Question

Bill Bloom is interested in investing in a new rooms-only lodging property. He needs some financial projections for a single year for the proposed operations.

Bill Bloom is interested in investing in a new rooms-only lodging property. He needs some financial projections for a single year for the proposed operations. He provides the following information:

1. Room Sales

a. Average room rate- $100

b. Average daily occupancy-65%

c. Available rooms per day-100

2. Miscellaneous Income-5% of total revenue

3. administrative and general fixed labor-$20,000 per month

Marketing fixed labor-$50,000 annually

4. variable expenses (as a percentage of total room sales)

a. rooms labor-20%

b .Rooms other expenses-10%

c. administrative and general other-3%

d. marketing-4%

e. maintenance-5%

f. information and telecommunications systems-3%

5. Other fixed expenses:

a. depreciation- $200,000

b. Utilities-$95,000

c. Insurance- $60,000

d. Property taxes-$80,000

e. Interest Expense-$100,000

6. management fee-2% of room sales and 10% of GOP

7. non-operating income-$50,000 annually

8. Income tax rate- 20 percent (as percentage of income before taxes)

9. Assume the property will be open 365 days of the year.

Required:

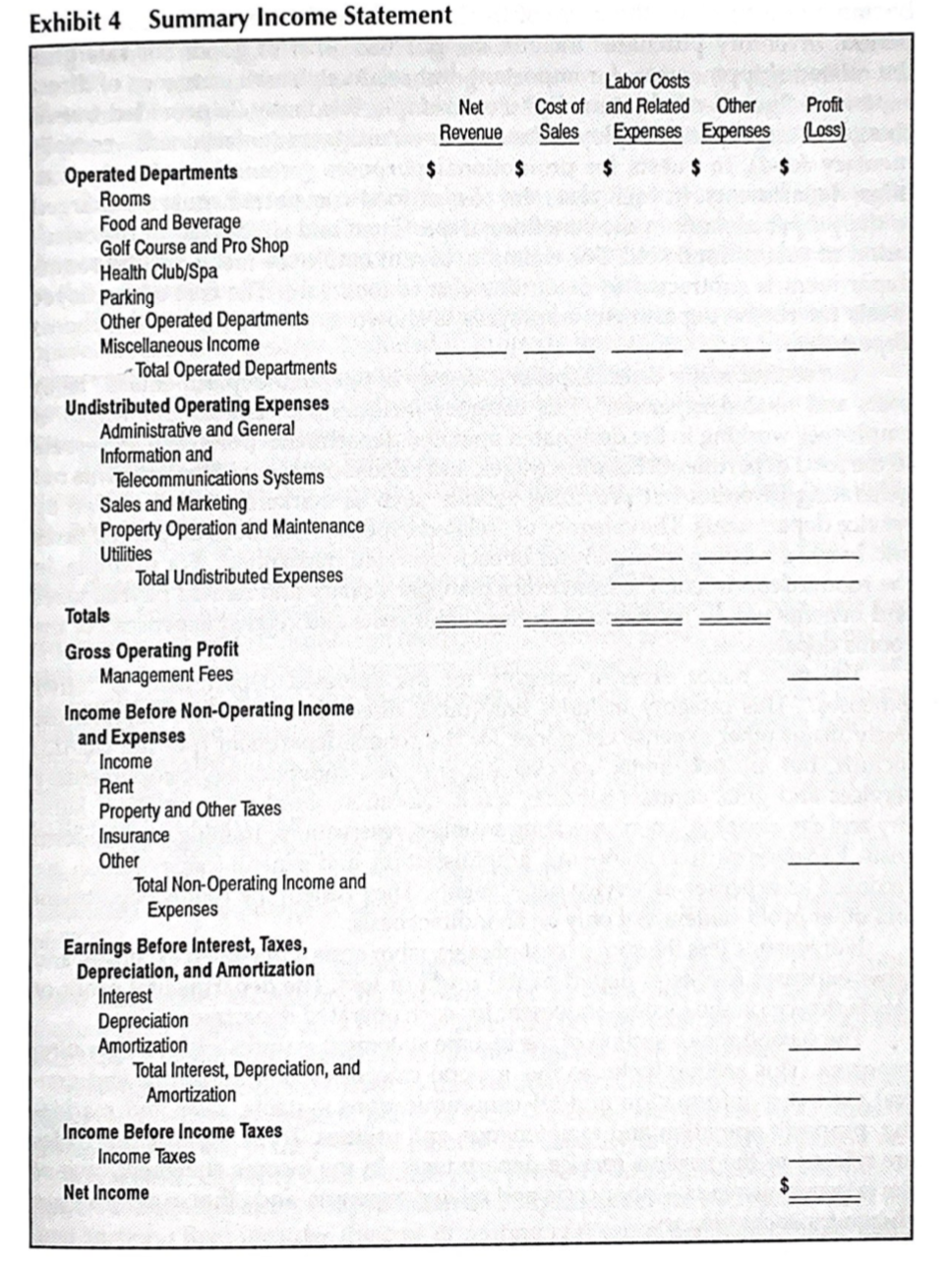

Prepare an Income Statement based on USALI. Use exhibit 4 as a guide. Round all figures to the nearest $1.

Exhibit 4 Summary Income Statement Operated Departments Rooms Food and Beverage Golf Course and Pro Shop Health Club/Spa Parking Other Operated Departments Miscellaneous Income Total Operated Departments Undistributed Operating Expenses Administrative and General Information and Telecommunications Systems Sales and Marketing Property Operation and Maintenance Utilities Total Undistributed Expenses Totals Gross Operating Profit Management Fees Income Before Non-Operating Income and Expenses Income Rent Property and Other Taxes Insurance Other Total Non-Operating Income and Expenses Earnings Before Interest, Taxes, Depreciation, and Amortization Interest Depreciation Amortization Total Interest, Depreciation, and Amortization Income Before Income Taxes Income Taxes Net Income Net Revenue Cost of Sales Labor Costs and Related Other Profit Expenses Expenses (Loss) ||

Step by Step Solution

3.48 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Working Notes Revenue from Rooms per day Average Rooms Per day Average Daily Occupancy Average Room ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started