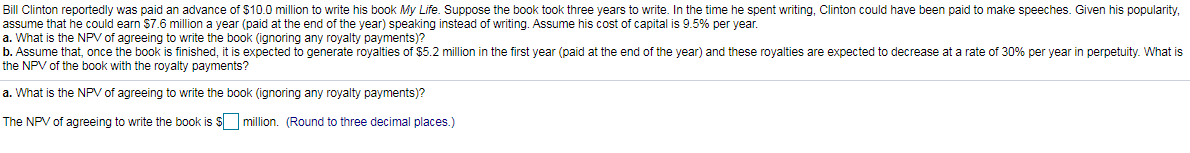

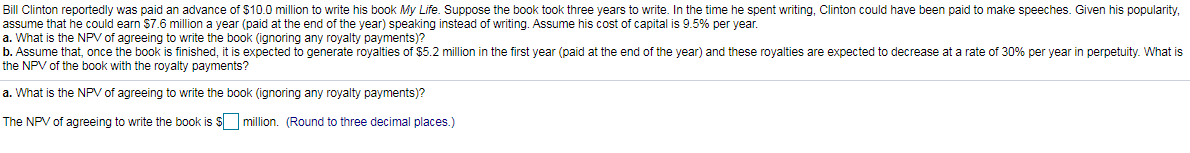

Bill Clinton reportedly was paid an advance of 10.0 million to write his book . Suppose the book took three years to write. In the time he spent writing, Clinton could have been paid to make speeches. Given his popularity, assume that he could earn 7.6 million a year (paid at the end of the year) speaking instead of writing. Assume his cost of capital is 9.5% per year.

a. What is the NPV of agreeing to write the book (ignoring any royalty payments)?

b. Assume that, once the book is finished, it is expected to generate royalties of 5.2 million in the first year (paid at the end of the year) and these royalties are expected to decrease at a rate of 30% per year in perpetuity. What is the NPV of the book with the royalty payments?

a. What is the NPV of agreeing to write the book (ignoring any royalty payments)? The NPV of agreeing to write the book is ____million. (Round to three decimal places.)

