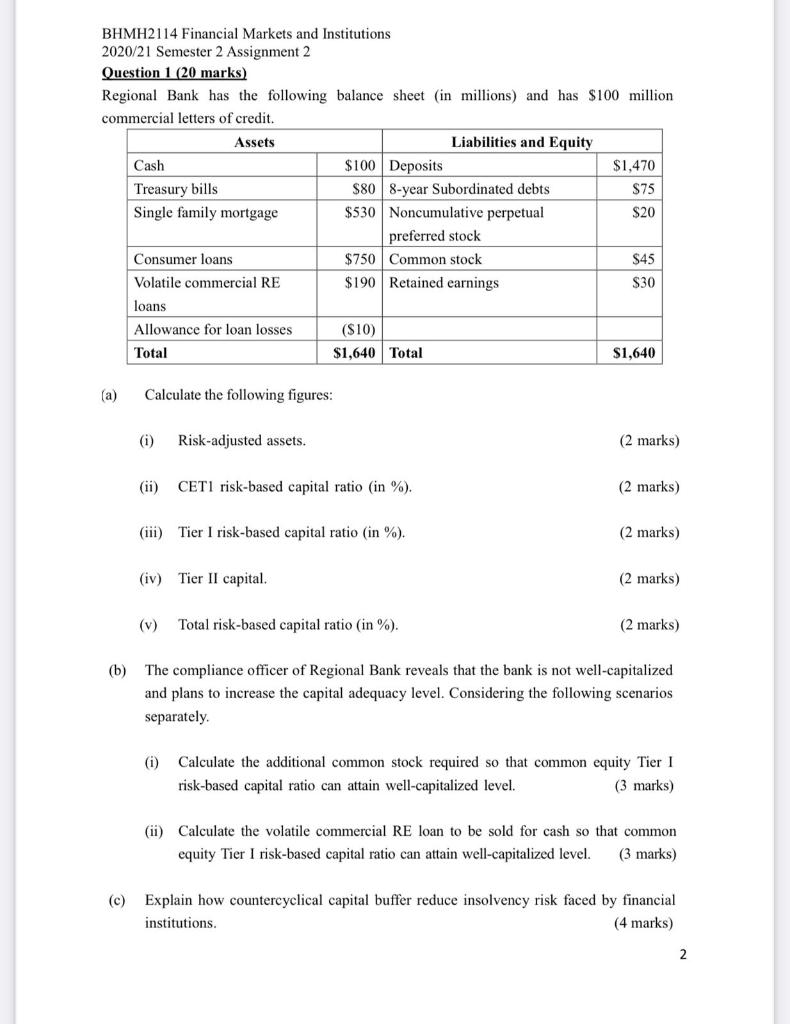

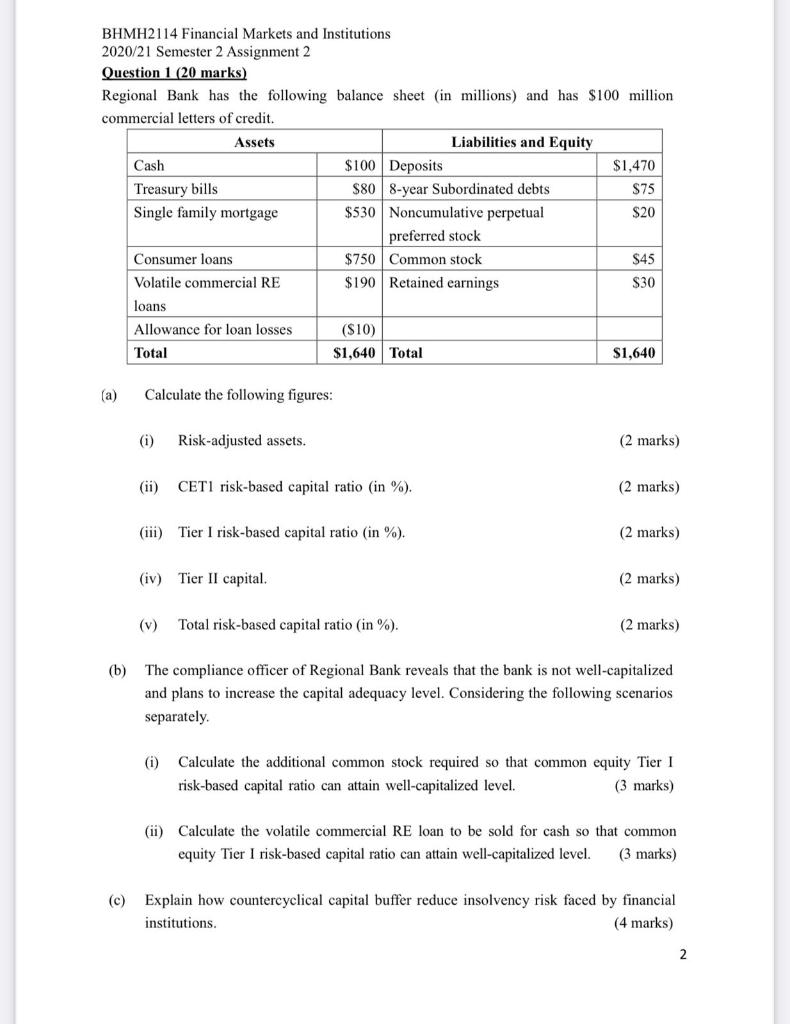

BHMH2114 Financial Markets and Institutions 2020/21 Semester 2 Assignment 2 Question 1 (20 marks) Regional Bank has the following balance sheet (in millions) and has $100 million commercial letters of credit. Assets Liabilities and Equity Cash $100 Deposits $1,470 Treasury bills $80 8-year Subordinated debts $75 Single family mortgage $530 Noncumulative perpetual $20 preferred stock Consumer loans $750 Common stock $45 Volatile commercial RE $190 Retained earnings S30 loans Allowance for loan losses (810) $1,640 Total $1,640 Total (a) Calculate the following figures: (i) Risk-adjusted assets. (2 marks) (ii) CETI risk-based capital ratio (in %). (2 marks) (iii) Tier I risk-based capital ratio (in %). (2 marks) (iv) Tier II capital. (2 marks) (V) Total risk-based capital ratio (in %). (2 marks) (b) The compliance officer of Regional Bank reveals that the bank is not well-capitalized and plans to increase the capital adequacy level. Considering the following scenarios separately. (i) Calculate the additional common stock required so that common equity Tier I risk-based capital ratio can attain well-capitalized level. (3 marks) (ii) Calculate the volatile commercial RE loan to be sold for cash so that common equity Tier I risk-based capital ratio can attain well-capitalized level. (3 marks) (c) Explain how countercyclical capital buffer reduce insolvency risk