Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Big Co acquired 70% of the common Stock of Little Co. on 1/1/22 for $301,000. The fair value of the non-controlling interest was $129,000.

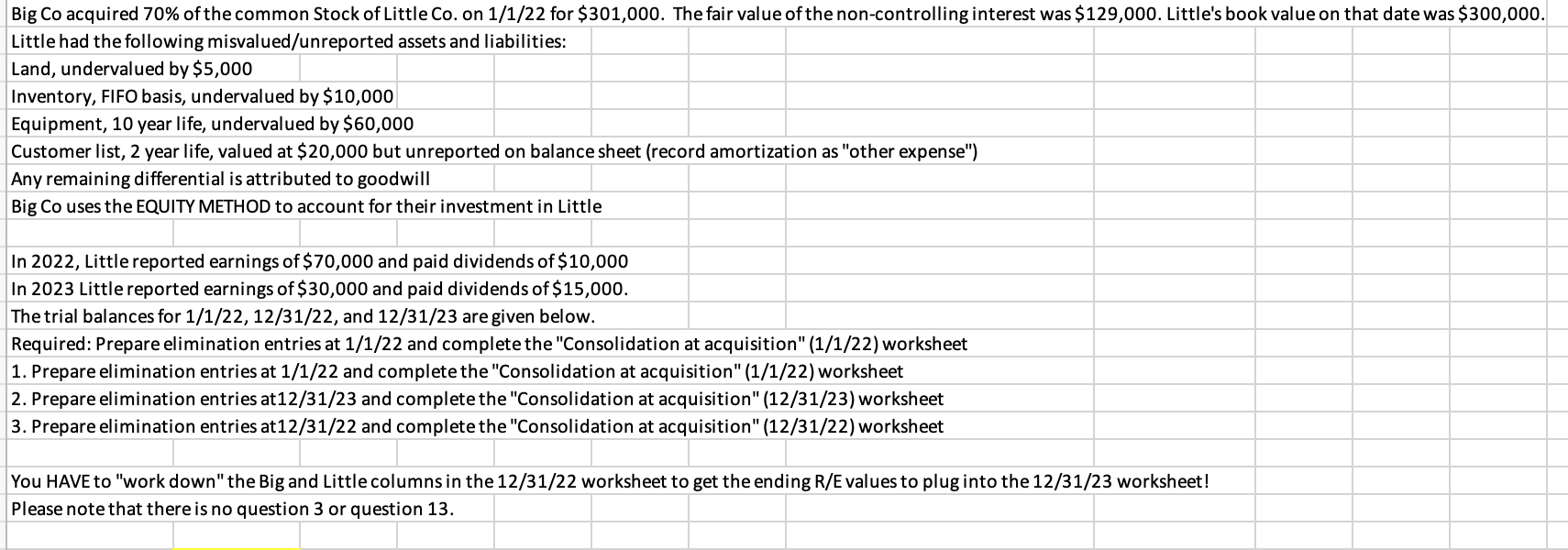

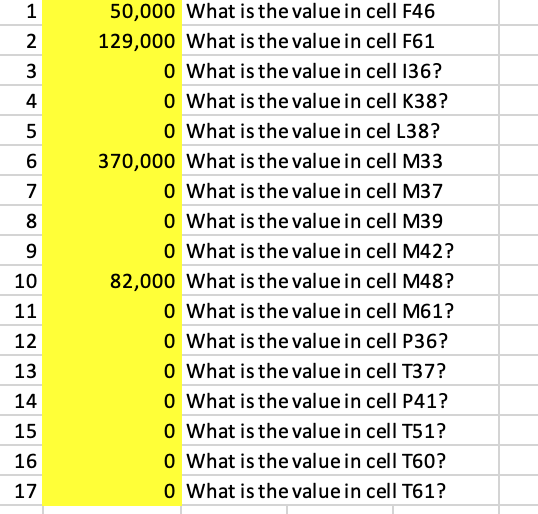

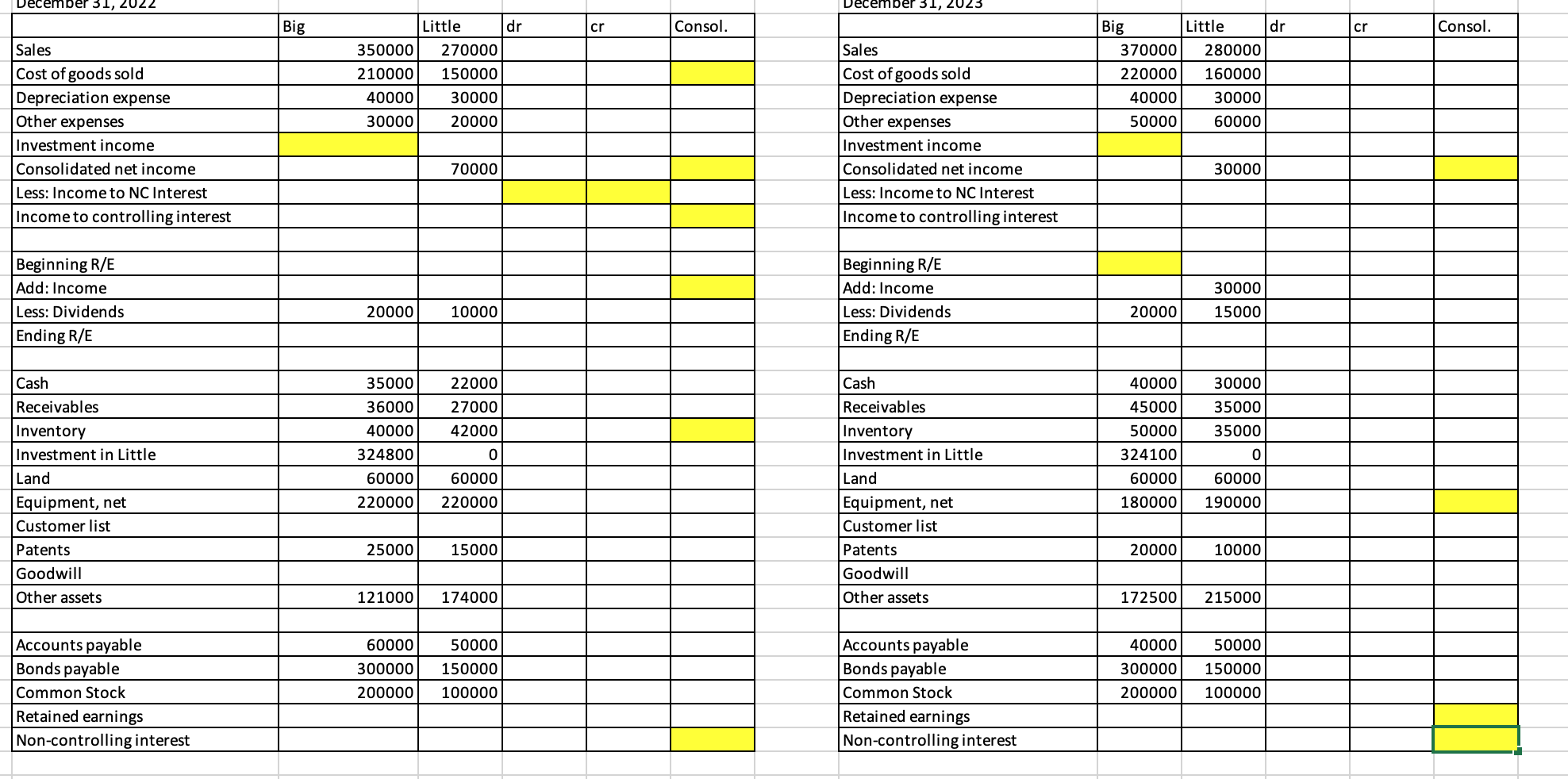

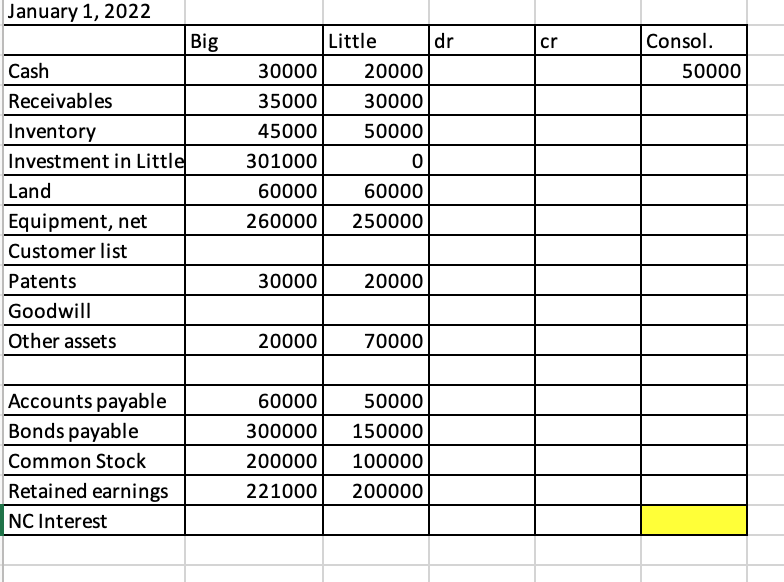

Big Co acquired 70% of the common Stock of Little Co. on 1/1/22 for $301,000. The fair value of the non-controlling interest was $129,000. Little's book value on that date was $300,000. Little had the following misvalued/unreported assets and liabilities: Land, undervalued by $5,000 Inventory, FIFO basis, undervalued by $10,000 Equipment, 10 year life, undervalued by $60,000 Customer list, 2 year life, valued at $20,000 but unreported on balance sheet (record amortization as "other expense") Any remaining differential is attributed to goodwill Big Co uses the EQUITY METHOD to account for their investment in Little In 2022, Little reported earnings of $70,000 and paid dividends of $10,000 In 2023 Little reported earnings of $30,000 and paid dividends of $15,000. The trial balances for 1/1/22, 12/31/22, and 12/31/23 are given below. Required: Prepare elimination entries at 1/1/22 and complete the "Consolidation at acquisition" (1/1/22) worksheet 1. Prepare elimination entries at 1/1/22 and complete the "Consolidation at acquisition" (1/1/22) worksheet 2. Prepare elimination entries at 12/31/23 and complete