PLEASE TYPE!!!

Based on three scenarios where an individual started saving at different ages. Answer all of the following in your paragraph:

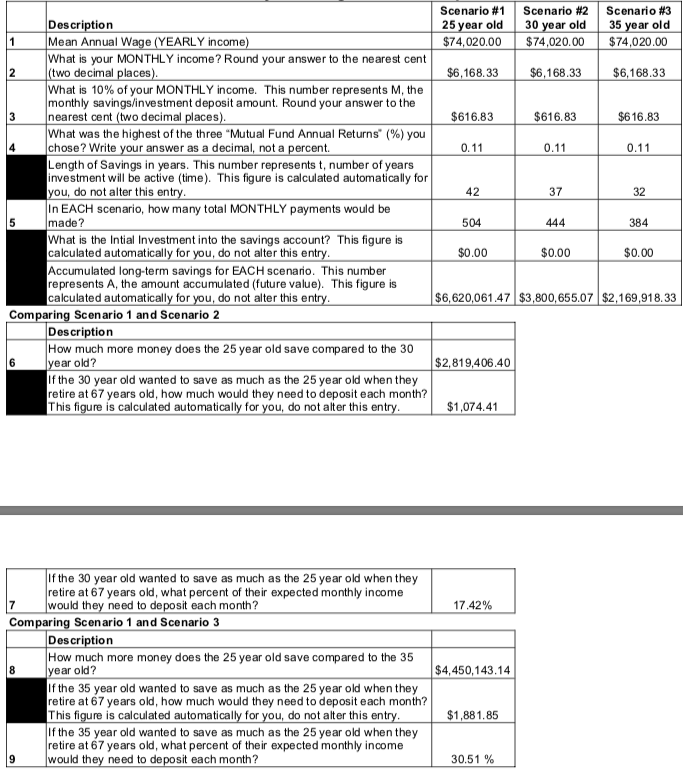

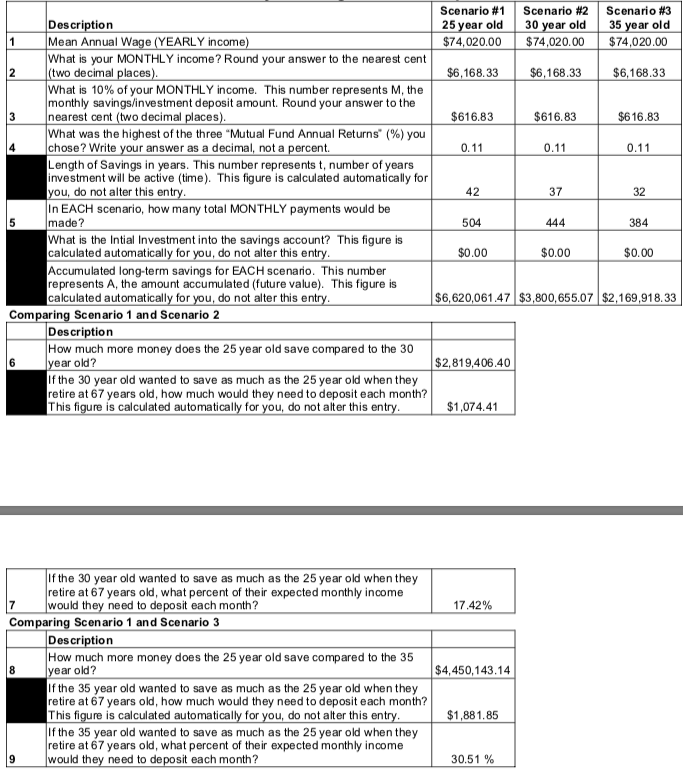

- What did you notice about the effect of saving for 42 years rather than for 37 years or 32 years?

- How does the length of savings (number of years) affect the amount that is earned by the time of retirement? Was this surprising or not surprising to you?

- How realistic do you think it is for someone who waits to start saving for retirement to have enough money saved to support any type of lifestyle during retirement?

- Based on what you have learned in this project, what advice would you give to someone thinking about saving for retirement?

- What was the dollar amount and percentage of the monthly income that was calculated in order for the:

- 30 year old to save as much as the 25 year old?

- 35 year old to save as much as the 25 year old?

- Explain how these percentages you calculated compare to the 50-20-30 budget rule?

- OPINION: What percent of your monthly income would you consider depositing if you were using a systematic savings/investment plan to help you build long-term savings? Explain your reasoning.

