Question

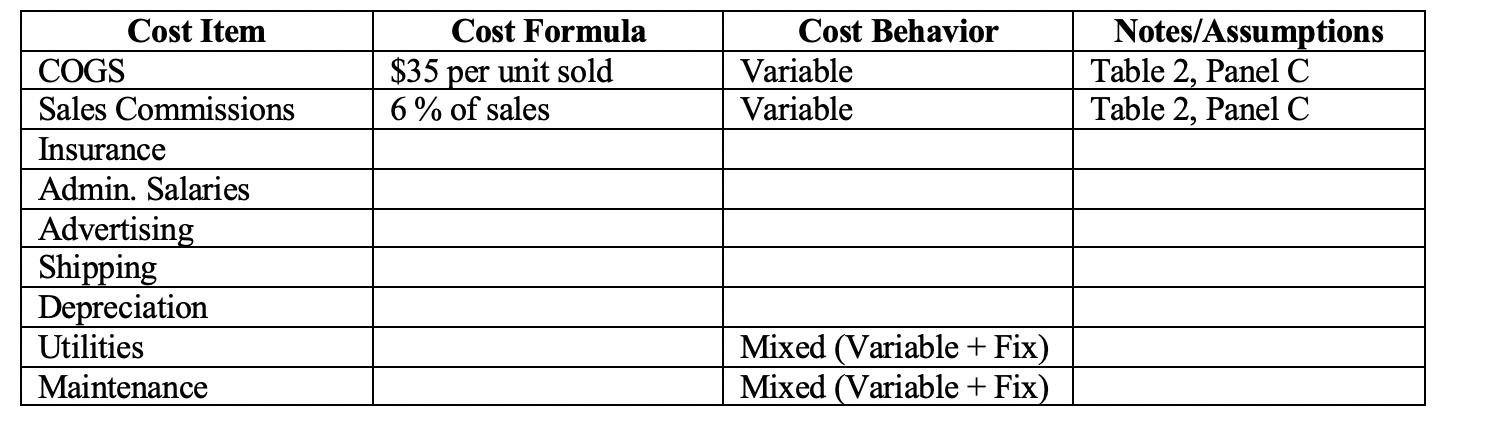

Financial Analysis First bullet point Complete the table similar to the following (use the information provided Table 2, Panels B and C): Cost Item Cost

Financial Analysis

Financial Analysis

First bullet point

Complete the table similar to the following (use the information provided Table 2, Panels B and C):

Cost Item Cost Formula Cost Behavior Notes/Assumptions

COGS $35 per unit sold Variable Table 2, Panel C

Sales Commissions 6 % of sales Variable Table 2, Panel C

Insurance

Admin. Salaries

Advertising

Shipping

Depreciation

Utilities Mixed (Variable + Fix)

Maintenance Mixed (Variable + Fix)

Each cost will either be variable, fixed, or mixed. Any managerial or cost accounting book will have a chapter (or portion of a chapter) on "Cost Behavior" that will explain how to determine whether a cost is variable, fixed, or mixed.

Second Bullet Point

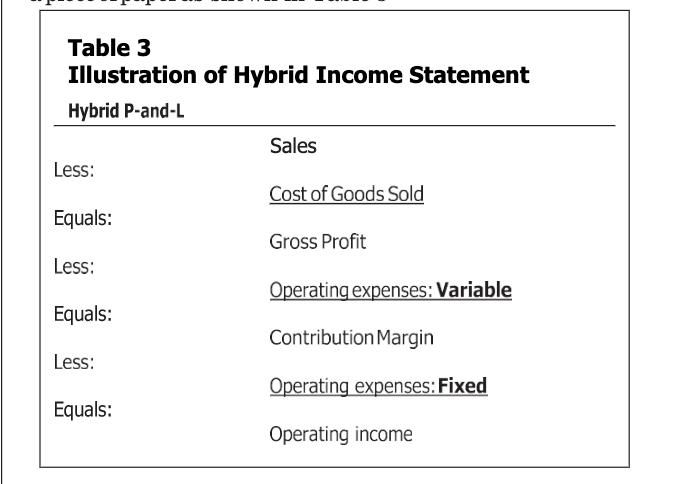

Use the information from the table above and the three scenarios listed at the bottom of Table 2, Panel C to create "hybrid" income statements like the one in Table 3.

Third Bullet Point

List pros (and cons) of the income statement format used above and discuss whether it will be useful for Storm.