the "Consolidation at acquisition" (12/31/23) worksheet 3. Prepare elimination entries at 12/31/22 and complete the "Consolidation at acquisition" (12/31/22) worksheet You HAVE to "work down" the Big and Little columns in the 12/31/22 worksheet to get the ending R/E values to plug into the 12/31/23 worksheet! Please note that there is no question 3 or question 13. 123 + 2 4 5 6 7 8 9 10 11 12 13 14 15 16 17 50,000 What is the value in cell F46 129,000 What is the value in cell F61 370,000 0 0 What is the value in cell 136? 0 What is the value in cell K38? 0 What is the value in cel L38? What is the value in cell M33 What is the value in cell M37 0 What is the value in cell M39 0 What is the value in cell M42? What is the value in cell M48? 0 What is the value in cell M61? What is the value in cell P36? 0 What is the value in cell T37? 0 What is the value in cell P41? 0 What is the value in cell T51? 0 What is the value in cell T60? 0 What is the value in cell T61? 0 82,000 December 31, 2022 Sales Cost of goods sold Depreciation expense Other expenses Investment income Consolidated net income Less: Income to NC Interest Income to controlling interest Beginning R/E Add: Income Less: Dividends Ending R/E Cash Receivables Inventory Investment in Little Land Equipment, net Customer list Patents Goodwill Other assets Accounts payable Bonds payable Common Stock Retained earnings Non-controlling interest Big 350000 270000 210000 150000 40000 30000 30000 20000 