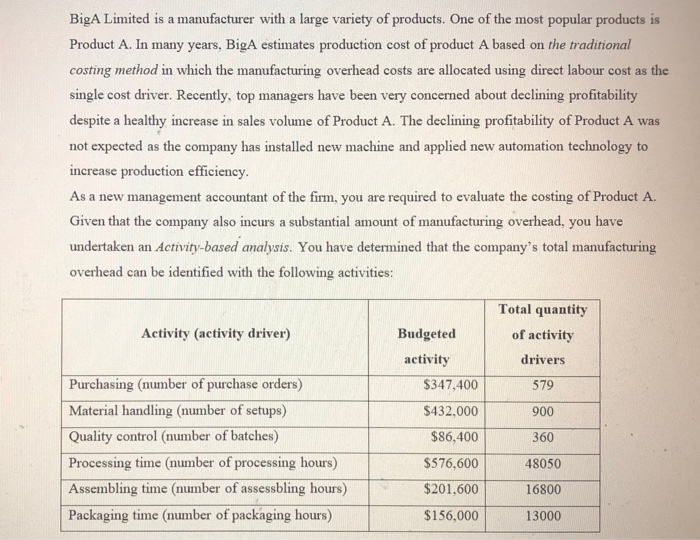

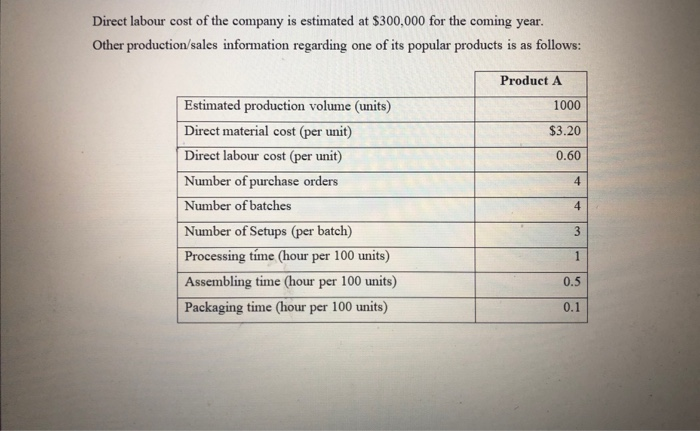

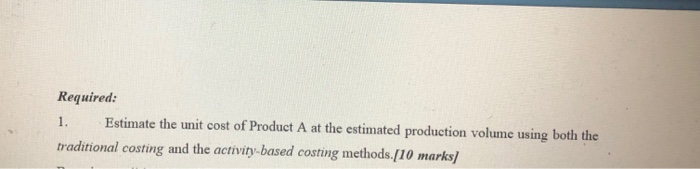

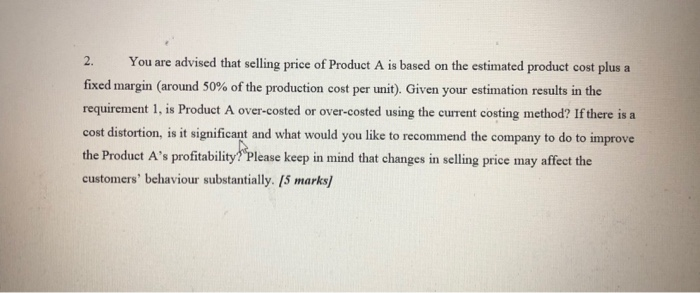

BigA Limited is a manufacturer with a large variety of products. One of the most popular products is Product A. In many years, BigA estimates production cost of product A based on the traditional costing method in which the manufacturing overhead costs are allocated using direct labour cost as the single cost driver. Recently, top managers have been very concerned about declining profitability despite a healthy increase in sales volume of Product A. The declining profitability of Product A was not expected as the company has installed new machine and applied new automation technology to increase production efficiency. As a new management accountant of the firm, you are required to evaluate the costing of Product A. Given that the company also incurs a substantial amount of manufacturing overhead, you have undertaken an Activity-based analysis. You have determined that the company's total manufacturing overhead can be identified with the following activities: Activity (activity driver) Budgeted activity $347.400 Total quantity of activity drivers 579 900 $432,000 $86,400 50 Purchasing (number of purchase orders) Material handling (number of setups) Quality control (number of batches) Processing time (number of processing hours) Assembling time number of assessbling hours) Packaging time (number of packaging hours) $576,600 48050 $ 201,600 16800 $156,000 13000 Direct labour cost of the company is estimated at $300,000 for the coming year. Other production/sales information regarding one of its popular products is as follows: Product A 1000 $3.20 0.60 4 Estimated production volume (units) Direct material cost (per unit) Direct labour cost (per unit) Number of purchase orders Number of batches Number of Setups (per batch) Processing time (hour per 100 units) Assembling time (hour per 100 units) Packaging time (hour per 100 units) 4 3 1 0.5 0.1 Required: 1. Estimate the unit cost of Product A at the estimated production volume using both the traditional costing and the activity-based costing methods. [10 marks 2. You are advised that selling price of Product A is based on the estimated product cost plus a fixed margin (around 50% of the production cost per unit). Given your estimation results in the requirement 1, is Product A over-costed or over-costed using the current costing method? If there is a cost distortion, is it significant and what would you like to recommend the company to do to improve the Product A's profitability? Please keep in mind that changes in selling price may affect the customers' behaviour substantially. [5 marks]