Question

Bill and Brittany's father, Stuart, died in January 2021. Under Stuart's will, Stuart gave Bill his investment property in Bathurst and his holiday house

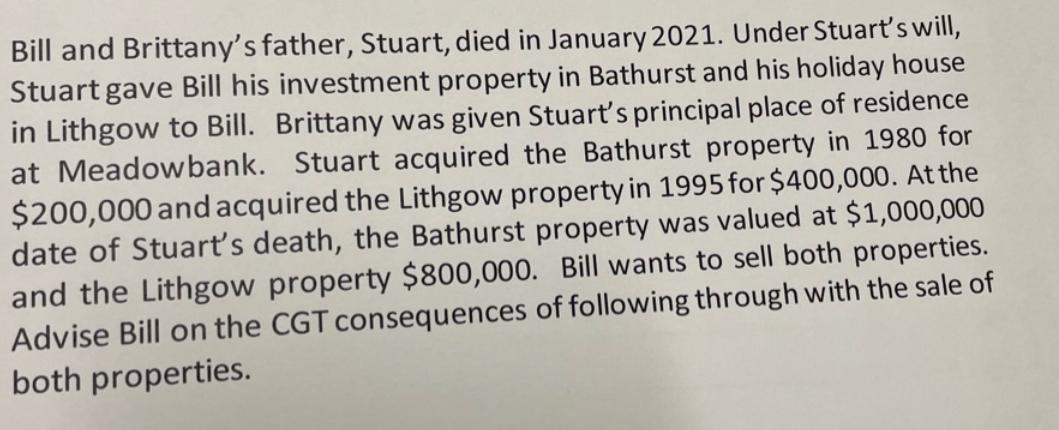

Bill and Brittany's father, Stuart, died in January 2021. Under Stuart's will, Stuart gave Bill his investment property in Bathurst and his holiday house in Lithgow to Bill. Brittany was given Stuart's principal place of residence at Meadowbank. Stuart acquired the Bathurst property in 1980 for $200,000 and acquired the Lithgow property in 1995 for $400,000. At the date of Stuart's death, the Bathurst property was valued at $1,000,000 and the Lithgow property $800,000. Bill wants to sell both properties. Advise Bill on the CGT consequences of following through with the sale of both properties.

Step by Step Solution

3.29 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

At first instance any property that is inherited from ancestors by the individual does n...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

South-Western Federal Taxation 2020 Comprehensive

Authors: David M. Maloney, William A. Raabe, James C. Young, Annette Nellen, William H. Hoffman

43rd Edition

357109147, 978-0357109144

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App