Answered step by step

Verified Expert Solution

Question

1 Approved Answer

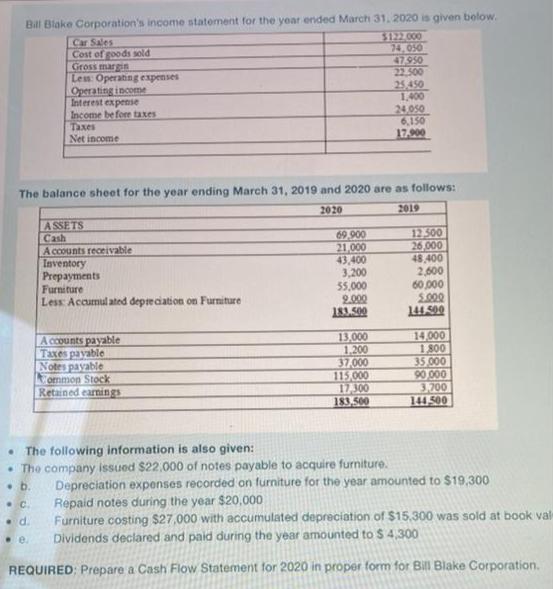

Bill Blake Corporation's income statement for the year ended March 31, 2020 is given below. Car Sales Cost of goods sold Gross margin Less:

Bill Blake Corporation's income statement for the year ended March 31, 2020 is given below. Car Sales Cost of goods sold Gross margin Less: Operating expenses Operating income Interest expense Income be fore taxes Taxes Net income $122.000 74, 050 47.950 22,500 25,450 1,400 24,050 6,150 17.900 The balance sheet for the year ending March 31, 2019 and 2020 are as follows: 2020 2019 A SSETS Cash A ccounts receivable Inventory Prepayments Furniture Less Accumul ated depteciation on Furniture 69.900 21,000 43,400 3,200 55,000 2.000 183.500 12.500 26,000 48,400 2,600 60,000 2000 A ccounts payable Taxes pavable Notes payable ormmon Stock Retained earnings 13,000 1,200 37.000 115,000 17.300 183.500 14,000 1.800 35,000 90 000 3700 144 500 The following information is also given: The company issued $22.000 of notes payable to acquire furniture. Depreciation expenses recorded on furniture for the year amounted to $19,300 Repaid notes during the year $20,000 Furniture costing $27,000 with accumulated depreciation of $15,300 was sold at book val Dividends declared and paid during the year amounted to $ 4,300 .C. d. .e. REQUIRED: Prepare a Cash Flow Statement for 2020 in proper form for Bill Blake Corporation.

Step by Step Solution

★★★★★

3.46 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

Cash flow statement of bill bake Particulars Amount Net income 1...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started