Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Big Wacky Motors (BWM), a manufacturer of traditional North American-style spacious cars, is considering constructing a factory in Germany. The initial cash outlay in

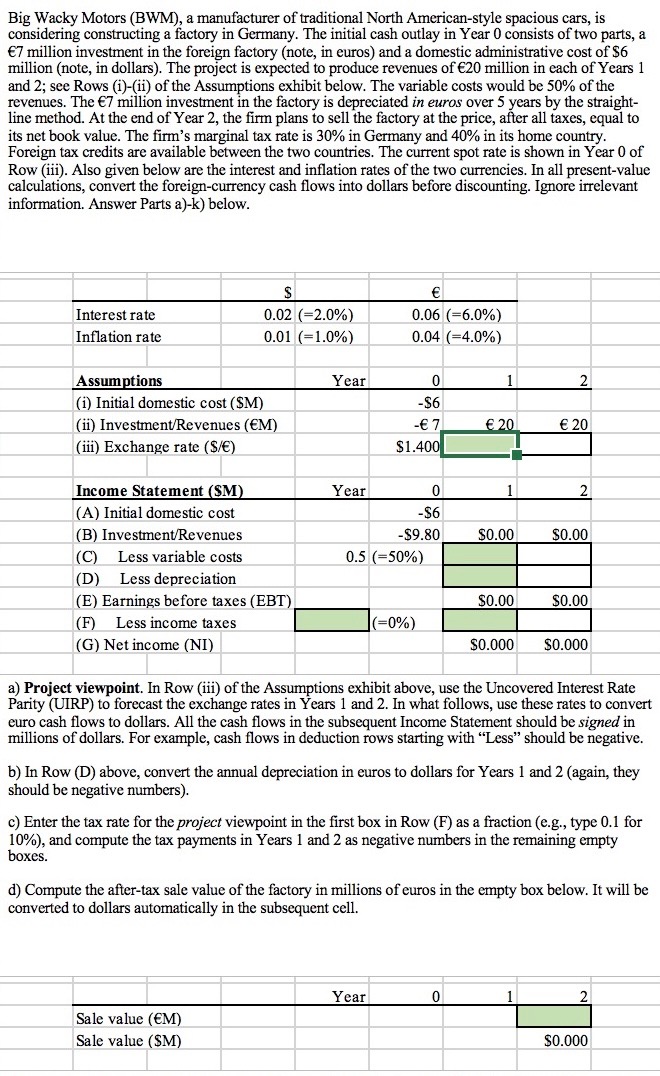

Big Wacky Motors (BWM), a manufacturer of traditional North American-style spacious cars, is considering constructing a factory in Germany. The initial cash outlay in Year 0 consists of two parts, a 7 million investment in the foreign factory (note, in euros) and a domestic administrative cost of $6 million (note, in dollars). The project is expected to produce revenues of 20 million in each of Years 1 and 2; see Rows (i)-(ii) of the Assumptions exhibit below. The variable costs would be 50% of the revenues. The 7 million investment in the factory is depreciated in euros over 5 years by the straight- line method. At the end of Year 2, the firm plans to sell the factory at the price, after all taxes, equal to its net book value. The firm's marginal tax rate is 30% in Germany and 40% in its home country. Foreign credits are available between the two countries. The current spot rate is shown in Year 0 of Row (iii). Also given below are the interest and inflation rates of the two currencies. In all present-value calculations, convert the foreign-currency cash flows into dollars before discounting. Ignore irrelevant information. Answer Parts a)-k) below. Interest rate Inflation rate Assumptions (i) Initial domestic cost (SM) (ii) Investment/Revenues (EM) (iii) Exchange rate ($/) Income Statement (SM) (A) Initial domestic cost (B) Investment/Revenues (C) Less variable costs (D) Less depreciation S 0.02 (-2.0%) 0.01 (-1.0%) (E) Earnings before taxes (EBT) (F) Less income taxes (G) Net income (NI) Year Year Sale value (EM) Sale value (SM) 0.06 (-6.0%) 0.04 (-4.0%) 0 -$6 -7 $1.400 0 -$6 -$9.80 0.5 (-50%) (=0%) Year 1 20 i 1 0 $0.00 $0.00 $0.000 2 20 2 $0.00 a) Project viewpoint. In Row (iii) of the Assumptions exhibit above, use the Uncovered Interest Rate Parity (UIRP) to forecast the exchange rates in Years 1 and 2. In what follows, use these rates to convert euro cash flows to dollars. All the cash flows in the subsequent Income Statement should be signed in millions of dollars. For example, cash flows in deduction rows starting with "Less" should be negative. $0.00 b) In Row (D) above, convert the annual depreciation in euros to dollars for Years 1 and 2 (again, they should be negative numbers). $0.000 c) Enter the tax rate for the project viewpoint in the first box in Row (F) as a fraction (e.g., type 0.1 for 10%), and compute the tax payments in Years 1 and 2 as negative numbers in the remaining empty boxes. d) Compute the after-tax sale value of the factory in millions of euros in the empty box below. It will be converted to dollars automatically in the subsequent cell. 2 $0.000

Step by Step Solution

★★★★★

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

a Using Uncovered Interest Rate Parity UIRP to forecast exchange rates in Years 1 and 2 Year 1 Exch...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started