Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider 1-year and 2-year spot rates of r(1) = 6.2% and r(2) = 8.2% Consider the following bonds: Bond A: 2-year, 5% coupon bond;

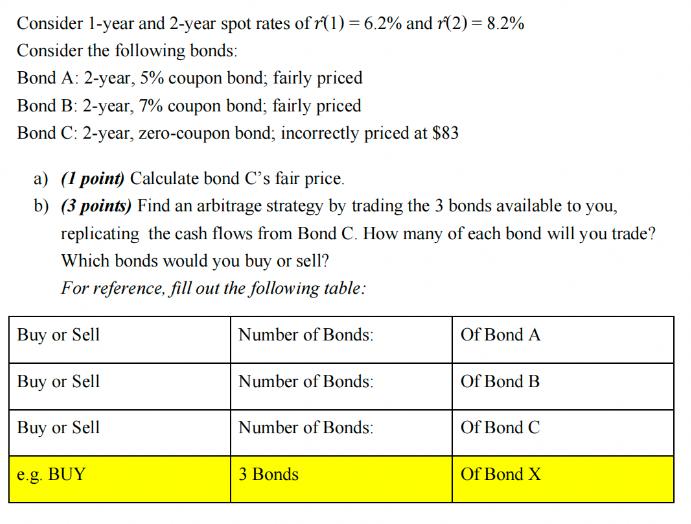

Consider 1-year and 2-year spot rates of r(1) = 6.2% and r(2) = 8.2% Consider the following bonds: Bond A: 2-year, 5% coupon bond; fairly priced Bond B: 2-year, 7% coupon bond; fairly priced Bond C: 2-year, zero-coupon bond; incorrectly priced at $83 a) (1 point) Calculate bond C's fair price. b) (3 points) Find an arbitrage strategy by trading the 3 bonds available to you, replicating the cash flows from Bond C. How many of each bond will you trade? Which bonds would you buy or sell? For reference, fill out the following table: Buy or Sell Buy or Sell Buy or Sell e.g. BUY Number of Bonds: Number of Bonds: Number of Bonds: 3 Bonds Of Bond A Of Bond B Of Bond C Of Bond X

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate bond Cs fair price we can use the concept of present value The fair price of a bond is the present value of its future cash flows Bond C ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started