faced by financial institutions. (4 marks) 2 BHMH2114 Financial Markets and Institutions 2020/21 Semester 2 Assignment 2 Question 1 (20 marks) Regional Bank has the following balance sheet (in millions) and has $100 million commercial letters of credit. Assets Liabilities and Equity Cash $100 Deposits $1,470 Treasury bills $80 8-year Subordinated debts $75 Single family mortgage $530 Noncumulative perpetual $20 preferred stock Consumer loans $750 Common stock $45 Volatile commercial RE $190 Retained earnings S30 loans Allowance for loan losses (810) $1,640 Total $1,640 Total (a) Calculate the following figures: (i) Risk-adjusted assets. (2 marks) (ii) CETI risk-based capital ratio (in %). (2 marks) (iii) Tier I risk-based capital ratio (in %). (2 marks) (iv) Tier II capital. (2 marks) (V) Total risk-based capital ratio (in %). (2 marks) (b) The compliance officer of Regional Bank reveals that the bank is not well-capitalized and plans to increase the capital adequacy level. Considering the following scenarios separately. (i) Calculate the additional common stock required so that common equity Tier I risk-based capital ratio can attain well-capitalized level. (3 marks) (ii) Calculate the volatile commercial RE loan to be sold for cash so that common equity Tier I risk-based capital ratio can attain well-capitalized level. (3 marks) (c) Explain how countercyclical capital buffer reduce insolvency risk faced by financial institutions. (4 marks) 2