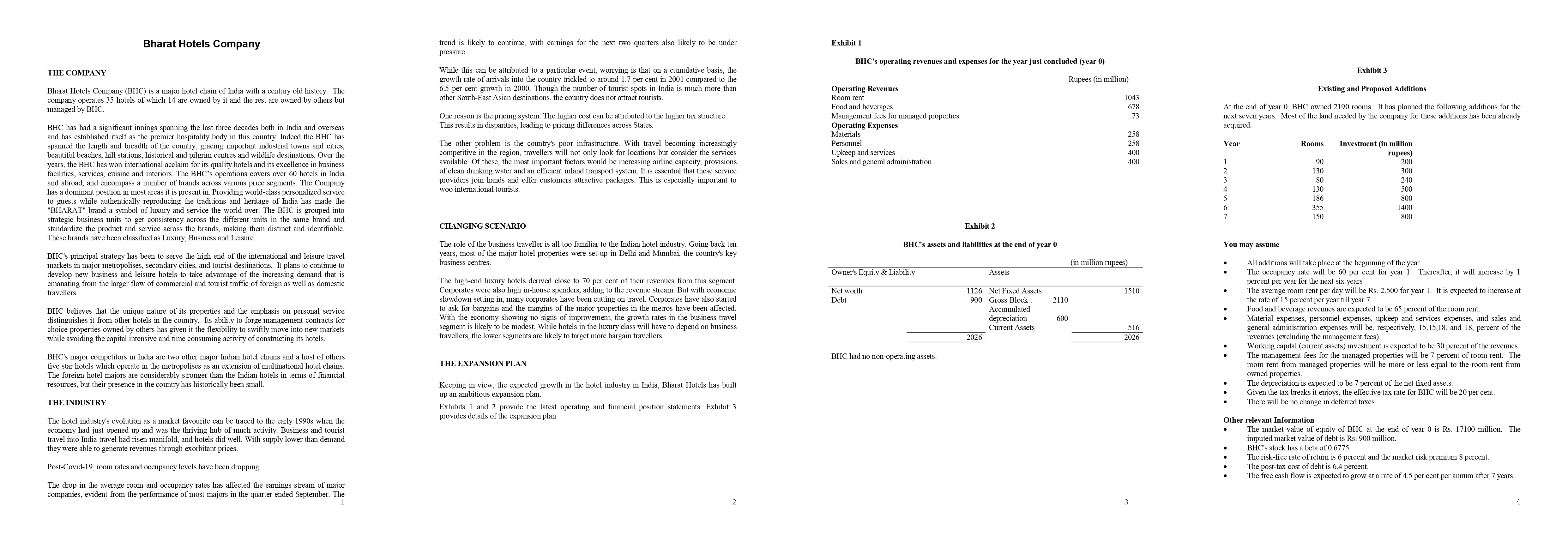

BHCs operating revenues and expenses for the year just concluded year

Rupees in million

Operating Revenues

Room rent

Food and beverages

Management fees for managed properties

Operating Expenses

Materials

Personnel

Upkeep and services

Sales and general administration

Exhibit

BHCs assets and liabilities at the end of year

in million rupees

Owner's Equity & Liability

Assets

Net worth

Net Fixed Assets

Debt

Gross Block : Accumulated depreciation

Current Assets

BHC had no nonoperating assets.Existing and Proposed Additions

At the end of year BHC owned rooms. It has planned the following additions for the next seven years. Most of the land needed by the company for these additions has been already acquired.

Year

Rooms

Investment in million rupees

You may assume

All additions will take place at the beginning of the year.

The occupancy rate will be per cent for year Thereafter, it will increase by percent per year for the next six years

The average room rent per day will be Rs for year It is expected to increase at the rate of percent per year till year

Food and beverage revenues are expected to be percent of the room rent.

Material expenses, personnel expenses, upkeep and services expenses, and sales and general administration expenses will be respectively, and percent of the revenues excluding the management fees

Working capital current assets investment is expected to be percent of the revenues.

The management fees for the managed properties will be percent of room rent. The room rent from managed properties will be more or less equal to the room rent from owned properties.

The depreciation is expected to be percent of the net fixed assets.

Given the tax breaks it enjoys, the effective tax rate for BHC will be per cent.

There will be no change in deferred taxes.

Other relevant Information

The market value of equity of BHC at the end of year is Rs million. The imputed market value of debt is Rs million.

BHCs stock has a beta of

The riskfree rate of return is percent and the market risk premium percent.

The posttax cost of debt is percent.

The free cash flow is expected to grow at a rate of per cent per annum after years

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started