Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Big Corp. acquired 6 0 % of Little Inc. ' s outstanding shares on January 1 , 2 0 2 0 , for $

Big Corp. acquired of Little Inc.s outstanding shares on January for $ in cash. On this date, the fairvalue of noncontrolling interest was $ With a tenyear remaining useful life, littles equipment was undervaluedby $ Goodwill of $ had also been identified. Big applied the equity method.On January Big Corp. sold Land with a book value of $ to Little for $ Little continues to hold theland.Little issued $ par value year bonds with a coupon rate of percent on January at $ OnJanuary Big purchased a $ par value of Littles bonds for $ Both companies amortize bond premiumsand discounts on a straightline basis. Interest payments are made on December In Little began selling merchandise to Big. That year, inventory costing $ was transferred at a price of$ At the end of December Big still has $ for inventory shipped from Little.The following financial figures were for the two companies for the year ended December

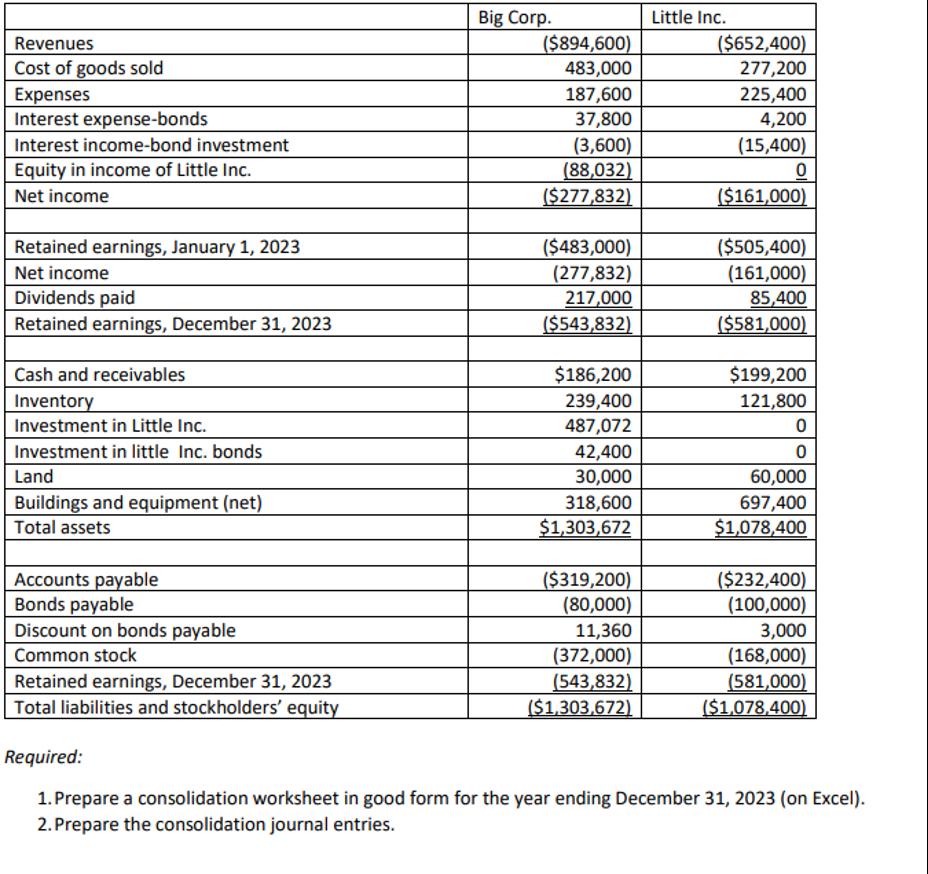

Revenues Big Corp. ($894,600) Little Inc. ($652,400) Cost of goods sold Expenses Interest expense-bonds Interest income-bond investment Equity in income of Little Inc. Net income Retained earnings, January 1, 2023 483,000 277,200 187,600 225,400 37,800 4,200 (3,600) (15,400) (88,032) 0 ($277,832) ($161,000) ($483,000) ($505,400) Net income (277,832) (161,000) Dividends paid 217,000 85,400 Retained earnings, December 31, 2023 ($543,832) ($581,000) Cash and receivables $186,200 $199,200 Inventory 239,400 121,800 Investment in Little Inc. 487,072 0 Investment in little Inc. bonds 42,400 0 Land 30,000 60,000 Buildings and equipment (net) 318,600 697,400 Total assets $1,303,672 $1,078,400 Accounts payable ($319,200) ($232,400) Bonds payable (80,000) (100,000) Discount on bonds payable 11,360 3,000 Common stock (372,000) (168,000) Retained earnings, December 31, 2023 Total liabilities and stockholders' equity (543,832) ($1,303,672) (581,000) ($1,078,400) Required: 1. Prepare a consolidation worksheet in good form for the year ending December 31, 2023 (on Excel). 2. Prepare the consolidation journal entries.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here is the consolidation worksheet for Big Corp and Little Inc for the year ending December 31 2023 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started