Answered step by step

Verified Expert Solution

Question

1 Approved Answer

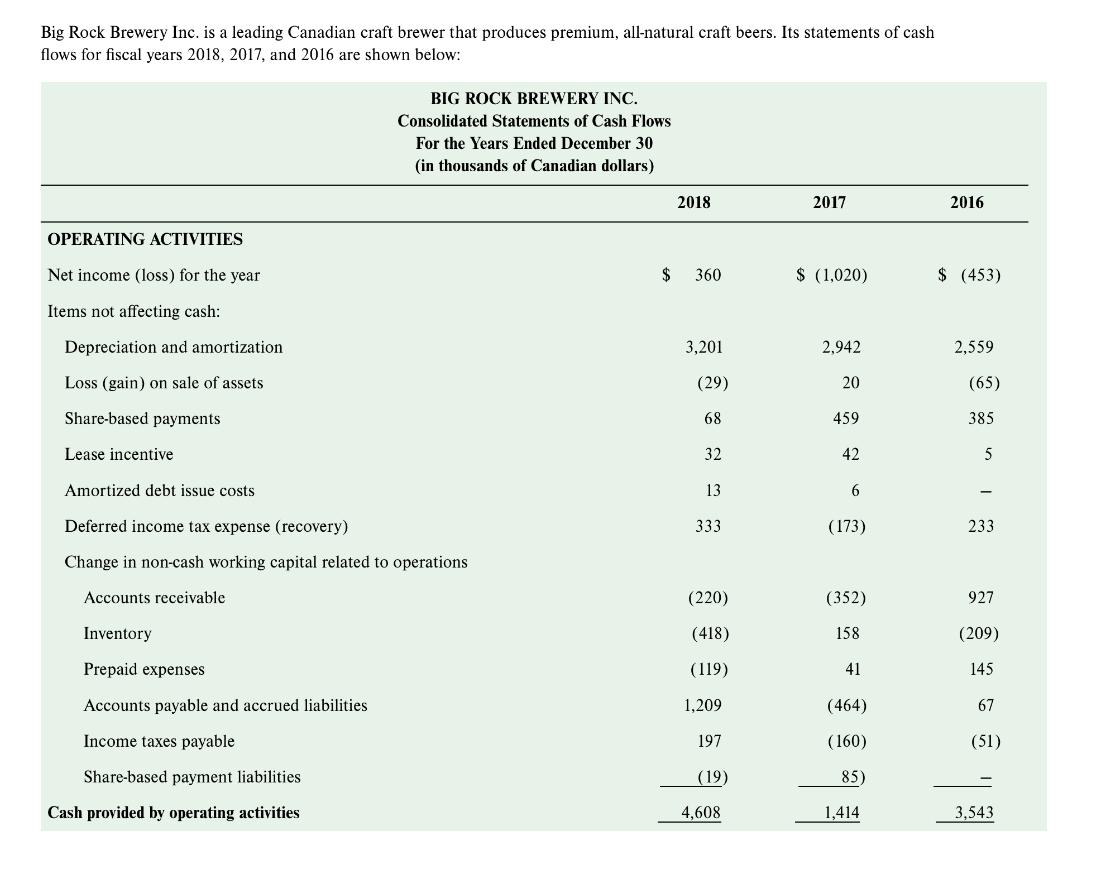

Big Rock Brewery Inc. is a leading Canadian craft brewer that produces premium, all-natural craft beers. Its statements of cash flows for fiscal years

