Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Big Box Hardware Company engaged in the following transactions in March. March 1 Sold merchandise on account for $282,900; terms 2/10, n/30, FOB shipping

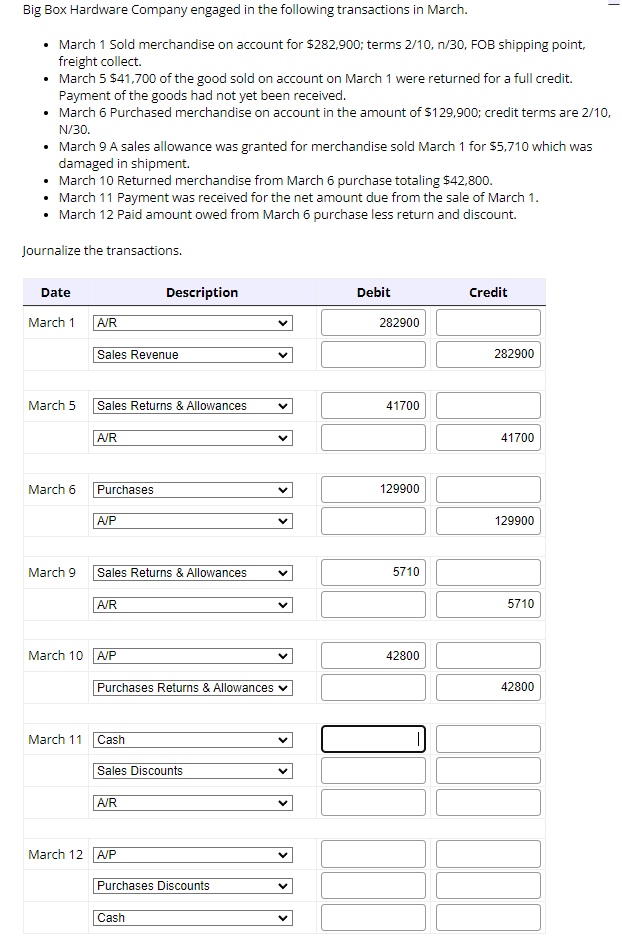

Big Box Hardware Company engaged in the following transactions in March. March 1 Sold merchandise on account for $282,900; terms 2/10, n/30, FOB shipping point, freight collect. March 5 $41,700 of the good sold on account on March 1 were returned for a full credit. Payment of the goods had not yet been received. March 6 Purchased merchandise on account in the amount of $129,900; credit terms are 2/10, N/30. March 9 A sales allowance was granted for merchandise sold March 1 for $5,710 which was damaged in shipment. March 10 Returned merchandise from March 6 purchase totaling $42,800. March 11 Payment was received for the net amount due from the sale of March 1. March 12 Paid amount owed from March 6 purchase less return and discount. Journalize the transactions. Date March 1 A/R March 5 March 6 March 9 March 11 Sales Revenue Sales Returns & Allowances A/R Purchases A/P Sales Returns & Allowances A/R March 10 A/P Description Purchases Returns & Allowances Cash Sales Discounts A/R March 12 A/P Purchases Discounts Cash Debit 282900 41700 129900 5710 42800 Credit 282900 41700 129900 5710 T 42800 Big Box Hardware Company engaged in the following transactions in March. March 1 Sold merchandise on account for $282,900; terms 2/10, n/30, FOB shipping point, freight collect. March 5 $41,700 of the good sold on account on March 1 were returned for a full credit. Payment of the goods had not yet been received. March 6 Purchased merchandise on account in the amount of $129,900; credit terms are 2/10, N/30. March 9 A sales allowance was granted for merchandise sold March 1 for $5,710 which was damaged in shipment. March 10 Returned merchandise from March 6 purchase totaling $42,800. March 11 Payment was received for the net amount due from the sale of March 1. March 12 Paid amount owed from March 6 purchase less return and discount. Journalize the transactions. Date March 1 A/R March 5 March 6 March 9 March 11 Sales Revenue Sales Returns & Allowances A/R Purchases A/P Sales Returns & Allowances A/R March 10 A/P Description Purchases Returns & Allowances Cash Sales Discounts A/R March 12 A/P Purchases Discounts Cash Debit 282900 41700 129900 5710 42800 Credit 282900 41700 129900 5710 T 42800

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The last two transactions are being given here Rest transactions are ok Ne...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started