Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Big Red Trucking (BRT) currently provides trucking and storage services to an upper-midwest clientele. BRT is considering an expansion of its geographic coverage into

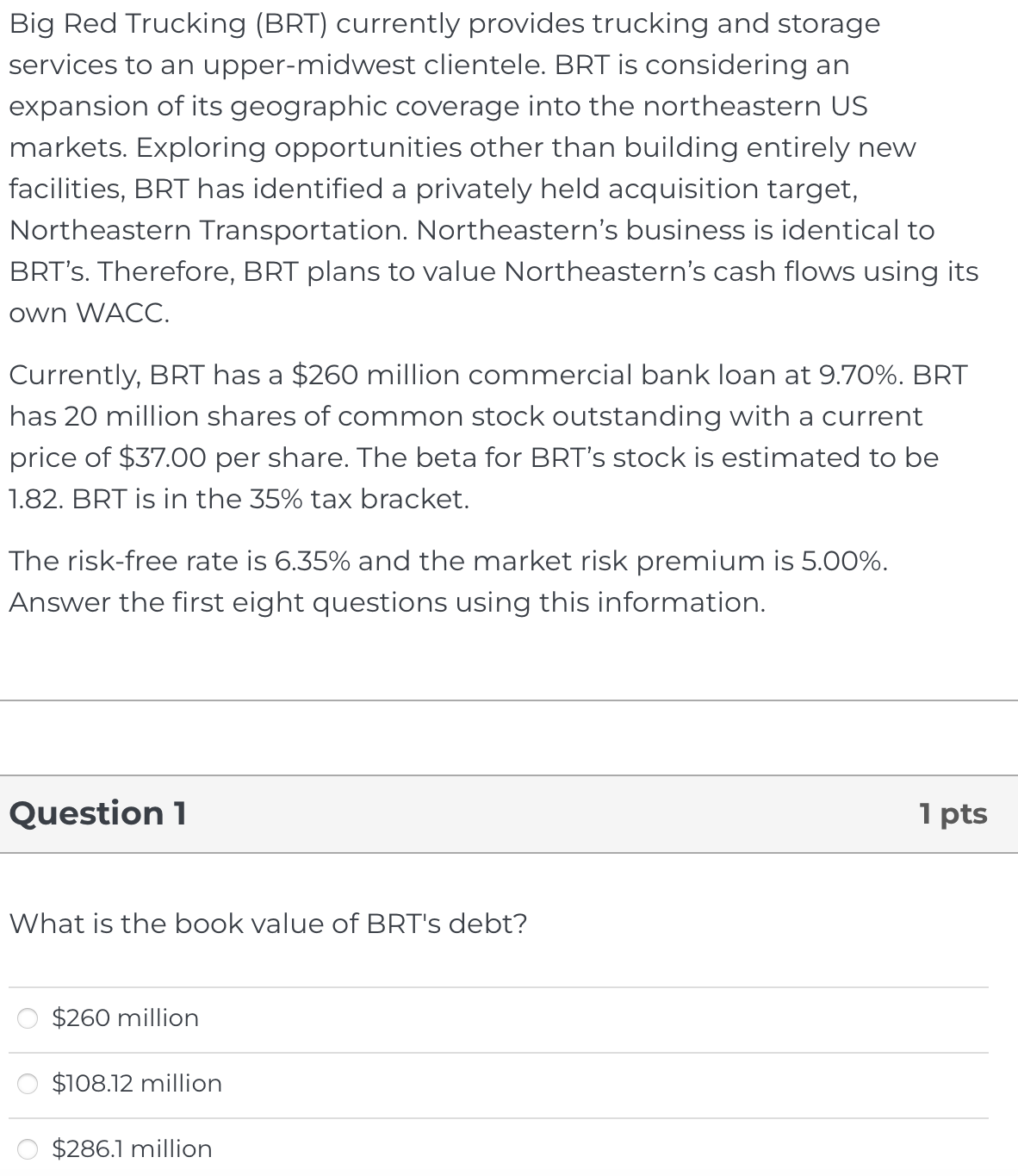

Big Red Trucking (BRT) currently provides trucking and storage services to an upper-midwest clientele. BRT is considering an expansion of its geographic coverage into the northeastern US markets. Exploring opportunities other than building entirely new facilities, BRT has identified a privately held acquisition target, Northeastern Transportation. Northeastern's business is identical to BRT's. Therefore, BRT plans to value Northeastern's cash flows using its own WACC. Currently, BRT has a $260 million commercial bank loan at 9.70%. BRT has 20 million shares of common stock outstanding with a current price of $37.00 per share. The beta for BRT's stock is estimated to be 1.82. BRT is in the 35% tax bracket. The risk-free rate is 6.35% and the market risk premium is 5.00%. Answer the first eight questions using this information. Question 1 What is the book value of BRT's debt? $260 million $108.12 million $286.1 million 1 pts

Step by Step Solution

★★★★★

3.56 Rating (142 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below The answer to ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started