Question

Bill and Ted are ages 30 and 40 respectively, are in the midst of an Excellent Adventure, and have independent future lifetimes whose mortality

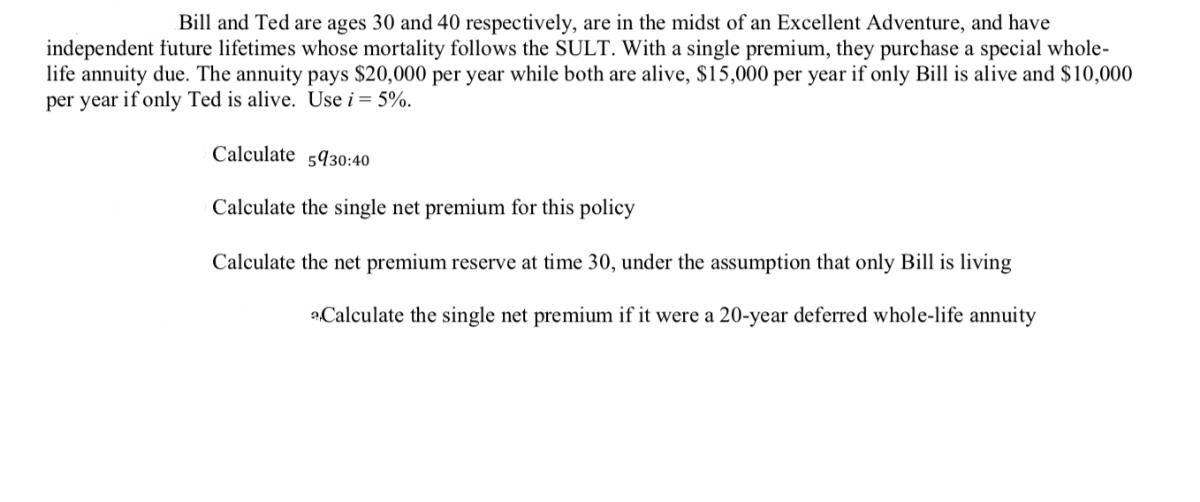

Bill and Ted are ages 30 and 40 respectively, are in the midst of an Excellent Adventure, and have independent future lifetimes whose mortality follows the SULT. With a single premium, they purchase a special whole- life annuity due. The annuity pays $20,000 per year while both are alive, $15,000 per year if only Bill is alive and $10,000 per year if only Ted is alive. Use i = 5%. Calculate 5930:40 Calculate the single net premium for this policy Calculate the net premium reserve at time 30, under the assumption that only Bill is living Calculate the single net premium if it were a 20-year deferred whole-life annuity

Step by Step Solution

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Cal cul ate 59 30 40 ANS WER 59 303 40 WORK ING Bill and Ted purchase a whole life ann uity for a si...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Andersons Business Law and the Legal Environment

Authors: David p. twomey, Marianne moody Jennings

21st Edition

1111400547, 324786662, 978-1111400545, 978-0324786668

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App