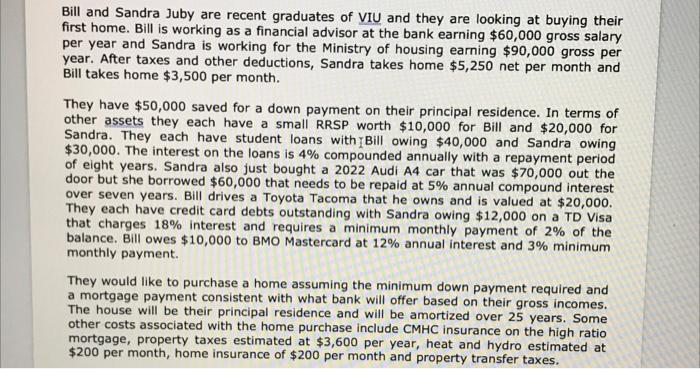

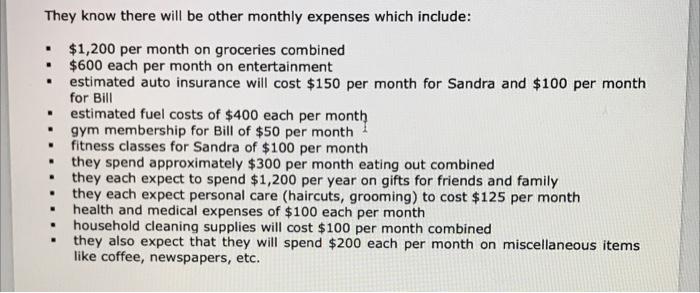

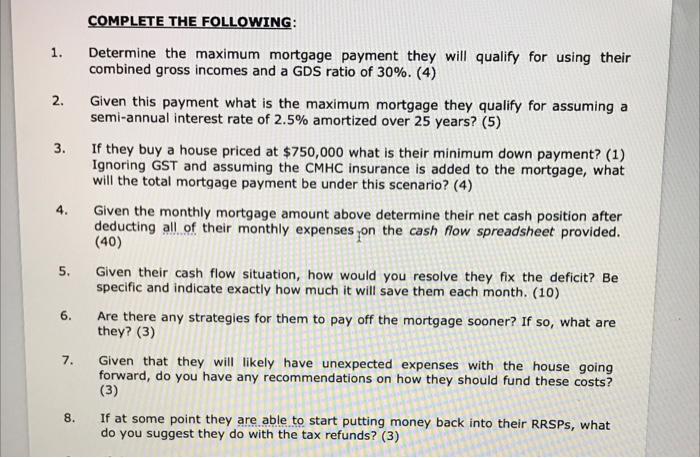

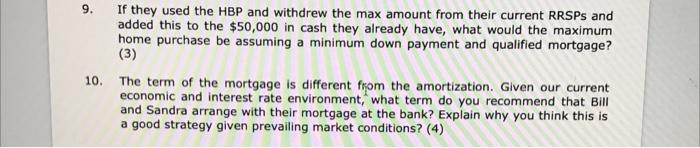

Bill and Sandra Juby are recent graduates of VIU and they are looking at buying their first home. Bill is working as a financial advisor at the bank earning $60,000 gross salary per year and Sandra is working for the Ministry of housing earning $90,000 gross per year. After taxes and other deductions, Sandra takes home $5,250 net per month and Bill takes home $3,500 per month. They have $50,000 saved for a down payment on their principal residence. In terms of other assets they each have a small RRSP worth $10,000 for Bill and $20,000 for Sandra. They each have student loans with Bill owing $40,000 and Sandra owing $30,000. The interest on the loans is 4% compounded annually with a repayment period of eight years. Sandra also just bought a 2022 Audi A4 car that was $70,000 out the door but she borrowed $60,000 that needs to be repaid at 5% annual compound interest over seven years. Bill drives a Toyota Tacoma that he owns and is valued at $20,000. They each have credit card debts outstanding with Sandra owing $12,000 on a TD Visa that charges 18% interest and requires a minimum monthly payment of 2% of the balance. Bill owes $10,000 to BMO Mastercard at 12% annual interest and 3% minimum monthly payment. They would like to purchase a home assuming the minimum down payment required and a mortgage payment consistent with what bank will offer based on their gross incomes. The house will be their principal residence and will be amortized over 25 years. Some other costs associated with the home purchase include CMHC Insurance on the high ratio mortgage, property taxes estimated at $3,600 per year, heat and hydro estimated at $200 per month, home insurance of $200 per month and property transfer taxes. . . . . They know there will be other monthly expenses which include: $1,200 per month on groceries combined $600 each per month on entertainment estimated auto insurance will cost $150 per month for Sandra and $100 per month for Bill estimated fuel costs of $400 each per month gym membership for Bill of $50 per month fitness classes for Sandra of $100 per month they spend approximately $300 per month eating out combined they each expect to spend $1,200 per year on gifts for friends and family they each expect personal care (haircuts, grooming) to cost $125 per month health and medical expenses of $100 each per month household cleaning supplies will cost $100 per month combined they also expect that they will spend $200 each per month on miscellaneous items like coffee, newspapers, etc. . . . . . COMPLETE THE FOLLOWING: 1. Determine the maximum mortgage payment they will qualify for using their combined gross incomes and a GDS ratio of 30%. (4) 2. Given this payment what is the maximum mortgage they qualify for assuming a semi-annual interest rate of 2.5% amortized over 25 years? (5) 3. If they buy a house priced at $750,000 what is their minimum down payment? (1) Ignoring GST and assuming the CMHC Insurance is added to the mortgage, what will the total mortgage payment be under this scenario? (4) Given the monthly mortgage amount above determine their net cash position after deducting all of their monthly expenses on the cash flow spreadsheet provided. (40) 5. Given their cash flow situation, how would you resolve they fix the deficit? Be specific and indicate exactly how much it will save them each month. (10) 6. Are there any strategies for them to pay off the mortgage sooner? If so, what are they? (3) Given that they will likely have unexpected expenses with the house going forward, do you have any recommendations on how they should fund these costs? (3) If at some point they are able to start putting money back into their RRSPs, what do you suggest they do with the tax refunds? (3) 7. 8. 