20000 35000 36000 40000 324800 60000 220000 25000 121000 Little 60000 300000 200000 70000 10000 22000 27000 42000 60000 220000 15000 174000 50000 150000 100000 dr cr Consol. December 31, 2023 Sales Cost of goods sold Depreciation expense Other expenses Investment income Consolidated net income Less: Income to NC Interest Income to controlling interest Beginning R/E Add: Income Less: Dividends Ending R/E Cash Receivables Inventory Investment in Little Land Equipment, net Customer list Patents Goodwill Other assets Accounts payable Bonds payable Common Stock Retained earnings Non-controlling interest Little 370000 280000 220000 160000 40000 30000 50000 60000 Big 20000 30000 20000 30000 15000 40000 45000 50000 324100 60000 60000 180000 190000 30000 35000 35000 0 10000 172500 215000 40000 50000 300000 150000 200000 100000 dr cr Consol. January 1, 2022 Cash Receivables Inventory Investment in Little Land Equipment, net Customer list Patents Goodwill Other assets Accounts payable Bonds payable Common Stock Retained earnings NC Interest Big 30000 20000 35000 30000 45000 50000 301000 0 60000 60000 260000 250000 30000 20000 Little 60000 300000 200000 221000 20000 70000 50000 150000 100000 200000 dr cr Consol. 50000

Step by Step Solution

★★★★★

3.33 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

First lets prepare the elimination entries at January 1 2022 1 Eliminate the Investment in Little ac...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started