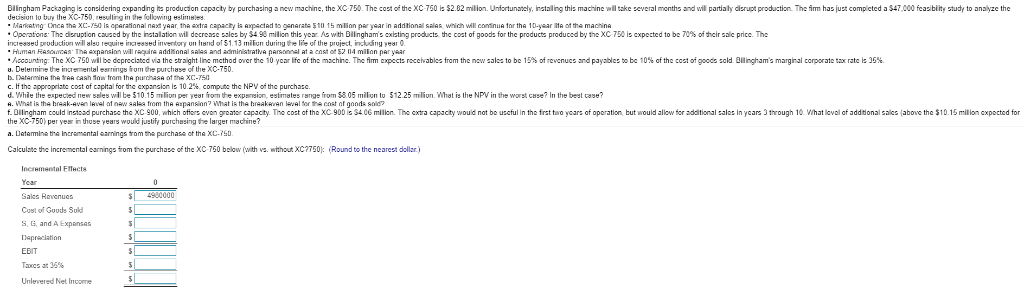

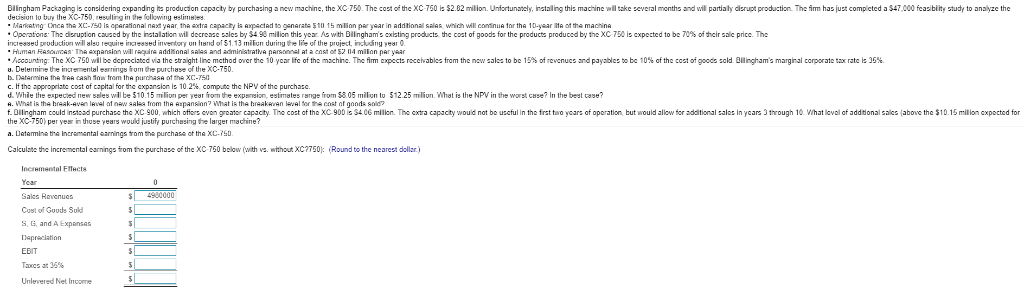

Bilingham Packaging is considering expanding i production capacity by purchasing a new machine, the XC 750. The cost of the XC 750 i S2.82 milion. Unfortunately, instaling this machine will take several months and will partialy cizrupt production. The firm has just comp eted a $47,000 feasibiity study to analyze the detision lobu te XC-750,rsulting in thelowing eslimeles . Manatng 0nca tha XC-/50 operational net yaar tha extra capachy is adad to genarata 10 1 5 millon pr yaar in additional salas which wil caninua tor tha 10-year ita of tha machina eratons. The derupt on caused by he i stalation wil decrease sales b $4 90 mil on this yer As with Bilingham s existing products the cost of goods for the products produced by the mcreowed production wils, 'equ're maewwed "ventory u" l'end of $1 13 milion during he lie of the project, rckng yes' 0 C 750 is expected to be 70% of their sale price. The Accoun ng: The C 750 wl be depreciated via he straight line mcthod over the 10 ycar . Del," the incremental esrrings ium th purchase of the XC-750 e o the machine. The fir ec s occ ables am the new sales to be 15% o ever ucs and payables to bc 10% o oods sald Biln hams margnal cor rate tax rate s 35%, the cost o c c. If the appropriate cost of capital for the cxpansion is 10.2% compute te NPV of te purchase. d. Whle the expected new seles will be 510.15 milin per year from the expssion, estimates range from $8.05 milion to $12 25 milion.What is the NPW in the worst case? In the best case? f. Dilingham cculd instcad purchas the XC 900, which offers avon greater capacity The coct of the XC 900 is $4 06 milion. The cxtra capacity wouid not be uscful in the frat tero ycars of operation, but would allow for additional sales in ycars 3 through 10 What lovall of addtional sales (above the $10.15 milion cxpected for the XC-750) per year in those years would justify purchasing the larger machine a. Detarmine tha Incramental earnings rom the purchase ot tha XC-50 Calculate the incremental earnings tom te purchase of the XC 750 below (with vs. without XC?75 Round to the nearest dollar.) Unlevered Net Income Bilingham Packaging is considering expanding i production capacity by purchasing a new machine, the XC 750. The cost of the XC 750 i S2.82 milion. Unfortunately, instaling this machine will take several months and will partialy cizrupt production. The firm has just comp eted a $47,000 feasibiity study to analyze the detision lobu te XC-750,rsulting in thelowing eslimeles . Manatng 0nca tha XC-/50 operational net yaar tha extra capachy is adad to genarata 10 1 5 millon pr yaar in additional salas which wil caninua tor tha 10-year ita of tha machina eratons. The derupt on caused by he i stalation wil decrease sales b $4 90 mil on this yer As with Bilingham s existing products the cost of goods for the products produced by the mcreowed production wils, 'equ're maewwed "ventory u" l'end of $1 13 milion during he lie of the project, rckng yes' 0 C 750 is expected to be 70% of their sale price. The Accoun ng: The C 750 wl be depreciated via he straight line mcthod over the 10 ycar . Del," the incremental esrrings ium th purchase of the XC-750 e o the machine. The fir ec s occ ables am the new sales to be 15% o ever ucs and payables to bc 10% o oods sald Biln hams margnal cor rate tax rate s 35%, the cost o c c. If the appropriate cost of capital for the cxpansion is 10.2% compute te NPV of te purchase. d. Whle the expected new seles will be 510.15 milin per year from the expssion, estimates range from $8.05 milion to $12 25 milion.What is the NPW in the worst case? In the best case? f. Dilingham cculd instcad purchas the XC 900, which offers avon greater capacity The coct of the XC 900 is $4 06 milion. The cxtra capacity wouid not be uscful in the frat tero ycars of operation, but would allow for additional sales in ycars 3 through 10 What lovall of addtional sales (above the $10.15 milion cxpected for the XC-750) per year in those years would justify purchasing the larger machine a. Detarmine tha Incramental earnings rom the purchase ot tha XC-50 Calculate the incremental earnings tom te purchase of the XC 750 below (with vs. without XC?75 Round to the nearest dollar.) Unlevered Net Income