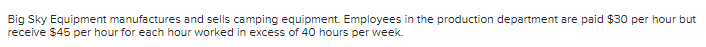

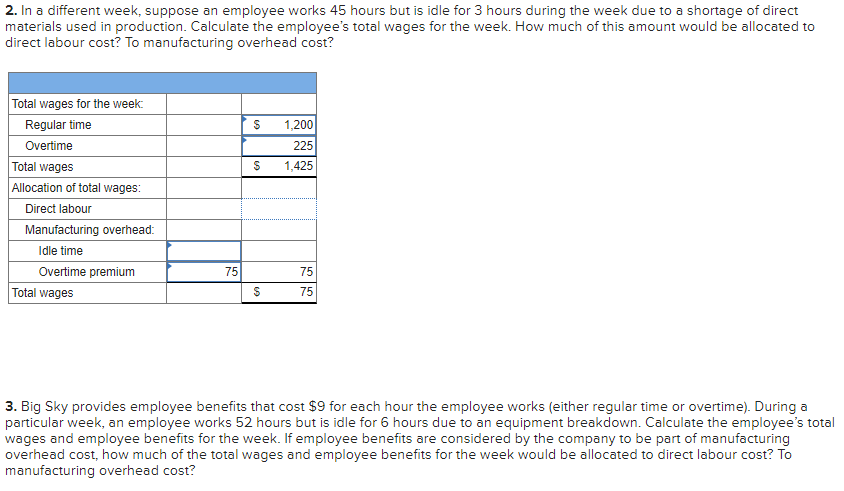

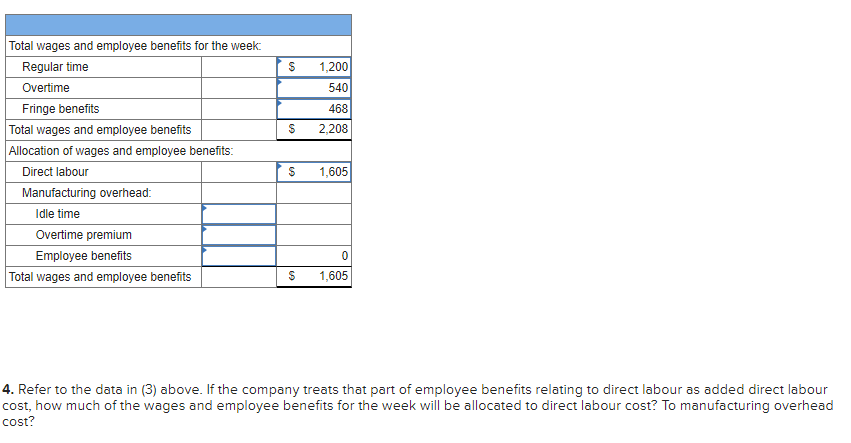

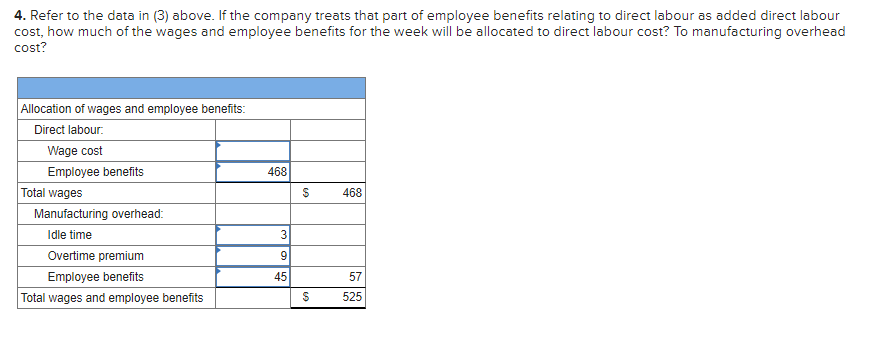

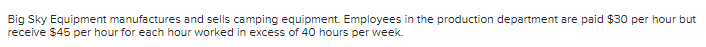

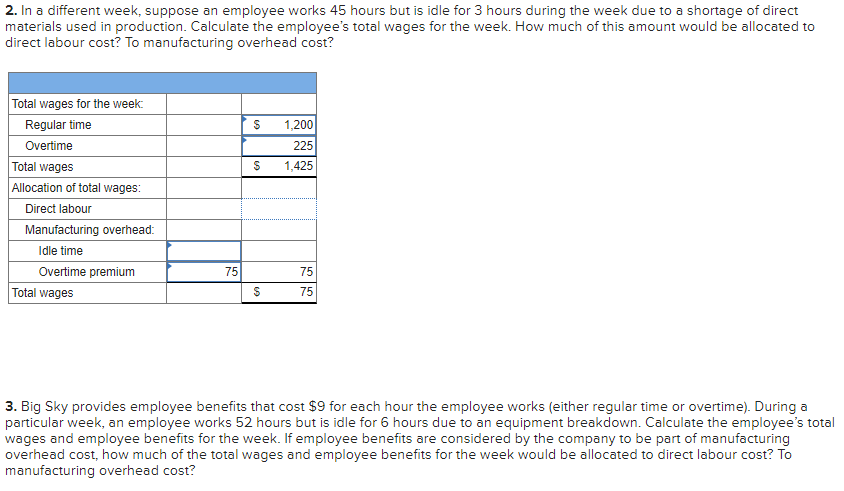

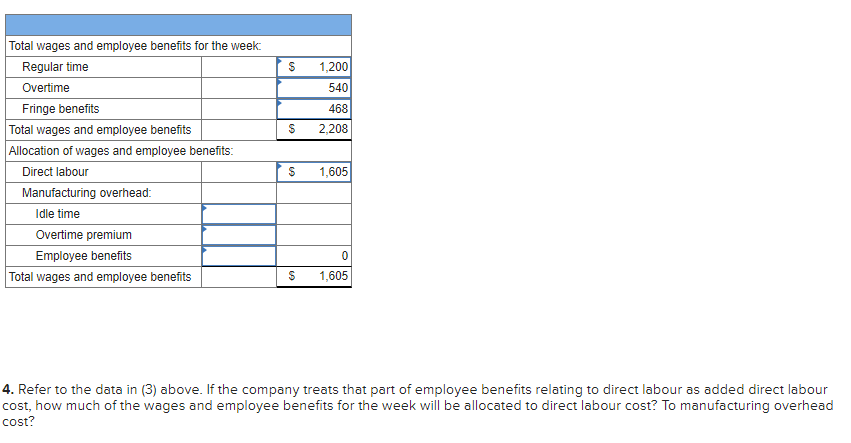

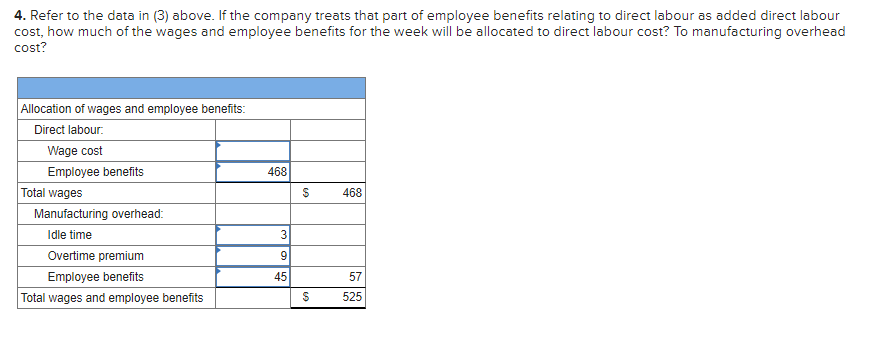

Big Sky Equipment manufactures and sells camping equipment. Employees in the production department are paid $30 per hour but receive $45 per hour for each hour worked in excess of 40 hours per week. 2. In a different week, suppose an employee works 45 hours but is idle for 3 hours during the week due to a shortage of direct materials used in production. Calculate the employee's total wages for the week. How much of this amount would be allocated to direct labour cost? To manufacturing overhead cost? S 1,200 225 S 1,425 Total wages for the week: Regular time Overtime Total wages Allocation of total wages: Direct labour Manufacturing overhead: Idle time Overtime premium Total wages 75 75 S 75 3. Big Sky provides employee benefits that cost $9 for each hour the employee works (either regular time or overtime). During a particular week, an employee works 52 hours but is idle for 6 hours due to an equipment breakdown. Calculate the employee's total wages and employee benefits for the week. If employee benefits are considered by the company to be part of manufacturing overhead cost, how much of the total wages and employee benefits for the week would be allocated to direct labour cost? To manufacturing overhead cost? S 1,200 540 468 2,208 S Total wages and employee benefits for the week: Regular time Overtime Fringe benefits Total wages and employee benefits Allocation of wages and employee benefits: Direct labour Manufacturing overhead Idle time Overtime premium Employee benefits Total wages and employee benefits S 1,605 0 1,605 S 4. Refer to the data in (3) above. If the company treats that part of employee benefits relating to direct labour as added direct labour cost, how much of the wages and employee benefits for the week will be allocated to direct labour cost? To manufacturing overhead cost? 4. Refer to the data in (3) above. If the company treats that part of employee benefits relating to direct labour as added direct labour cost, how much of the wages and employee benefits for the week will be allocated to direct labour cost? To manufacturing overhead cost? 468 S 468 Allocation of wages and employee benefits: Direct labour Wage cost Employee benefits Total wages Manufacturing overhead: Idle time Overtime premium Employee benefits Total wages and employee benefits 3 45 57 $ 525