Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Big company on 60% of little company, and uses the full equity method to account for their investment. Assume little had zero accumulated depreciation at

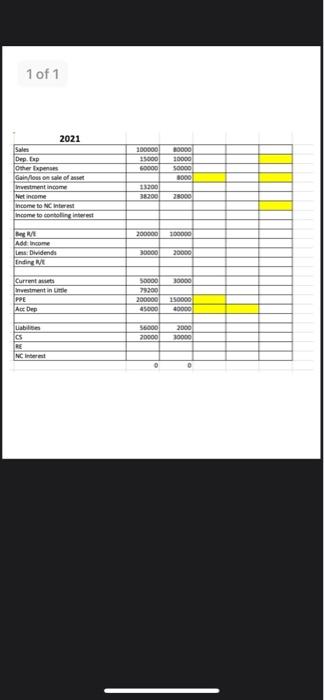

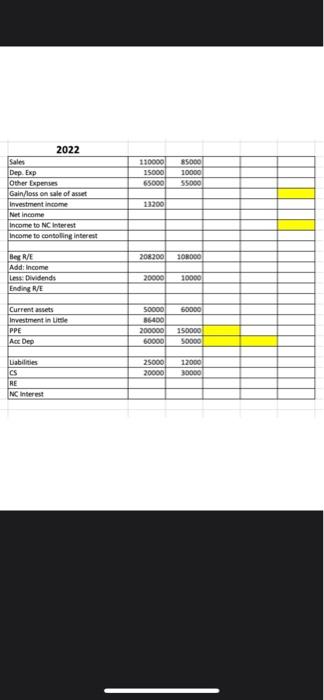

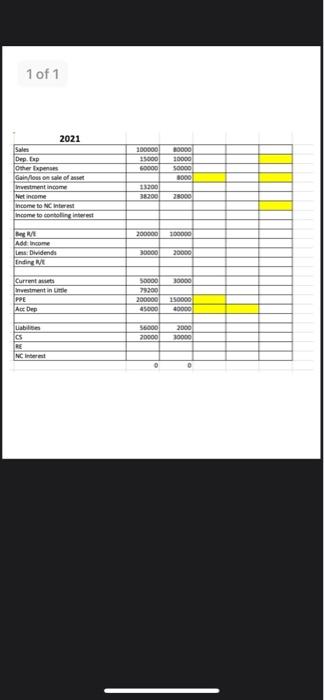

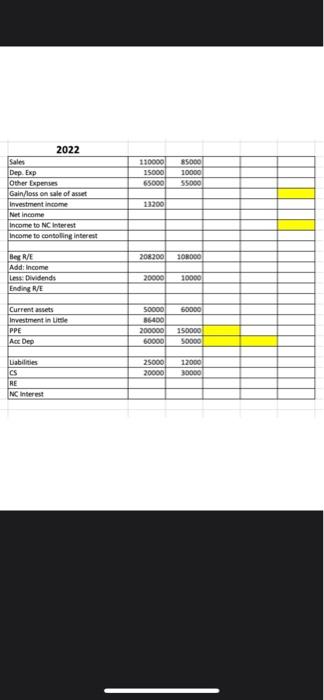

Big company on 60% of little company, and uses the full equity method to account for their investment. Assume little had zero accumulated depreciation at acquisition several years ago. It is now 2021. On 1/1/21 Little sells PPE to Big for $28,000. The PPE originally cost $50,000, and was originally purchased on 1/1/15. It has a 10 year useful life. Required: prepare elimination entries and complete the worksheets. PLEASE NOTE FIRMS ARE USING A SEPARATE ACCUMULATED DEPRECIATION ACCOUNT!! This Will affect how the realization of the game is recorded, and how the unrealized portion is carried forward to the following years! please note also that the number 13,200 shows up a few times and that it's just a coincidence.

