Bill and Natalia Martinez Today, January 1, 2021, Bill and Natalia Martinez have come to your firm for help in developing a plan to accomplish

Bill and Natalia Martinez

Today, January 1, 2021, Bill and Natalia Martinez have come to your firm for help in developing

a plan to accomplish their financial goals. From your initial meeting together, you have

gathered the following information:

I. Personal Background and Information

Bill Martinez

Age 60 employed 25 years as a Vice President for an oil field services company.

He participates in a 401k plan at work where the company matches $.25 on each

$1.00 Bill contributes up to 5% of his salary. Currently, Bill is putting the

5% in to get his employer's match. His salary is currently $100,000 and he

generally, gets a 2% raise each year (assume this continues).

Natalia Martinez

Age 48 owns Publications, Inc. and Natalia's Advertising, Inc. Natalia takes

$40,000 in withdrawals combined, as a salary from the two businesses.

The combined fair market value of the businesses, though since she is the

primary employee, should she decide to liquidate the businesses, it is assumed

she would net $100,000.

Bill and Natalia Martini

They met July 4, 1995 on a cruise, fell in love, and married November 23, 1995.

They have no children together.

Bill's children from a previous marriage

Michaela

Age 34

Jameel

Age 32

Bob

Age 30

Lucy

Age 28

All are healthy, employed, married, and not living with Bill and Natalia.

II. Personal and Financial Goals

1. Natalia plans to sell her businesses.

2. Bill planned to retire in 5 years, but would like to do it now (life expectancy is 25

years)

3. They plan to sell their primary residence which is not paid off. (Could net $300,000)

4. They plan to refinance their vacation home and have that be a temporary home

base. Fair market value of vacation home is $150,000. Original mortgage at 9%, 15

years. Current mortgage balance is $120,000, remaining term is 120 months and the

current payment is $1,522 per month (principal and interest).

5. They would like to be able to travel extensively before deciding where to

permanently relocate.

6. Bill and Natalia think they would need 2/3 of the current combined income in order

to live the lifestyle they currently think they live. You need to determine if this is

possible, and/or required.

III. Economic Information

-

They expect inflation to average 3.0% (CPI) annually over both the short and long-

term.

-

Expected stock market return of 8% on the S&P index (this is the Martini's guess)

-

T-bills are currently yielding 1%

-

Current mortgage rates are:

o

Adjustable 5 year balloon

2.25%

o

Fixed 15 year

2.75%

o

Fixed 30 year

3.25%

-

Closing costs are expected to be 3% of any mortgage

-

They will finance closing costs in any refinance

IV. Insurance Information

Life Insurance

Policy 1

Policy 2

Insured

Bill

Natalia

Owner

Bill

Natalia

Beneficiary

Children (25% each)

Booth

Face Amount

$200,000

$150,000

Cash value

0

0

Type of Policy

Term

Term

Settlement Options

Lump Sum

Lump Sum

Premium (annual)

$750

$550

Health Insurance - Employer provides during employment only. The current coverage is for Bill

and Natalia.

Disability Insurance - Neither has disability insurance

Homeowner's Insurance - HO3 on both primary residence and vacation home.

Residence

Vacation Home

Dwelling

$300,000

$150,000

Co-Insurance

80/20

80/20

Deductible

0

0

Umbrella Policy - $3,000,000

Automobile Insurance - Maximum liability, no comprehensive or collision.

V. Investment Data

- Emergency fund is at $20,000

- The Martinez couple can accept moderate risk

- Bill's IRA investment portfolio is $300,000 with half invested in low to medium risk equity

mutual funds. Of this amount invested in low to medium risk equity mutual funds, is in Roth

IRAs. Natalia is beneficiary

- The other half is in staggered maturity short-term treasury notes.

- Bill Martinez expects to use the income from the treasury notes to make up any short fall

between his retirement needs and his 401(k) plan for period of time until Social Security

benefits are received (would like to start at 62, understands benefits will be reduced).

-Bill is currently earning 4.0% on the short-term treasury notes, though when they mature, 1.0%

will be the going rate on any new investments in this type of security.