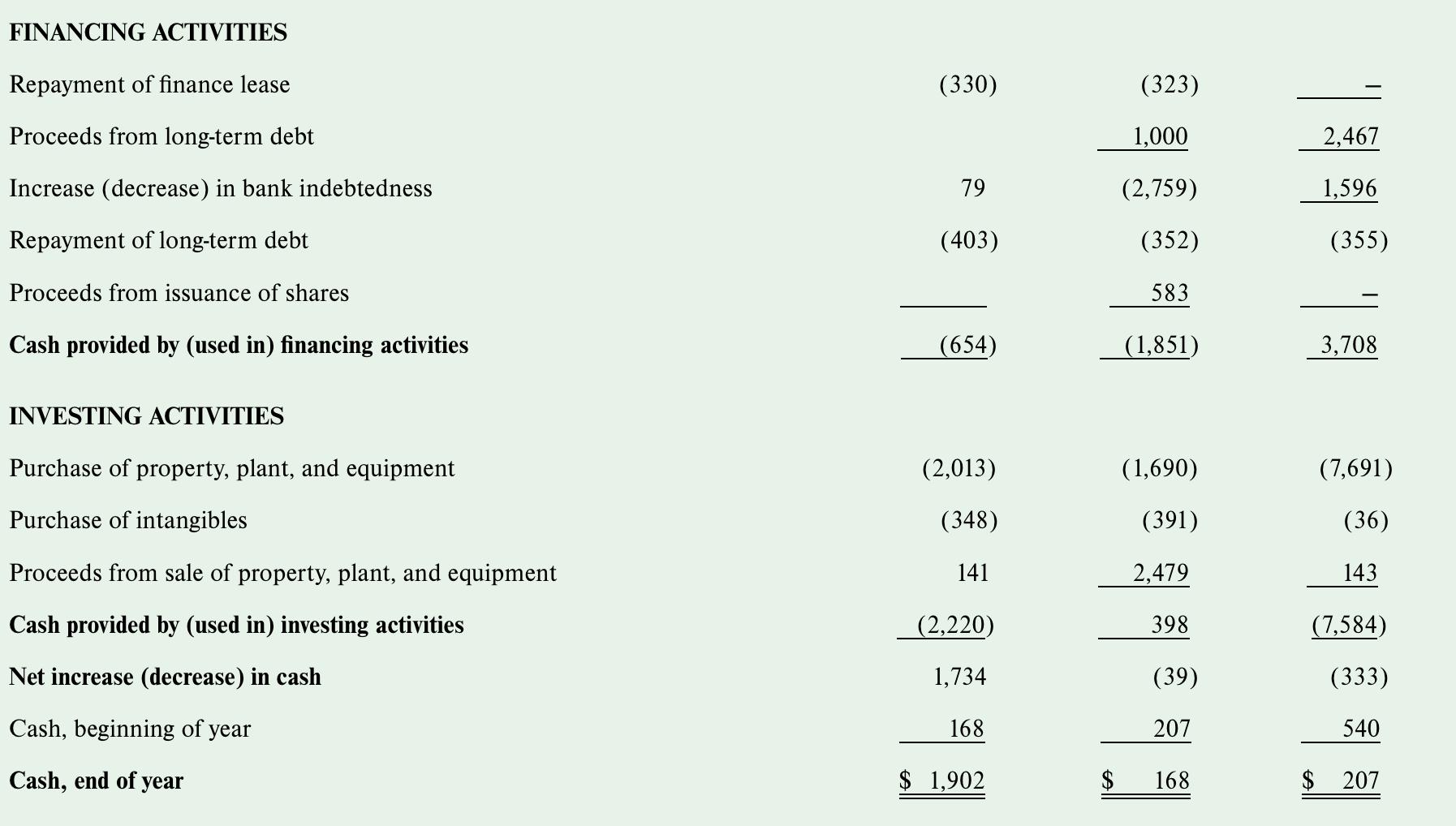

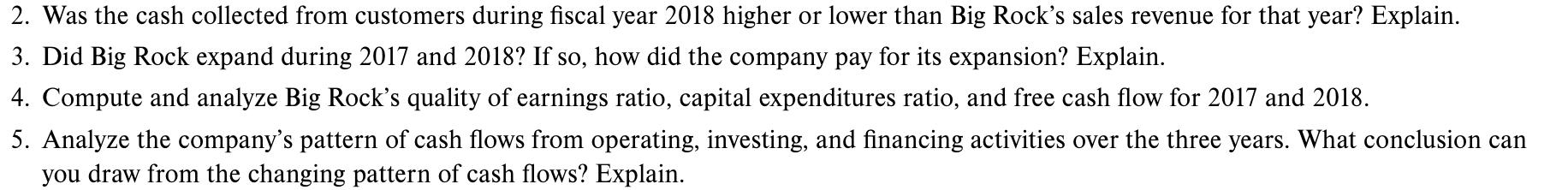

Big Rock Brewery Inc. is a leading Canadian craft brewer that produces premium, all-natural craft beers. Its statements of cash flows for fiscal years 2018, 2017, and 2016 are shown below: OPERATING ACTIVITIES Net income (loss) for the year Items not affecting cash: Depreciation and amortization Loss (gain) on sale of assets Share-based payments Lease incentive BIG ROCK BREWERY INC. Consolidated Statements of Cash Flows For the Years Ended December 30 (in thousands of Canadian dollars) Amortized debt issue costs Deferred income tax expense (recovery) Change in non-cash working capital related to operations Accounts receivable Inventory Prepaid expenses Accounts payable and accrued liabilities Income taxes payable Share-based payment liabilities Cash provided by operating activities $ 2018 360 3,201 (29) 68 32 13 333 (220) (418) (119) 1,209 197 (19) 4,608 2017 $ (1,020) 2,942 20 459 42 6 (173) (352) 158 41 (464) (160) 85) 1,414 2016 $ (453) 2,559 (65) 385 5 233 927 (209) 145 67 (51) 1. 3,543 FINANCING ACTIVITIES Repayment of finance lease Proceeds from long-term debt Increase (decrease) in bank indebtedness Repayment of long-term debt Proceeds from issuance of shares Cash provided by (used in) financing activities INVESTING ACTIVITIES Purchase of property, plant, and equipment Purchase of intangibles Proceeds from sale of property, plant, and equipment Cash provided by (used in) investing activities Net increase (decrease) in cash Cash, beginning of year Cash, end of year (330) 79 (403) (654) (2,013) (348) 141 (2,220) 1,734 168 $ 1,902 $ (323) 1,000 (2,759) (352) 583 (1,851) (1,690) (391) 2,479 398 (39) 207 168 2,467 1.596 (355) 3,708 (7,691) (36) 143 (7,584) (333) 540 $ 207 2. Was the cash collected from customers during fiscal year 2018 higher or lower than Big Rock's sales revenue for that year? Explain. 3. Did Big Rock expand during 2017 and 2018? If so, how did the company pay for its expansion? Explain. 4. Compute and analyze Big Rock's quality of earnings ratio, capital expenditures ratio, and free cash flow for 2017 and 2018. 5. Analyze the company's pattern of cash flows from operating, investing, and financing activities over the three years. What conclusion can you draw from the changing pattern of cash flows? Explain.

Step by Step Solution

★★★★★

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started