9. If they used the HBP and withdrew the max amount from their current RRSPs and added this to the $50,000 in cash they already have, what would the maximum home purchase be assuming a minimum down payment and qualified mortgage? (3) The term of the mortgage is different from the amortization. Given our current economic and interest rate environment, what term do you recommend that Bill and Sandra arrange with their mortgage at the bank? Explain why you think this is a good strategy given prevailing market conditions? (4) 10. Bill and Sandra Juby are recent graduates of VIU and they are looking at buying their first home. Bill is working as a financial advisor at the bank earning $60,000 gross salary per year and Sandra is working for the Ministry of housing earning $90,000 gross per year. After taxes and other deductions, Sandra takes home $5,250 net per month and Bill takes home $3,500 per month. They have $50,000 saved for a down payment on their principal residence. In terms of other assets they each have a small RRSP worth $10,000 for Bill and $20,000 for Sandra. They each have student loans with Bill owing $40,000 and Sandra owing $30,000. The interest on the loans is 4% compounded annually with a repayment period of eight years. Sandra also just bought a 2022 Audi A4 car that was $70,000 out the door but she borrowed $60,000 that needs to be repaid at 5% annual compound interest over seven years. Bill drives a Toyota Tacoma that he owns and is valued at $20,000. They each have credit card debts outstanding with Sandra owing $12,000 on a TD Visa that charges 18% interest and requires a minimum monthly payment of 2% of the balance. Bill owes $10,000 to BMO Mastercard at 12% annual interest and 3% minimum monthly payment. They would like to purchase a home assuming the minimum down payment required and a mortgage payment consistent with what bank will offer based on their gross incomes. The house will be their principal residence and will be amortized over 25 years. Some other costs associated with the home purchase include CMHC Insurance on the high ratio mortgage, property taxes estimated at $3,600 per year, heat and hydro estimated at $200 per month, home insurance of $200 per month and property transfer taxes. . . . . They know there will be other monthly expenses which include: $1,200 per month on groceries combined $600 each per month on entertainment estimated auto insurance will cost $150 per month for Sandra and $100 per month for Bill estimated fuel costs of $400 each per month gym membership for Bill of $50 per month fitness classes for Sandra of $100 per month they spend approximately $300 per month eating out combined they each expect to spend $1,200 per year on gifts for friends and family they each expect personal care (haircuts, grooming) to cost $125 per month health and medical expenses of $100 each per month household cleaning supplies will cost $100 per month combined they also expect that they will spend $200 each per month on miscellaneous items like coffee, newspapers, etc. . . . . . COMPLETE THE FOLLOWING: 1. Determine the maximum mortgage payment they will qualify for using their combined gross incomes and a GDS ratio of 30%. (4) 2. Given this payment what is the maximum mortgage they qualify for assuming a semi-annual interest rate of 2.5% amortized over 25 years? (5) 3. If they buy a house priced at $750,000 what is their minimum down payment? (1) Ignoring GST and assuming the CMHC Insurance is added to the mortgage, what will the total mortgage payment be under this scenario? (4) Given the monthly mortgage amount above determine their net cash position after deducting all of their monthly expenses on the cash flow spreadsheet provided. (40) 5. Given their cash flow situation, how would you resolve they fix the deficit? Be specific and indicate exactly how much it will save them each month. (10) 6. Are there any strategies for them to pay off the mortgage sooner? If so, what are they? (3) Given that they will likely have unexpected expenses with the house going forward, do you have any recommendations on how they should fund these costs? (3) If at some point they are able to start putting money back into their RRSPs, what do you suggest they do with the tax refunds? (3) 7. 8. 9. If they used the HBP and withdrew the max amount from their current RRSPs and added this to the $50,000 in cash they already have, what would the maximum home purchase be assuming a minimum down payment and qualified mortgage? (3) The term of the mortgage is different from the amortization. Given our current economic and interest rate environment, what term do you recommend that Bill and Sandra arrange with their mortgage at the bank? Explain why you think this is a good strategy given prevailing market conditions? (4) 10