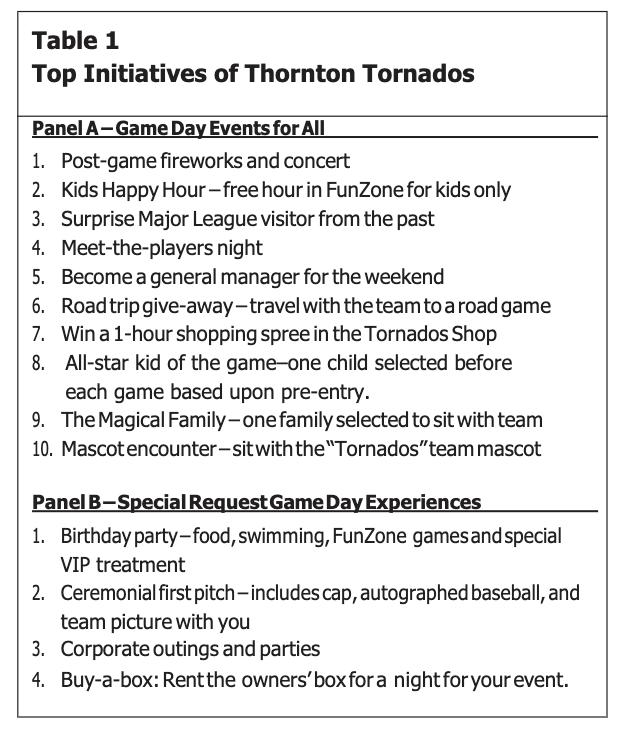

Strategic Analysis - Future Expansion

This section actually includes two parts. Part (1) is not listed in the case:

Part (1)

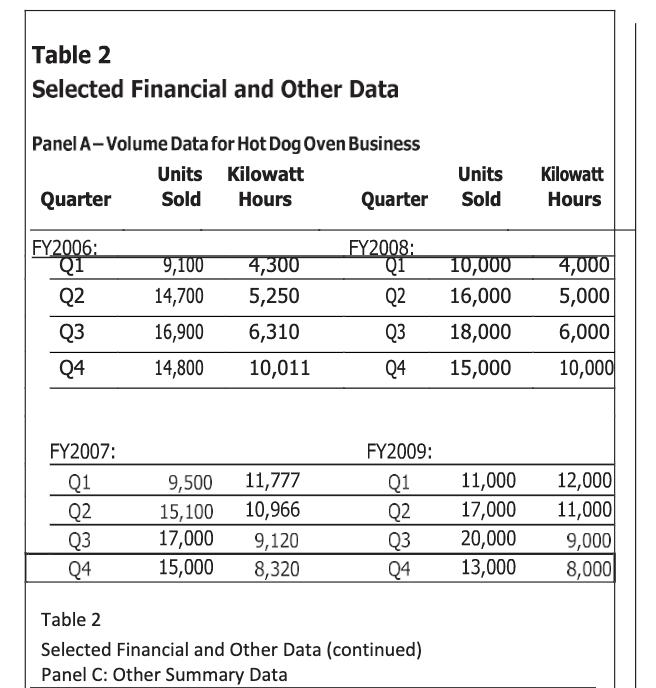

You need to decide which of the three scenarios Storm should use: (1) base case, (2) market penetration strategy, or (3) market premium strategy. I used Excel for this.

(a) Use the information you entered in the table for the Financial Analysis (above) and calculate breakeven for the Base Strategy:

Breakeven = PX - VX - F

0 = (Price)(X) - (COGS/unit)(X) - [(Price)(X)](Commission Rate) - (Shipping/unit)(X) - (Utilities/KWH)(# of KWH) - (Mtce./KWH)(KWH) - Insurance - Adm. Salaries - Advertising - Depreciation - Fixed Portion of Utilities - Fixed Portion of Mtce.

P = price/unit

V = variable cost/unit (I listed each variable cost and each variable portion of mixed costs separately)

F = total fixed costs (I listed each fixed cost and each fixed portion of mixed costs separately)

X = number of units to breakeven

(b) After making adjustments for the information provided in the case, calculate breakeven for the Market Penetration Strategy and compare to the Base (1 above). Using this strategy, how many more (fewer) units would Storm have to sell to breakeven compared to the Base Strategy?

(c) Making adjustments for the information provided in the case, calculate breakeven for the Market Premium Strategy and compare to the Base (1 above). Using this strategy, how many more (fewer) units would Storm have to sell to breakeven compared to the Base Strategy?

(d) Based on this analysis, which strategy should Storm implement?

Again, a managerial or cost accounting book can help you with this. It would be listed under "Cost-Volume-Profit Analysis" (CVP).

Part (2)

Complete the task given in the case; that is, provide one strategy (activity) that Storm can implement to earn a profit during the off season (winter). Make sure to include all of the considerations listed (e.g., operating capital, personnel, etc.)

Strategic Analysis - Employing the C-framework - Use the C-framework to outline your advice to Storm about how to improve its strategic financial management function. Include a thorough discussion of the framework by linking each CFO-lever input to each of the three company-lever outputs.

Cost Item COGS Sales Commissions Insurance Admin. Salaries Advertising Shipping Depreciation Utilities Maintenance Cost Formula $35 per unit sold 6% of sales Cost Behavior Variable Variable Mixed (Variable + Fix) Mixed (Variable + Fix) Notes/Assumptions Table 2, Panel C Table 2, Panel C

Step by Step Solution

3.55 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Cost Item Cost Formula Cost Behavior NotesAssumptions COGS 35 per unit sold Variable Table 2 Panel C Sales Commissions 6 of sales Variable Table 2 Panel C Insurance 2000 per quarter Fixed Assumption A...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started