Question

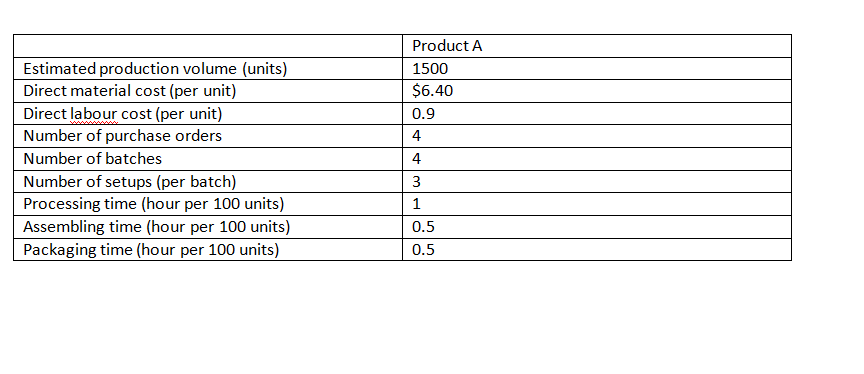

BigB Limited is a manufacturer with a large variety of products. One of the most popular products is product A. In many year, BigB estimates

BigB Limited is a manufacturer with a large variety of products. One of the most popular products is product A. In many year, BigB estimates production cost of product A based on the traditional costing method in which the manufacturing overhead costs are allocated using direct labour cost as the single cost driver. Recently, top manager have been very concerned about declining profitability despite a healthy increase in sales volume of Product A. The declining profitability of Product A was not expected as the company has installed new machine and applied new automation technology to increase production efficiency.

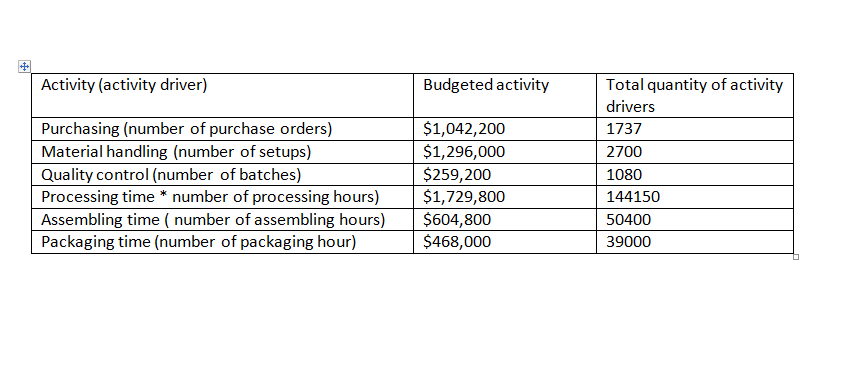

As a new management accountant of the firm, it is required to evaluate the costing of Product A. Given that the company also incurs a substantial amount of manufacturing overhead, have undertaken an Activity-based analysis. The manager have determined that the company's total manufacturing overhead can be identified with the following activities:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started