10:44 Done 1 of 3 Questions What was the book value of the set on the date of sale 1/1/217 What was the acumulated deprecation as the won the date of sale? How much was the gain or loss on the intercompany? Was the sale upstream or downstream? How much of the gain is realedrogach? Value in cell 17 Value in cell E30 Value in cell E31 Value in cell 3: Value in cell 15 Value in cell G17 Value in cell G20 Value in cell 030 Value in cel 031 Value in 31 Value in cell 17 Value in all 20 0 0 0 0 0 o 0 ini 1 of 1 100000 15000 50000 2021 Sales DE [w Other Expenses Gain/lous on sale of investment in Net income income to NCI Income to conting interest 10000 10000 S0000 1000 13200 38200 28000 200000 100000 te MVE Adre L: Dividende Ending IVE 30000 20000 30000 Current Investment in PPE As tel 50000 79200 200000 45000 1500D 40000 5600D 20000 2000 10000 Uabili CS RE NC Irbert 0 110000 15000 65000 8500 10000 55000 2022 Sales Dep Em Other Expenses Gain/loss on sale of asset Investment income Net Income Income to NC Interest Income to contoling interest 13200 208200 10000 Ber R/E Add: Income Less: Dividends Ending R/E 20000 10000 50000 Current assets Investment in de PPE 50000 86400 200000 60000 Act Deo 150000 S6000 25000 20000 12000 300001 Liabilities CS RE NC interest 10:44 Done 1 of 3 Questions What was the book value of the set on the date of sale 1/1/217 What was the acumulated deprecation as the won the date of sale? How much was the gain or loss on the intercompany? Was the sale upstream or downstream? How much of the gain is realedrogach? Value in cell 17 Value in cell E30 Value in cell E31 Value in cell 3: Value in cell 15 Value in cell G17 Value in cell G20 Value in cell 030 Value in cel 031 Value in 31 Value in cell 17 Value in all 20 0 0 0 0 0 o 0 ini 1 of 1 100000 15000 50000 2021 Sales DE [w Other Expenses Gain/lous on sale of investment in Net income income to NCI Income to conting interest 10000 10000 S0000 1000 13200 38200 28000 200000 100000 te MVE Adre L: Dividende Ending IVE 30000 20000 30000 Current Investment in PPE As tel 50000 79200 200000 45000 1500D 40000 5600D 20000 2000 10000 Uabili CS RE NC Irbert 0 110000 15000 65000 8500 10000 55000 2022 Sales Dep Em Other Expenses Gain/loss on sale of asset Investment income Net Income Income to NC Interest Income to contoling interest 13200 208200 10000 Ber R/E Add: Income Less: Dividends Ending R/E 20000 10000 50000 Current assets Investment in de PPE 50000 86400 200000 60000 Act Deo 150000 S6000 25000 20000 12000 300001 Liabilities CS RE NC interest

10:44 Done 1 of 3 Questions What was the book value of the set on the date of sale 1/1/217 What was the acumulated deprecation as the won the date of sale? How much was the gain or loss on the intercompany? Was the sale upstream or downstream? How much of the gain is realedrogach? Value in cell 17 Value in cell E30 Value in cell E31 Value in cell 3: Value in cell 15 Value in cell G17 Value in cell G20 Value in cell 030 Value in cel 031 Value in 31 Value in cell 17 Value in all 20 0 0 0 0 0 o 0 ini 1 of 1 100000 15000 50000 2021 Sales DE [w Other Expenses Gain/lous on sale of investment in Net income income to NCI Income to conting interest 10000 10000 S0000 1000 13200 38200 28000 200000 100000 te MVE Adre L: Dividende Ending IVE 30000 20000 30000 Current Investment in PPE As tel 50000 79200 200000 45000 1500D 40000 5600D 20000 2000 10000 Uabili CS RE NC Irbert 0 110000 15000 65000 8500 10000 55000 2022 Sales Dep Em Other Expenses Gain/loss on sale of asset Investment income Net Income Income to NC Interest Income to contoling interest 13200 208200 10000 Ber R/E Add: Income Less: Dividends Ending R/E 20000 10000 50000 Current assets Investment in de PPE 50000 86400 200000 60000 Act Deo 150000 S6000 25000 20000 12000 300001 Liabilities CS RE NC interest 10:44 Done 1 of 3 Questions What was the book value of the set on the date of sale 1/1/217 What was the acumulated deprecation as the won the date of sale? How much was the gain or loss on the intercompany? Was the sale upstream or downstream? How much of the gain is realedrogach? Value in cell 17 Value in cell E30 Value in cell E31 Value in cell 3: Value in cell 15 Value in cell G17 Value in cell G20 Value in cell 030 Value in cel 031 Value in 31 Value in cell 17 Value in all 20 0 0 0 0 0 o 0 ini 1 of 1 100000 15000 50000 2021 Sales DE [w Other Expenses Gain/lous on sale of investment in Net income income to NCI Income to conting interest 10000 10000 S0000 1000 13200 38200 28000 200000 100000 te MVE Adre L: Dividende Ending IVE 30000 20000 30000 Current Investment in PPE As tel 50000 79200 200000 45000 1500D 40000 5600D 20000 2000 10000 Uabili CS RE NC Irbert 0 110000 15000 65000 8500 10000 55000 2022 Sales Dep Em Other Expenses Gain/loss on sale of asset Investment income Net Income Income to NC Interest Income to contoling interest 13200 208200 10000 Ber R/E Add: Income Less: Dividends Ending R/E 20000 10000 50000 Current assets Investment in de PPE 50000 86400 200000 60000 Act Deo 150000 S6000 25000 20000 12000 300001 Liabilities CS RE NC interest

Big company on 60% of little company, and uses the full equity method to account for their investment.

Assume little had zero accumulated depreciation at acquisition several years ago.

It is now 2021. On 1/1/21 Little sells PPE to Big for $28,000. The PPE originally cost $50,000, and was originally purchased on 1/1/15. It has a 10 year useful life.

Required: prepare elimination entries and complete the worksheets.

PLEASE NOTE FIRMS ARE USING A SEPARATE ACCUMULATED DEPRECIATION ACCOUNT!!

This Will affect how the realization of the game is recorded, and how the unrealized portion is carried forward to the following years!

please note also that the number 13,200 shows up a few times and that it's just a coincidence.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started