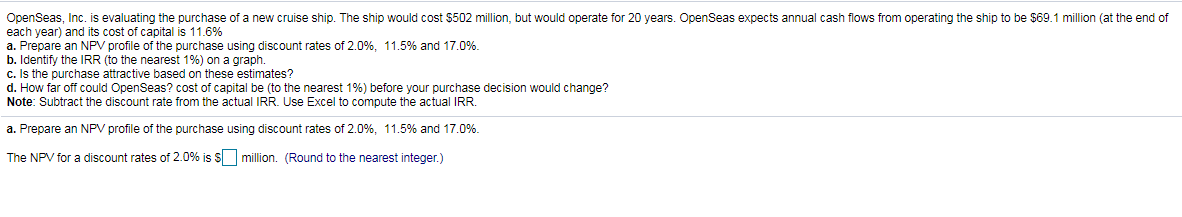

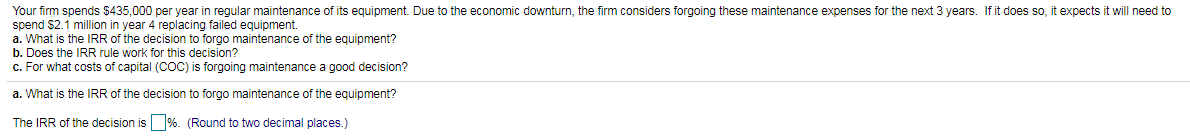

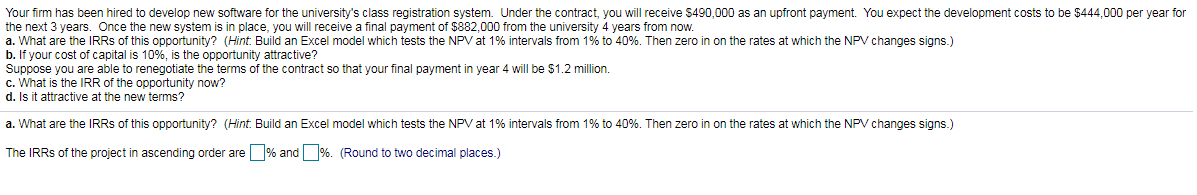

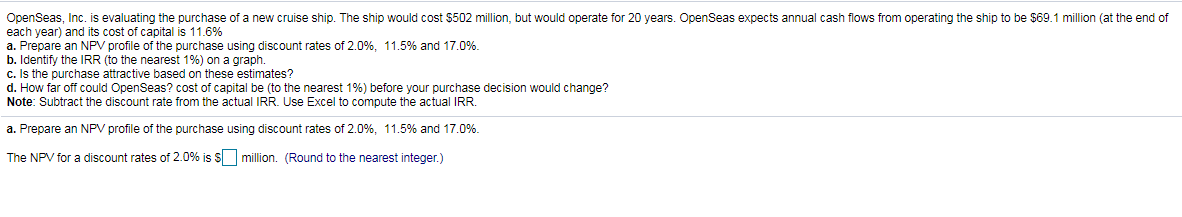

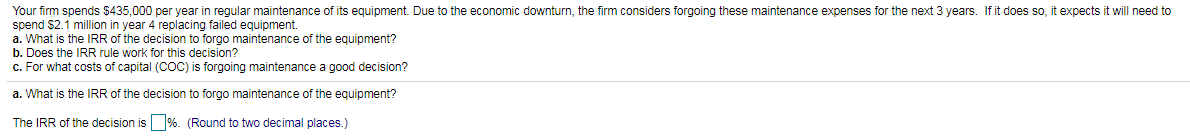

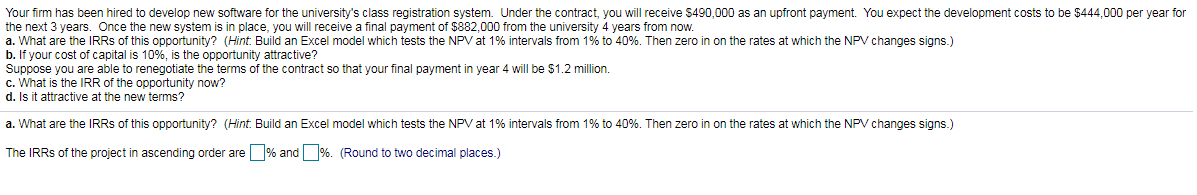

Bill Clinton reportedly was paid an advance of $10.0 million to write his book My Life. Suppose the book took three years to write. In the time he spent writing, Clinton could have been paid to make speeches. Given his popularity, assume that he could earn 57.6 million a year (paid at the end of the year) speaking instead of writing. Assume his cost of capital is 9.5% per year. a. What is the NPV of agreeing to write the book (ignoring any royalty payments)? b. Assume that, once the book is finished, it is expected to generate royalties of $5.2 million in the first year (paid at the end of the year) and these royalties are expected to decrease at a rate of 30% per year in perpetuity. What is the NPV of the book with the royalty payments? a. What is the NPV of agreeing to write the book (ignoring any royalty payments)? The NPV of agreeing to write the book is million (Round to three decimal places.) OpenSeas, Inc. is evaluating the purchase of a new cruise ship. The ship would cost $502 million, but would operate for 20 years. OpenSeas expects annual cash flows from operating the ship to be $69.1 million (at the end of each year) and its cost of capital is 11.6% a. Prepare an NPV profile of the purchase using discount rates of 2.0%, 11.5% and 17.0% b. Identify the IRR (to the nearest 1%) on a graph. C. Is the purchase attractive based on these estimates? d. How far off could OpenSeas? cost of capital be to the nearest 1%) before your purchase decision would change? Note: Subtract the discount rate from the actual IRR. Use Excel to compute the actual IRR. a. Prepare an NPV profile of the purchase using discount rates of 2.0%, 11.5% and 17.0%. The NPV for a discount rates of 2.0% is million. (Round to the nearest integer.) Your firm has been hired to develop new software for the university's class registration system. Under the contract, you will receive $490,000 as an upfront payment. You expect the development costs to be $444,000 per year for the next 3 years. Once the new system is in place, you will receive a final payment of $882,000 from the university 4 years from now. a. What are the IRRs of this opportunity? (Hint. Build an Excel model which tests the NPV at 1% intervals from 1% to 40%. Then zero in on the rates at which the NPV changes signs.) b. If your cost of capital is 10%, is the opportunity attractive? Suppose you are able to renegotiate the terms of the contract so that your final payment in year 4 will be $1.2 million. c. What is the IRR of the opportunity now? d. Is it attractive at the new terms? a. What are the IRRs of this opportunity? (Hint: Build an Excel model which tests the NPV at 1% intervals from 1% to 40%. Then zero in on the rates at which the NPV changes signs.) The IRRs of the project in ascending order are % and %. (Round to two decimal places.)