Answered step by step

Verified Expert Solution

Question

1 Approved Answer

BigCo is buying LittleCo, and they are paying in shares. BigCo has levered cash flows of $400,000 per year in perpetuity, 5000 shares outstanding,

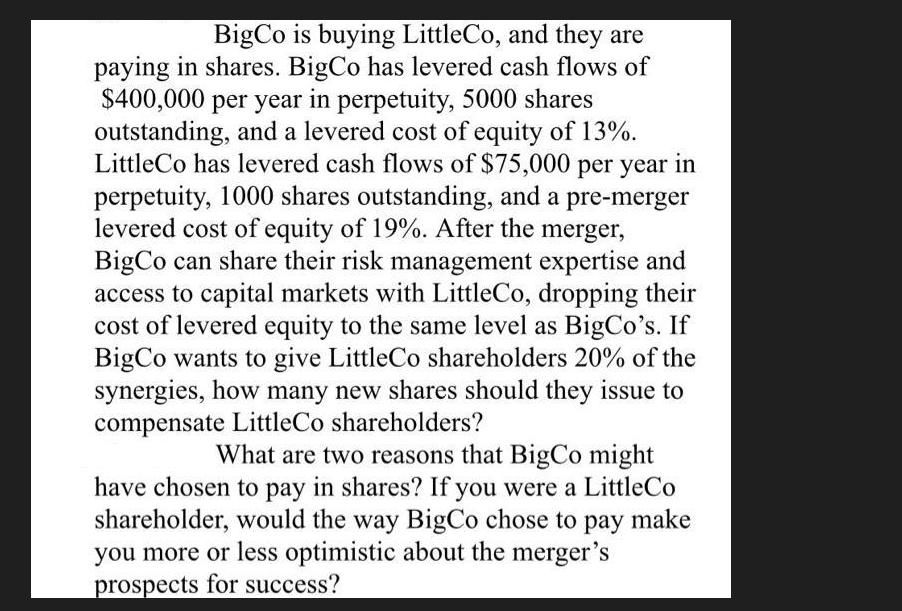

BigCo is buying LittleCo, and they are paying in shares. BigCo has levered cash flows of $400,000 per year in perpetuity, 5000 shares outstanding, and a levered cost of equity of 13%. LittleCo has levered cash flows of $75,000 per year in perpetuity, 1000 shares outstanding, and a pre-merger levered cost of equity of 19%. After the merger, BigCo can share their risk management expertise and access to capital markets with LittleCo, dropping their cost of levered equity to the same level as BigCo's. If BigCo wants to give LittleCo shareholders 20% of the synergies, how many new shares should they issue to compensate LittleCo shareholders? What are two reasons that BigCo might have chosen to pay in shares? If you were a LittleCo shareholder, would the way BigCo chose to pay make you more or less optimistic about the merger's prospects for success?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started