-Other than IRAs, Natalia's business, and any other retirement accounts, all assets are listed as

JTWROS (joint tenants with rights of survivorship).

VI. Income Tax Information

- Bill and Natalia Martinez file a joint tax return and are both average and marginal 28%

taxpayers with state income tax of 5%.

VII. Retirement Information

-The present value of Bill's Social Security benefits at 65 is $13,500 per year or 80% of that

amount at age 62. Social Security benefits are expected to increase at the same rate as

inflation (listed above).

-Bill has the 401(k) plan at work which currently has a value of $750,000.

-Natalia has no IRA funding, but created a SEP-IRA plan for her business and it has a balance of

$200,000 (split into a guaranteed investment contract fund and a money market fund)

VIII. Gifts, Estates, Trusts, and Will Information

Gifts - In 1996, Bill gifted $200,000 to each of his four children. The $800,000 was put into an

irrevocable trust. Natalia has made no taxable gifts during her lifetime.

Estates - For purposes of estimating estate tax liability (of either spouse):

-

Last illness and funeral estimated at $20,000

-

Estate administration expense estimated at $30,000

Wills - Bill and Natalia have simple wills leaving all probate assets to the other. Debts and taxes

are to be paid from the inheritance of the survivor.

IX. Statement of Financial Position

Bill and Natalia Martinez

Statement of Financial Position

ASSETS

LIABILITIES and NET WORTH

Cash and Equivalents

Liabilities

Cash (money market)

$40,000

Current:

Total Cash

$40,000

Credit Card (hers)

$15,000

Invested Assets

Credit Card (his)

$25,000

Publications, Inc.

$100,000

Auto (his) note balance

$20,000

Natalia's Advertising, Inc.

$90,000

Auto (hers) note balance

$10,000

Natalia's Investments

$200,000

Home Equity Line of Credit

$40,000

Bill's Investments

$300,000

Total Current Liabilities

$110,000

Bill's 401(k) (vested)

$750,000

Total Investments

$1,440,000

Long Term:

Mortgage - Residence

$100,000

Personal Use Assets

Mortgage - Vacation Home

$120,000

Primary Residence

$300,000

Total Long-Term Liabilities

$220,000

Vacation Home

$150,000

Personal Prop./Furniture

$100,000

Total Liabilities

$330,000

Auto (his)

$40,000

Auto (hers)

$22,000

Net Worth

$1,762,000

Total Personal Use

$612,000

Total Assets

$2,092,000

Total Liabilities & Net Worth

$2,092,000

All assets are stated at fair market value.

Liabilities are stated at principal only.

Gifts - In 1996, Bill gifted $200,000 to each of his four children. The $800,000 was put into an

irrevocable trust. Natalia has made no taxable gifts during her lifetime.

Estates - For purposes of estimating estate tax liability (of either spouse):

-

Last illness and funeral estimated at $20,000

-

Estate administration expense estimated at $30,000

Wills - Bill and Natalia have simple wills leaving all probate assets to the other. Debts and taxes

are to be paid from the inheritance of the survivor.

IX. Statement of Financial Position

Bill and Natalia Martinez

Statement of Financial Position

ASSETS

LIABILITIES and NET WORTH

Cash and Equivalents

Liabilities

Cash (money market)

$40,000

Current:

Total Cash

$40,000

Credit Card (hers)

$15,000

Invested Assets

Credit Card (his)

$25,000

Publications, Inc.

$100,000

Auto (his) note balance

$20,000

Natalia's Advertising, Inc.

$90,000

Auto (hers) note balance

$10,000

Natalia's Investments

$200,000

Home Equity Line of Credit

$40,000

Bill's Investments

$300,000

Total Current Liabilities

$110,000

Bill's 401(k) (vested)

$750,000

Total Investments

$1,440,000

Long Term:

Mortgage - Residence

$100,000

Personal Use Assets

Mortgage - Vacation Home

$120,000

Primary Residence

$300,000

Total Long-Term Liabilities

$220,000

Vacation Home

$150,000

Personal Prop./Furniture

$100,000

Total Liabilities

$330,000

Auto (his)

$40,000

Auto (hers)

$22,000

Net Worth

$1,762,000

Total Personal Use

$612,000

Total Assets

$2,092,000

Total Liabilities & Net Worth

$2,092,000

All assets are stated at fair market value.

