Answered step by step

Verified Expert Solution

Question

1 Approved Answer

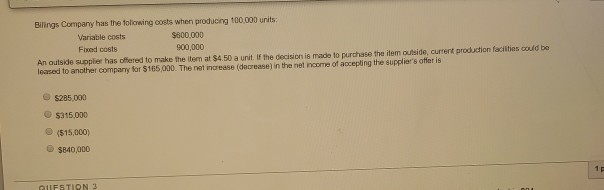

Bilings Company has the following costs when producing 100.000 units: Variable costs $800,000 Fixed costs 900,000 An outside supplier has offered to make the item

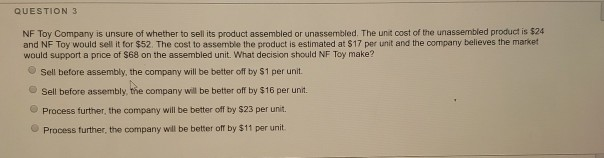

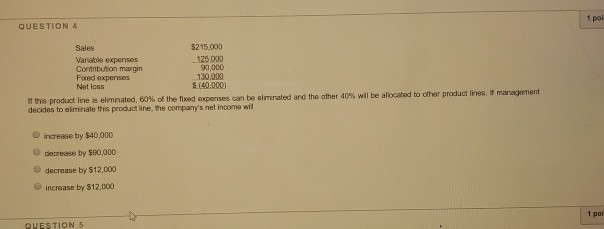

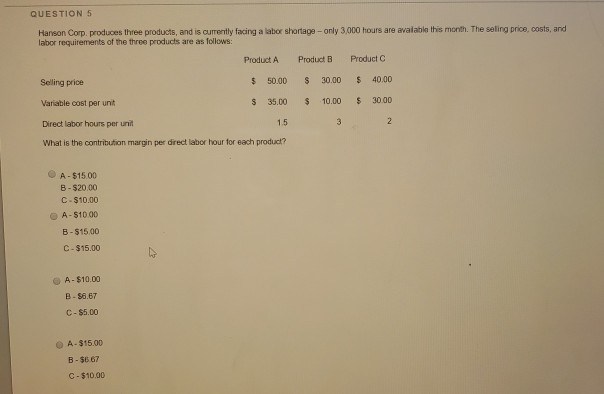

Bilings Company has the following costs when producing 100.000 units: Variable costs $800,000 Fixed costs 900,000 An outside supplier has offered to make the item at $4,50 a unit. If the decision is made to purchase the item outside, current produchon facilities could be leased to another company for $165,000. The net increase (decrease in the net income of accepting the supplier's offer is $285 000 $315.000 (515,000 $340,000 QUESTION 3 NF Toy Company is unsure of whether to sell its product assembled or unassembled. The unit cost of the unassembled product is 524 and NF Toy would sell it for $52. The cost to assemble the product is estimated at $17 per unit and the company believes the market would support a price of $68 on the assembled unit. What decision should NF Toy make? Sell before assembly, the company will be better off by $1 per unit Sell before assembly, the company will be better off by $16 per unit. Process further, the company will be better off by $23 per unit. Process further, the company will be better off by $11 per unit. QUESTION 4 Sales $215.000 Variable expenses 125023 Contribution margin Fored expenses 130.000 Netloss $140.000) If this product line is eliminated, 60% of the fixed expenses can be emrated and the other 40% will be allocated to other product lines. It management decides to eliminate this product line, the company's net income wil increase by $40,000 decrease by $90,000 decrease by $12,000 increase by $12,000 QUESTIONS QUESTIONS Hanson Corp. produces three products, and is currently facing a labor shortage-only 3,000 hours are avalable this month. The selling price costs, and labor requirements of the three products are as follows: Selling price Product $ 50.00 $ 35.00 Product $ 30.00 $ 0.00 Product $ 40.00 $ 30.00 Variable cost per unit Direct labor hours per unit What is the contribution margin per direct labor hour for each product? A - $15.00 B - $20.00 C - $10.00 A- $10.00 B - $15.00 C - $15.00 A- $10.00 B - $6.67 C - $5.00 A- $15.00 B - 3667 C - $10.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started