Question

Big East Citys Public Works Department is asking for an additional $100,000 for sign repairs in the next budget cycle because its costs have increased

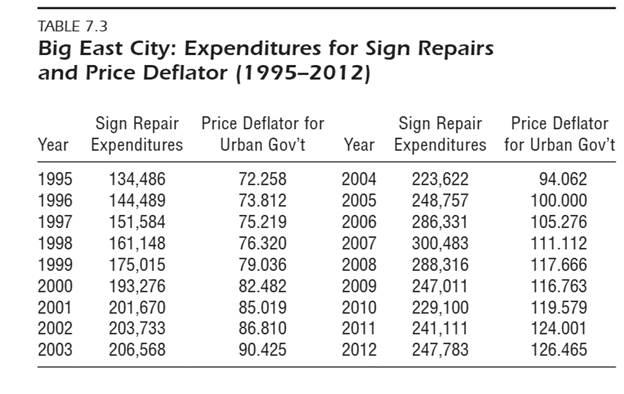

Big East City’s Public Works Department is asking for an additional $100,000 for sign repairs in the next budget cycle because its costs have increased by at least that much since 1995. The department has provided you with the information in Table 7.3. Big East City has adjusted funding for each of its departments every year to keep up with the buying power of money.

a. Calculate 2012 constant dollars for the expenditures.

b. Calculate 1995 constant dollars for the expenditures.

c. Create a line graph displaying the nominal dollars, 2012 constant dollars, and 1995 constant dollars across all years of data.d. Based on the data provided and the calculations you have completed above, does the Public Works Department’s request make sense? How much additional funding do you think it might need?

TABLE 7.3 Big East City: Expenditures for Sign Repairs and Price Deflator (1995-2012) Sign Repair Price Deflator for Year Expenditures 1995 134,486 1996 144,489 1997 151,584 1998 161,148 1999 175,015 2000 193,276 2001 201,670 2002 203,733 2003 206,568 Urban Gov't Year 72.258 73.812 75.219 76.320 79.036 82.482 85.019 86.810 90.425 Sign Repair Expenditures 2004 223,622 2005 248,757 2006 286,331 2007 300,483 2008 288,316 2009 247,011 2010 229,100 2011 241,111 2012 247,783 Price Deflator for Urban Gov't 94.062 100.000 105.276 111.112 117.666 116.763 119.579 124.001 126.465

Step by Step Solution

3.47 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the 2012 constant dollars for the expenditures we need to adjust the values using the p...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started