Question

Research what the actual bank provisions are for Covid relief in South Africa and how they can affect clients. Furthermore, you will work on this

Research what the actual bank provisions are for Covid relief in South Africa and how they can affect clients.

Furthermore, you will work on this scenario in which the client will extend his loan terms and when he choose to increase his payments (when he resumes payments) to remain within the same loan term/period or simply pay the outstanding interest as a lump sum in order to resume normal payments while remaining within the same loan period.

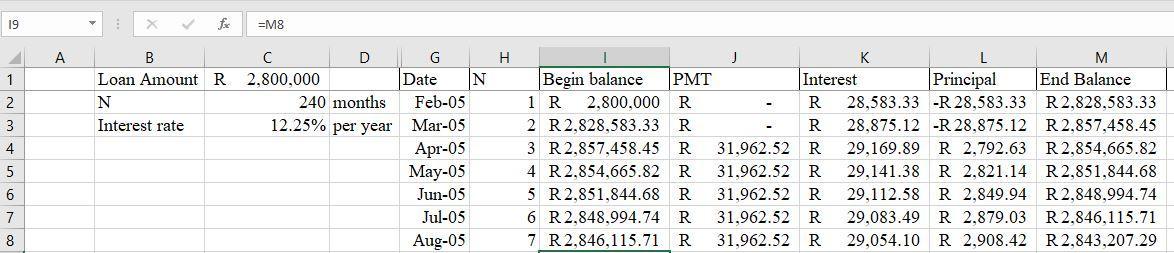

Client A: Bought a R 2.8 million house in Feb 2005. First instalment in April 2005. Loan term was also 20 years. Interest charged was 12.25% per annum.

Question: How will this client be affected by taking a payment holiday? Determine the following:

i.) How much in total interest (and total payments) he would have paid for the entire loan term if he had not taken a break in payments.

ii.) How much in total interest (total payments) he will pay if they take the payment holiday from i.e. miss payments from March to September 2020. Show how his loan term would change.

iii.) How much in total interest (total payments) he will pay if he take the payment holiday but choose to settle the accrued interest between March and September 2020. How much the accrued interest lump sum payment would be to maintain the original payment for the remaining loan term?

iv.) How much total interest will be paid if he decide to the payment holiday but increase his monthly instalments from October going forward so as to remain within the same loan term? Determine that new payment.

-----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

I AM TOTALLY LOST AND I DON'T KNOW IF THIS ONE IS CORRECT:

N = 20 x 12 = 240

rate = 12.25% / 12

Feb 2005. First instalment in April 2005 : i don't know if i have to calculate the PMT and interest only from April 2005

19 1 2 3 4 5 6 7 8 A E x =M8 B Loan Amount R 2,800,000 N Interest rate D 240 months 12.25% per year G Date Feb-05 Mar-05 Apr-05 May-05 Jun-05 Jul-05 Aug-05 N H Begin balance 1 R 2,800,000 R 2 R 2,828,583.33 R 3 R 2,857,458.45 R 4 R 2,854,665.82 R 5 R 2,851,844.68 R 6 R 2,848,994.74 R 7 R2,846,115.71 R PMT L M End Balance R 2,828,583.33 R2,857,458.45 Principal 28,583.33 -R 28,583.33 28,875.12 -R 28,875.12 29,169.89 R 2,792.63 R 2,854,665.82 29,141.38 R 2,821.14 R 2,851,844.68 29,112.58 R 2,849.94 R2,848,994.74 29,083.49 R 2,879.03 R2,846,115.71 29,054.10 R 2,908.42 R2,843,207.29 Interest R R 31,962.52 R 31,962.52 R 31,962.52 R 31,962.52 R 31,962.52 R K

Step by Step Solution

3.48 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Its great that youre interested in understanding the implications of COVID19 relief provisions on cl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started