Answered step by step

Verified Expert Solution

Question

1 Approved Answer

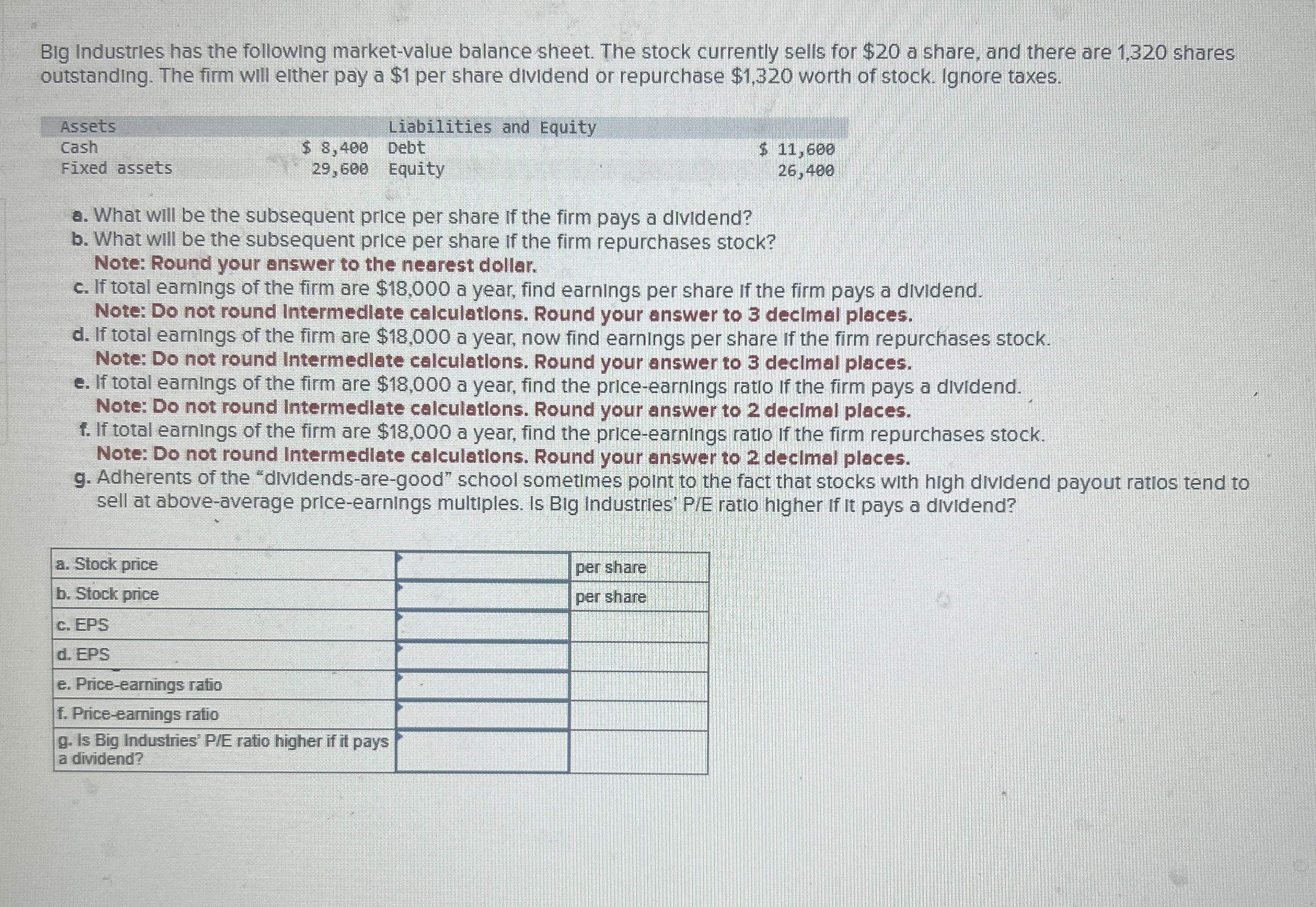

Big Industrles has the following market - value balance sheet. The stock currently sells for $ 2 0 a share, and there are 1 ,

Big Industrles has the following marketvalue balance sheet. The stock currently sells for $ a share, and there are shares

outstanding. The firm will either pay a $ per share dividend or repurchase $ worth of stock. Ignore taxes.

a What will be the subsequent price per share if the firm pays a dividend?

b What will be the subsequent price per share if the firm repurchases stock?

Note: Round your answer to the nearest dollar.

c If total earnings of the firm are $ a year, find earnings per share if the firm pays a dividend.

Note: Do not round Intermedlate calculations. Round your answer to decimal places.

d If total earnings of the firm are $ a year, now find earnings per share if the firm repurchases stock.

Note: Do not round Intermedlate calculations. Round your answer to decimal places.

e If total earnings of the firm are $ a year, find the priceearnings ratio if the firm pays a dividend.

Note: Do not round Intermedlate calculations. Round your answer to decimal places.

f If total earnings of the firm are $ a year, find the priceearnings ratio if the firm repurchases stock.

Note: Do not round Intermedlate calculatlons. Round your answer to decimal places.

g Adherents of the "dividendsaregood" school sometimes point to the fact that stocks with high dividend payout ratios tend to

sell at aboveaverage priceearnings multiples. Is Big Industries' PIE ratio higher if it pays a dividend?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started