- Consider the question that was asked in component #2, Do you think you will be budgeting some percent of your income using a systematic savings/investment plan now or some time in the future, to help you build long-term savings? Has your answer to this question changed based on what you learned from component #3 and the savings you would have accumulated in each scenario? Explain your reasoning.

1 3 Scenario #1 Scenario #2 Scenario #3 Description 25 year old 30 year old 35 year old Mean Annual Wage (YEARLY income) $74,020.00 $74,020.00 $74,020.00 What is your MONTHLY income? Round your answer to the nearest cent 2 (two decimal places). $6,168.33 $6,168.33 $6,168.33 What is 10% of your MONTHLY income. This number represents M, the monthly savings/investment deposit amount. Round your answer to the nearest cent (two decimal places). $616.83 $616.83 $6 16.83 What was the highest of the three "Mutual Fund Annual Returns" (%) you chose? Write your answer as a decimal, not a percent. 0.11 0.11 0.11 Length of Savings in years. This number represents t, number of years investment will be active (time). This figure is calculated automatically for you, do not alter this entry. 42 37 32 In EACH scenario, how many total MONTHLY payments would be made? 504 444 What is the Intial Investment into the savings account? This figure is calculated automatically for you, do not alter this entry. $0.00 $0.00 $0.00 Accumulated long-term savings for EACH scenario. This number represents A, the amount accumulated (future value). This figure is calculated automatically for you, do not alter this entry. $6,620,061.47 $3,800,655.07 $2,169,918.33 Comparing Scenario 1 and Scenario 2 Description How much more money does the 25 year old save compared to the 30 year old? $2,819,406.40 If the 30 year old wanted to save as much as the 25 year old when they retire at 67 years old, how much would they need to deposit each month? This figure is calculated automatically for you, do not alter this entry. $1,074.41 384 17.42% If the 30 year old wanted to save as much as the 25 year old when they retire at 67 years old, what percent of their expected monthly income would they need to deposit each month? Comparing Scenario 1 and Scenario 3 Description How much more money does the 25 year old save compared to the 35 8 year old? If the 35 year old wanted to save as much as the 25 year old when they retire at 67 years old, how much would they need to deposit each month? This figure is calculated automatically for you, do not alter this entry. If the 35 year old wanted to save as much as the 25 year old when they retire at 67 years old, what percent of their expected monthly income would they need to deposit each month? $4,450,143.14 $1,881.85 30.51 % 1 3 Scenario #1 Scenario #2 Scenario #3 Description 25 year old 30 year old 35 year old Mean Annual Wage (YEARLY income) $74,020.00 $74,020.00 $74,020.00 What is your MONTHLY income? Round your answer to the nearest cent 2 (two decimal places). $6,168.33 $6,168.33 $6,168.33 What is 10% of your MONTHLY income. This number represents M, the monthly savings/investment deposit amount. Round your answer to the nearest cent (two decimal places). $616.83 $616.83 $6 16.83 What was the highest of the three "Mutual Fund Annual Returns" (%) you chose? Write your answer as a decimal, not a percent. 0.11 0.11 0.11 Length of Savings in years. This number represents t, number of years investment will be active (time). This figure is calculated automatically for you, do not alter this entry. 42 37 32 In EACH scenario, how many total MONTHLY payments would be made? 504 444 What is the Intial Investment into the savings account? This figure is calculated automatically for you, do not alter this entry. $0.00 $0.00 $0.00 Accumulated long-term savings for EACH scenario. This number represents A, the amount accumulated (future value). This figure is calculated automatically for you, do not alter this entry. $6,620,061.47 $3,800,655.07 $2,169,918.33 Comparing Scenario 1 and Scenario 2 Description How much more money does the 25 year old save compared to the 30 year old? $2,819,406.40 If the 30 year old wanted to save as much as the 25 year old when they retire at 67 years old, how much would they need to deposit each month? This figure is calculated automatically for you, do not alter this entry. $1,074.41 384 17.42% If the 30 year old wanted to save as much as the 25 year old when they retire at 67 years old, what percent of their expected monthly income would they need to deposit each month? Comparing Scenario 1 and Scenario 3 Description How much more money does the 25 year old save compared to the 35 8 year old? If the 35 year old wanted to save as much as the 25 year old when they retire at 67 years old, how much would they need to deposit each month? This figure is calculated automatically for you, do not alter this entry. If the 35 year old wanted to save as much as the 25 year old when they retire at 67 years old, what percent of their expected monthly income would they need to deposit each month? $4,450,143.14 $1,881.85 30.51 %