Liabilities are stated at principal only.

CASE ASSIGNMENT

Your job as a financial planner is to work collaboratively with a team of 2 - 4 classmates to

develop a comprehensive financial plan for Bill and Natalia Martinez. You can make

assumptions, but you must justify those assumptions with data and clarify the impact of those

assumptions on your recommendations.

Your team will work collaboratively to review the clients' current situation, define the scope of

the plan, and establish plan goals. Collectively, you will review the retirement, insurance, and

investment needs of the clients and analysis of those needs to guide the plan.

Further, your team will define any necessary modifications to the clients' current plan/situation

that will be required in order for the defined goals to be met and summarize

recommendations to be presented to the clients.'

A lot of data about this family has been presented in the previous pages. Carefully look over the

information. You must determine how to analyze and utilize this information and develop a

plan that maximizes the financial way of life for the Martinez family, without taking an

inordinate amount of risk.

In your financial plan your team must address the following areas:

?

Description and Scope of the plan

(10 points)

?

Statement of Goals - group collaboration

(10 points)

?

Overall needs analysis - retirement, insurance, and investment/savings - group

collaboration (

10 pts

)

?

Retirement Needs Analysis

(40 points)

o

Calculate the amount needed in retirement

o

Bring lump sum needed back to the present

o

Establish the current value of projected future investments

o

Compare resources and needs

o

Establish additional savings needed to reach goals (if any)

?

Insurance Needs Analysis

(40 points)

o

Determine amount/type needed to fund pre-retirement

o

Determine amount/type needed to fund the retirement period (based on life

expectancy of each)

o

Determine the total lump sum needed today

o

Establish Insurance needs

?

Investments/Savings Analysis

(40 points)

o

Determine status of financial asset allocation

o

Determine appropriate risk levels currently

o

Determine appropriate risk levels for retirement

o

Determine if the businesses should be sold, and when

o

Determine the status and rational for keeping residence and vacation home

properties (or liquidating)

?

Gifts, Estates, Trusts, Will Analysis

(10 points)

o

Estate planning issues

?

Who gets what/most efficient way?

?

Modifications to current situation in order to meet the goals

(30 points)

o

Submit a post-modification statement of financial position

?

Summary/Plan Recommendations

(40 points)

o

You must sell this plan to the Martinez couple as the plan then need to adopt.

In addition, you work will be evaluated regarding the following aspects:

?

Using research: Choose a variety of appropriate sources using multiple criteria

(relevance, currency, authority, audience, and point of view) based on the type of

information needed to effectively develop the plan

(10 points)

?

Team cooperation and engagement

(10 points)

?

Proficiency in written communication

(10 points)

o

Determine the status and rational for keeping residence and vacation home

properties (or liquidating)

?

Gifts, Estates, Trusts, Will Analysis

(10 points)

o

Estate planning issues

?

Who gets what/most efficient way?

?

Modifications to current situation in order to meet the goals

(30 points)

o

Submit a post-modification statement of financial position

?

Summary/Plan Recommendation

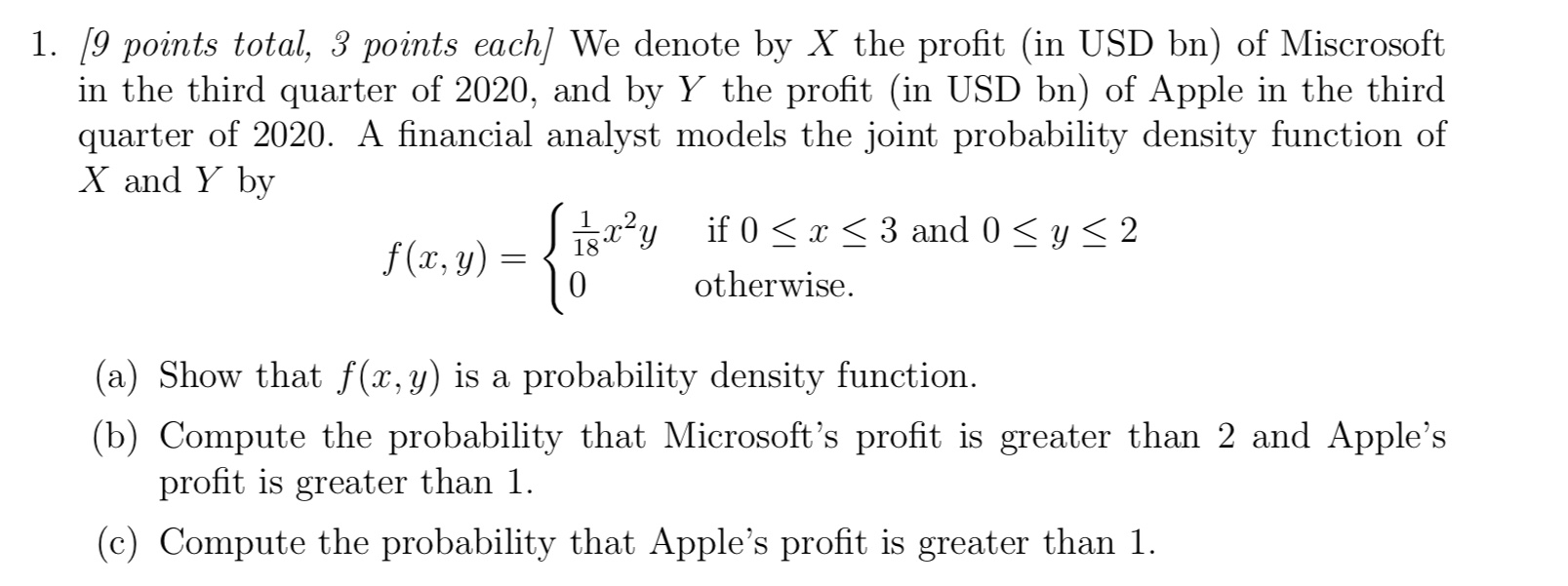

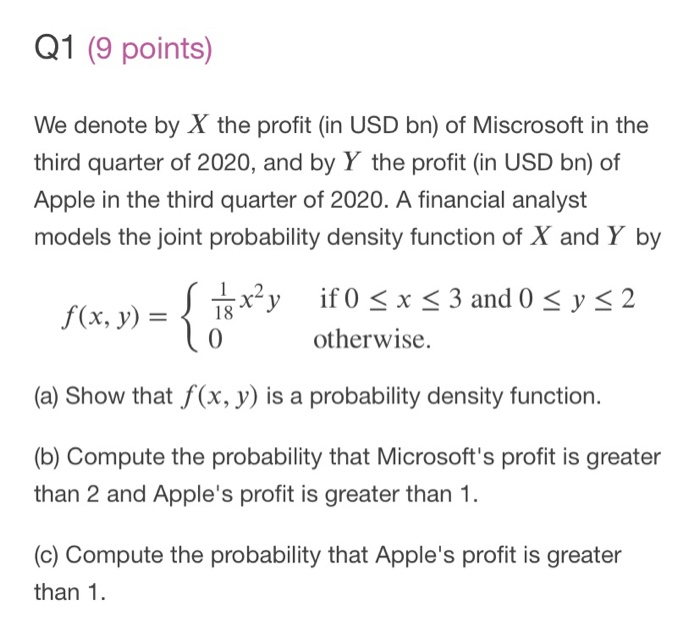

1. [9 points total, 3 points each] We denote by X the profit (in USD bn) of Miscrosoft in the third quarter of 2020, and by Y the profit (in USD bn) of Apple in the third quarter of 2020. A financial analyst models the joint probability density function of X and Y by f(x, y) = Sxy 18 if 0 x 3 and 0 y 2 otherwise. (a) Show that f(x, y) is a probability density function. (b) Compute the probability that Microsoft's profit is greater than 2 and Apple's profit is greater than 1. (c) Compute the probability that Apple's profit is greater than 1.

Step by Step Solution

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started